Dive Brief:

- Preparing California’s grid to manage an influx of distributed energy resources could cost approximately $50 billion in the service territories of its three investor-owned utilities by 2035, barring additional measures to reduce costs or manage load, a new study has found.

- The study, conducted by data and analytics company Kevala for the California Public Utilities Commission and released last week, also found that system-level peak load could increase 56% on average from 2025 to 2035 across different scenarios analyzed, driven largely by the electrification of the transportation sector.

- In 2020, California Gov. Gavin Newsom, D, issued an executive order that set California on a path to requiring sales of all new passenger vehicles be zero-emission by 2035.

Dive Insight:

The CPUC opened a new rulemaking in mid-2021, aimed at preparing the grid to handle an anticipated influx of DERs, including due to the electrification of the transportation and building sectors.

The Kevala study on electrification impacts is part of this proceeding and is “a starting point to open the discussion on how to reimagine distribution grid planning for the twenty-first century,” according to the CPUC.

The study’s conclusion that distribution grid investments needed for a high DER future could be as much as $50 billion by 2035 assumes that current time-of-use and behind-the-meter tariffs continue as they are, without any alternative dynamic ratemaking or load management strategies.

Of the projected load increases by 2035, over 60% of the demand stems from electrified light-duty vehicles, the study found.

But while electric vehicles are the key driver of grid impacts at the moment, the electrification of the building sector could play a larger role down the line.

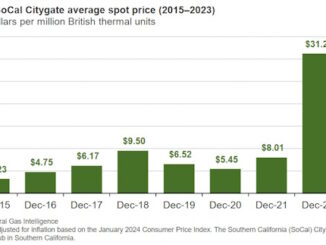

“The building electrification assumptions [in the study] are likely quite slower than we will expect to see building electrification assumptions in the future as a result of policy changes that are on the horizon,” Kevala CEO and Founder Aram Shumavon said. “As an example, just in the past year, the amount of heat pumps sold was very significant across the entire country, and those are using quite a lot of electricity compared to a gas furnace.”

One of the report’s recommendations for utilities is to look out over longer time horizons in their planning processes. California’s current distribution planning process spans five years, but with the expected adoption rate of technologies, the report suggests increasing it to align with other regulatory processes that span between 10 and 20 years.

While PG&E has not fully reviewed or vetted the study’s analysis and findings yet, the utility “is spending more on capacity expansion than ever, including investing nearly $1 billion in capacity upgrades between 2015 and 2021,” utility spokesperson Jennifer Robison said in an email.

“Our capacity investments have increased the past three years and will continue to grow in future years. We plan to invest $15 billion in capacity and asset health over the next decade and beyond,” she added.

Regarding the study’s recommendation to improve distribution planning processes, PG&E’s longer-term strategy is to create and adopt a new, integrated grid-planning approach, she said.

“We are also developing stable, multiyear plans to give our teams and communities visibility into what work we will do, and when we will do it, to enable more advanced resource planning, help customers understand when they can expect new connections and upgrades in their areas and support rapid electrification growth,” she added.