- Michael Wirth, chairman and CEO of Chevron (NYSE:CVX), said Monday that he sees “a fair amount of support” for current oil prices, which have spiked above $80 a barrel in recent weeks.

- Speaking to CNBC, Wirth explained that October usually sees a lull in demand between the peak summer months and the renewed need for energy during winter.

- While he shied away from making a specific projection, he suggested that the fact that crude prices have risen dramatically during a seasonally weak period indicates that a dramatic pull back is unlikely in the near term.

- “The fact that we’ve seen prices actually strengthen at a time when they typically weaken, suggests that there’s a fair amount of support in the market,” he said.

- Looking longer term, Wirth noted that the rising demand for green energy has made it more difficult to develop new supplies of oil.

- Specifically, he said this pressure takes the form of new government policies and in shareholder activism with an increased push towards ESG reforms.

- At the same time, he pointed to an increased pressure from shareholders to return excess cash to them in the form of dividends and stock buybacks rather than spend money on exploration.

- Wirth described a “tension” between the desire to achieve decarbonization and the need for fossil fuels to drive the global economy, a friction he says will require a “massive investment” to resolve.

- “We need to navigate an orderly transition that doesn’t put economies, consumers and societies at risk,” he said.

- CVX ticked up fractionally in Monday’s intraday trading, rising to $109.98 at about 10:30 AM ET.

- The stock reached a 52-week high of $113.11 early in the year but drifted off that level during the middle of the year.

- After trading below $95 in late September, CVX has risen steadily over the last several weeks, driven by the rise in the price of oil.

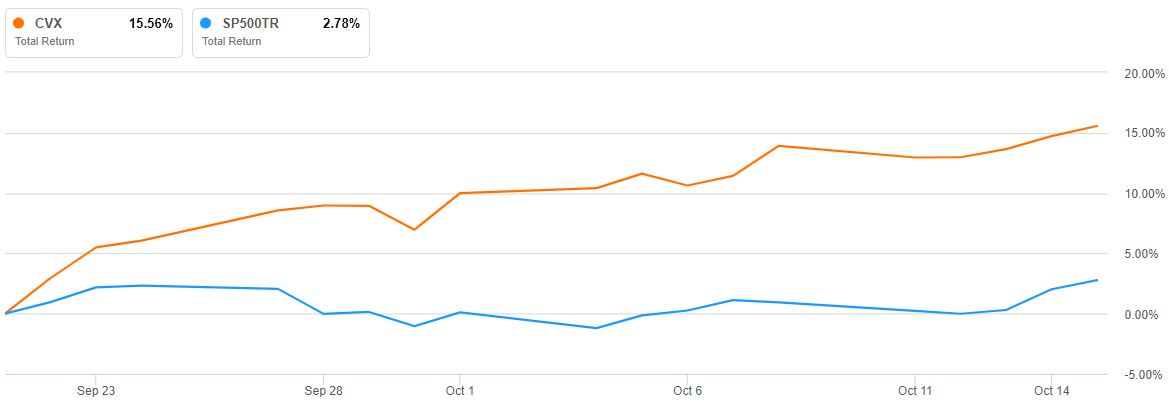

- Since Sept. 21, CVX has advanced nearly 16%. That has dramatically outpaced the broader market, with the S&P 500 rising just 3% over that period:

Source: Seeking Alpha