The “real” policy rate is massively negative, with the new policy rate of 0.25% far below Core CPI of 2.6%.

By Wolf Richter for WOLF STREET.

At its meeting today, the Bank of Japan raised its policy rate, the “uncollateralized overnight call rate,” by about 25 basis points, to “around 0.25%” from the range of around 0% at the March meeting. Before the March meeting, the rate had been negative (-0.1%).

The policy rate is far below the inflation rate in Japan. Annual core CPI accelerated to 2.6% in June. The BOJ’s target for core CPI is 2%. And the “real” policy rate (policy rate minus core CPI) remains massively negative at -2.35%.

So the BOJ is very late and very slow in raising its policy rates, and the yen has plunged over the past two years as a result of it. It’s the plunge in the yen – and its effect on prices of imported goods, including energy commodities – that has forced the BOJ to get off its crazed interest rate and QE policies.

At the press conference, when asked about another rate hike in 2024, BOJ governor Kazuo Ueda opened the door for more: “If data shows economic conditions are on track, and if such data accumulates, we would of course take the next step,” he said.

Initial QT starts now: The BOJ announced that it would start running off its holdings of Japanese Government Bonds (JGBs), at a rate that increases every quarter, until the monthly runoff reaches its full speed of about ¥3 trillion per month ($19 billion per month at today’s exchange rate) in January-March 2026. And it would then continue at that pace.

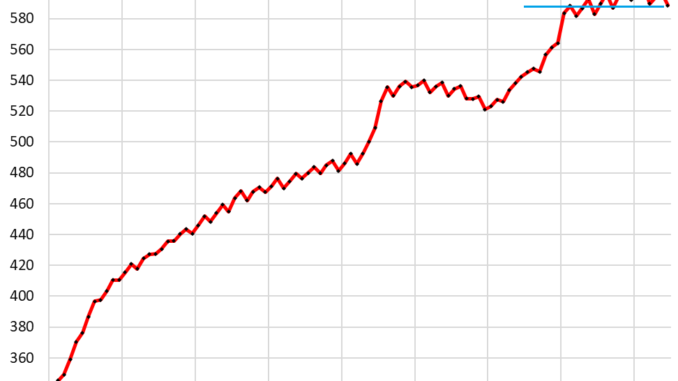

About ¥6 trillion in JGBs on its balance sheet are maturing every month. The BOJ has been replacing most of them in recent months, so that its holdings of JGBs have declined very gradually from the peak in February 2024.

This decline will accelerate until the decline rate hits about ¥3 trillion per month in early 2026. After this long ramp-up period, its JGB holding would continue to decline at about that rate.

The BOJ’s holdings of government securities through June:

That the BOJ would shift to QT was announced at the last meeting. What was new today were the amounts. The BOJ provided this schedule of the decline of its JGB purchases to increase QT:

July 2024: actually purchased ¥5.7 trillion ($38 billion).

Aug-Sep, 2024: to purchase ¥5.3 trillion, for QT of ¥700 billion per month.

Oct-Dec 2024: to purchase ¥4.9 trillion, for QT of ¥1.1 trillion per month.

Jan-Mar 2025: to purchase ¥4.5 trillion, for QT of ¥1.5 trillion per month.

etc.

Jan-Mar 2026: to purchase ¥2.9 trillion, for QT of about ¥3 trillion per month

Going forward until further notice: to purchase ¥2.9 trillion, for QT of about ¥3 trillion per month.

How big is this QT? When QT reaches about ¥3 trillion per month in 2026, it would represent a reduction of its JGB holdings of about 0.5% per month. How much is that relative to the Fed’s Treasury QT?

By comparison, the Fed, which at peak held $5.8 trillion in Treasury securities, rolled them off at a pace of $65 billion a month, after the three-month ramp-up period. It maintained that pace through May 2024. So when QT entered full speed in September 2022, the Fed rolled off about 1.1% of its Treasury holdings per month. The Fed has now rolled off $1.33 trillion of its Treasury holdings.

So the BOJ is very slow in ramping up QT – instead of three months, as the Fed had done to ramp up QT, it takes its goodly time through 2025. And when it finally gets to full speed in early 2026, it will be at half the relative pace of the Fed’s Treasury roll-off.

To prop up the plunging yen. The BOJ is doing minuscule rate hikes, way too late, and is very slowly accelerating QT to a pace that will ultimately be half the Fed’s full pace. But it is moving in the right direction, and that has given initial support to the yen to keep it from collapsing further.

The prior announcement that the BOJ would shift to QT (while leaving the decision on the amounts to this meeting), and the anticipation of further rate hikes, based on what BOJ governments had mentioned in their speeches, accompanied by large-scale and very costly currency interventions over the past few months, finally started to support the yen in July. Today, the yen traded up at ¥150 to the USD. Back on July 4, it had hit the low point of ¥162 to the USD.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/