In a strategic move that underscores Saudi Aramco’s commitment to bolstering its balance sheet while expanding its natural gas operations, the oil giant has inked an $11 billion lease-and-leaseback agreement with a consortium led by BlackRock’s Global Infrastructure Partners (GIP).

This deal, announced on August 14, 2025, involves the Jafurah gas processing facilities and is poised to inject significant capital into Aramco’s coffers, enhancing its financial flexibility amid fluctuating oil markets.

Unpacking the Deal: A Leaseback Strategy for Gas Expansion

The agreement centers on the creation of a new subsidiary, Jafurah Midstream Gas Company (JMGC), which will lease development and usage rights for the Jafurah Field’s gas facilities from Aramco.

Are you Paying High Taxes in New Jersey, New York, or California?

Under the terms, the BlackRock-led consortium—comprising GIP and other international investors—will pay $11 billion to Aramco in exchange for leasing these assets, which Aramco will then rent back for operational use.

This structure allows Aramco to monetize its infrastructure without relinquishing control, a tactic reminiscent of previous deals. This isn’t Aramco’s first foray into such arrangements with BlackRock. In 2021, a $15.5 billion leaseback deal was struck for Aramco’s gas pipeline network, led by BlackRock Real Assets.

A follow-up in 2022 saw BlackRock co-leading another minority investment in Aramco Gas Pipelines Company.

The latest Jafurah deal builds on these, targeting the massive Jafurah shale gas field—one of the world’s largest unconventional gas reserves. Aramco aims to ramp up gas production by 60% by 2030 from 2021 levels, as part of a $100 billion investment in the project.

This expansion is crucial for Saudi Arabia’s energy diversification, reducing reliance on oil for domestic power generation and positioning natural gas as a key export and transition fuel. The consortium’s involvement highlights growing investor interest in Middle Eastern energy infrastructure. GIP, recently acquired by BlackRock, brings expertise in global infrastructure investments, ensuring the deal aligns with sustainable energy trends while providing stable returns for participants.

Key Announcements Surrounding the Deal

Aramco’s announcement emphasized the deal’s role in optimizing capital allocation and accelerating the Jafurah project’s development.

Crown Prince Mohammed bin Salman’s Vision 2030 reform agenda, which seeks to transform Saudi Arabia into a diversified economy, is a driving force behind such initiatives. By unlocking value from existing assets, Aramco can fund ambitious upstream and downstream projects without tapping equity markets extensively. Market reactions were positive, with the deal seen as a vote of confidence in Aramco’s gas strategy amid global shifts toward cleaner energy. Analysts noted that this infusion of funds could support Aramco’s broader goals, including potential acquisitions, technology investments, and maintaining its status as a dividend powerhouse.

Insights from Aramco’s Latest Quarterly Report

Aramco released its Q2 and half-year 2025 results on August 5, 2025, just days before the deal’s announcement, providing context for why such financial maneuvers are timely.

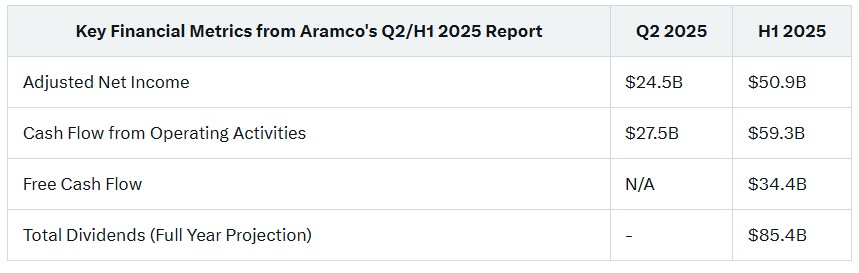

The report revealed adjusted net income of $24.5 billion for Q2 and $50.9 billion for the first half, reflecting a continued dip in profits—marking the 10th consecutive quarter of declines—primarily due to softer oil prices and production cuts under OPEC+ agreements.

Despite the profit squeeze, operational cash flows remained robust at $27.5 billion (SAR 103.3 billion) for Q2 and $59.3 billion (SAR 222.2 billion) for H1.

Free cash flow for the half-year stood at $34.4 billion, underscoring the company’s ability to generate substantial liquidity even in challenging markets.

Aramco also flagged plans for cost cuts and divestments to streamline operations, while affirming strong market fundamentals with anticipated oil demand growth of over 2 million barrels per day in H2 2025.

Dividends remain a cornerstone: The company outlined total payouts of $85.4 billion for 2025, a 31% reduction from 2024’s $124 billion, but still among the highest globally for energy firms.

This includes base and performance-linked dividends, demonstrating Aramco’s commitment to shareholder returns.Key Financial Metrics from Aramco’s Q2/H1 2025 Report

Why This Deal is a Win for Investors

For investors eyeing Aramco (Tadawul: 2222), this BlackRock-backed gas deal is a clear positive, reinforcing the company’s financial resilience and growth trajectory. Here’s why:Enhanced Liquidity Without Equity Dilution: The $11 billion influx provides immediate capital for reinvestment, debt reduction, or bolstering reserves. In a quarter where profits dipped, this non-dilutive funding shores up Aramco’s “financial firepower,” allowing it to navigate volatility while pursuing expansion.

Diversification into Gas: With oil facing long-term demand uncertainties, Aramco’s push into natural gas—targeting a 60% production increase by 2030—positions it as a leader in the energy transition. The Jafurah project could add billions in revenue from exports and domestic use, reducing oil dependency and appealing to ESG-focused investors.

Sustained Dividend Appeal: Despite lower profits, Aramco’s strong cash flows support its hefty dividends. The deal’s proceeds could help maintain or even enhance payouts, making the stock attractive for yield-seeking investors. At a time when the company is eyeing cost efficiencies, this capital injection eases pressure on core operations.

Strategic Partnerships and Market Confidence: Collaborating with heavyweights like BlackRock signals global trust in Aramco’s assets. As oil demand rebounds in H2 2025, per the quarterly outlook, investors can expect upside from both oil and gas segments.

In summary, this deal not only fortifies Aramco’s finances but also accelerates its pivot toward a more balanced energy portfolio. For long-term investors, it’s a compelling narrative of stability and growth in an evolving energy landscape. Stay tuned to Energy News Beat for more updates on global energy deals.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack