In a rapidly evolving global energy landscape, China’s strategic partnerships and import trends are reshaping international relations. Recent developments highlight a surge in Canadian oil imports to China, facilitated by expanded infrastructure like the Trans Mountain pipeline. This comes amid statements from Canadian Prime Minister Mark Carney emphasizing a “new strategic partnership” with China that positions both nations for a “new world order” amid global divisions.

This partnership includes tariff reductions, such as slashing duties on Canadian canola seeds from 84% to about 15%, boosting agricultural exports while underscoring broader energy ties. Meanwhile, China’s oil import patterns over the past five years reveal a diversification strategy, with Russia emerging as the dominant supplier.

As Western nations pursued aggressive Net Zero policies through 2024, China capitalized on its manufacturing dominance in clean technologies.

However, U.S. President Donald Trump’s renewed push to acquire Greenland introduces geopolitical tensions, potentially disrupting China’s access to Arctic resources and straining its close ties with Canada.

As I mentioned earlier China is going to buy Canadian OIL

JUST IN: 🇨🇦🇨🇳 Prime Minister Carney says Canada’s partnership with China “sets us up well for the new world order.”#oott https://t.co/Cv5EBHw2M5 pic.twitter.com/BBYN0WSg22

— Jack Prandelli (@jackprandelli) January 16, 2026

Reporter: What did you mean by the new world order?

Carney: The architecture, the multilateral system is being eroded, undercut. The question is what gets built in its place… pic.twitter.com/v42FpX6VgU

— Open Source Intel (@Osint613) January 16, 2026

🛢️Canada’s Trans Mountain expansion changed the oil map

It is now Canada’s only large export route that bypasses the US

And the marginal barrel is increasingly heading to Asia, especially China.

That weakens US buyer dominance

And Canadian Prime Minister Mark Carney, was… pic.twitter.com/D6AQaJ9QAv

— Jack Prandelli (@jackprandelli) January 16, 2026

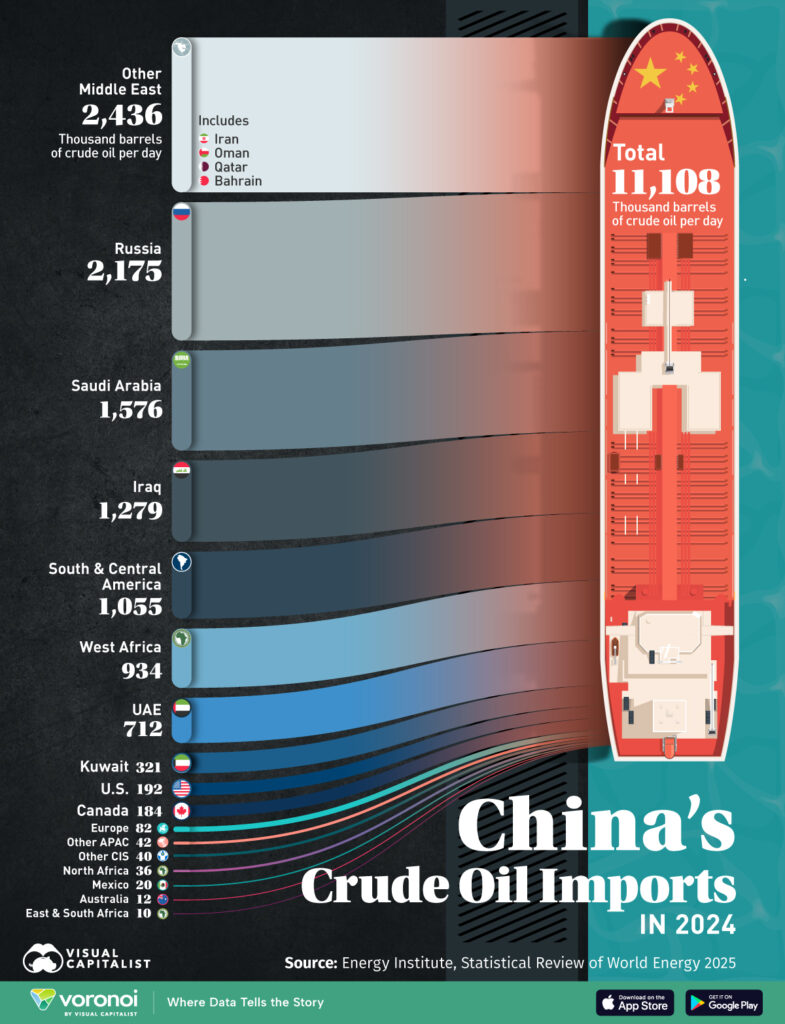

China’s Oil Imports: Trends and Breakdown by Country (2021-2025)

China remains the world’s largest crude oil importer, with total imports fluctuating but generally increasing amid economic recovery and stockpiling. Data from sources like the U.S. Energy Information Administration (EIA), Visual Capitalist, and China’s General Administration of Customs show a shift toward discounted suppliers like Russia, amid sanctions on other producers. Total imports dipped in 2021 due to refining crackdowns but rebounded, reaching record highs in 2025.

Canadian oil imports to China have surged dramatically year-over-year, driven by the Trans Mountain pipeline expansion in 2024. Average shipments rose from about 7,000 barrels per day (bpd) in the decade prior to 2023 to around 207,000 bpd since mid-2024—a staggering increase of over 2,800% in absolute terms, though recent reports highlight China overtaking the U.S. as Canada’s top crude buyer. This aligns with the 84% figure in recent trade deals, potentially referencing pipeline utilization rates (projected at 84% for 2025) or tied to broader export growth. In 2024, Canadian imports to China averaged 184,000 bpd, up significantly from negligible levels in prior years.

Below is a breakdown of China’s crude oil imports by top countries for 2021-2025, in thousand bpd (kbpd). Data is compiled from multiple sources; 2025 figures are preliminary based on year-to-date trends and record inflows reported in December 2025 (11.55 million bpd average monthly).

|

Year

|

Total Imports (kbpd)

|

Russia (kbpd)

|

Saudi Arabia (kbpd)

|

Iraq (kbpd)

|

UAE (kbpd)

|

Oman (kbpd)

|

Malaysia (kbpd)

|

Canada (kbpd)

|

Other Key Notes

|

|---|---|---|---|---|---|---|---|---|---|

|

2021

|

10,260

|

1,600

|

1,800

|

~1,000

|

642

|

~500

|

~800

|

<10

|

Dip due to refining quotas; Middle East ~50% share.

|

|

2022

|

10,100

|

1,800

|

1,700

|

1,100

|

~700

|

~600

|

~900

|

~10

|

Russia gains from discounts post-Ukraine invasion.

|

|

2023

|

11,300

|

2,150

|

1,730

|

1,190

|

~750

|

~700

|

1,100

|

~50

|

Russia overtakes Saudi; Persian Gulf ~50% total.

|

|

2024

|

11,100

|

2,175

|

1,576

|

1,279

|

712

|

~650

|

~1,000

|

184

|

Canada surges via Trans Mountain; total up 11% YoY in volume.

|

|

2025

|

11,550 (est.)

|

2,200+

|

1,600

|

1,300

|

~750

|

~700

|

~1,100

|

207+

|

Record December inflows; Canada up ~12% YoY from 2024.

|

Sources: EIA, Visual Capitalist, OEC World, Reuters. Note: “Other” includes South America (e.g., Brazil 500 kbpd in 2024) and U.S. (200 kbpd).

Values are approximate; 2025 is based on partial data showing 17% YoY increase in December.

This table illustrates Russia’s growing dominance (from ~16% share in 2021 to ~20% in 2024), while Saudi Arabia’s share declined due to competition from sanctioned crudes. China’s strategy focuses on cost-effective, diversified supplies, with overland pipelines from Russia and Kazakhstan covering ~5% of imports.

How China Benefited from Net Zero Policies in the EU, UK, Canada, and US (Up to Trump’s Second Term)

From 2021 to 2024—spanning the Biden administration in the U.S. and aligned policies in the EU, UK, and Canada—Western nations accelerated Net Zero ambitions through initiatives like the EU’s Green Deal (~$1 trillion investment), the UK’s Net Zero Strategy, Canada’s Clean Electricity Regulations, and the U.S. Inflation Reduction Act (IRA, ~$1 trillion in clean energy incentives). These policies aimed to slash emissions via renewables, EVs, and energy efficiency, but inadvertently boosted China’s economy.

China, as the global leader in clean tech manufacturing, captured massive export opportunities:

Solar and Wind Dominance: China produces 90% of global solar panels and 65% of wind turbines. EU and UK subsidies drove demand, with China exporting ~80% of Europe’s solar imports by 2024. This lowered global costs (e.g., solar adoption spurred by Chinese subsidies), but China earned billions—solar exports alone grew 50%+ YoY in 2023-2024.

Batteries and EVs: Controlling 70% of lithium batteries and EVs, China supplied ~73% of EU clean tech imports by 2024. The IRA’s EV tax credits increased U.S. demand for Chinese components, while Canada’s EV mandates (e.g., zero-emission vehicle targets) relied on Chinese supply chains.

Economic Gains: China’s clean energy exports cut global emissions while generating $100B+ annually. It achieved its 2030 renewables target in 2024 (six years early), with wind/solar capacity doubling since 2020. Western policies created a “win-win” for China: subsidized R&D lowered costs, and redirected exports (due to U.S. barriers) flooded the EU/UK, undercutting local producers.

Strategic Edge: By 2024, China’s investments (~10x U.S./Europe over five years) positioned it as a “clean energy powerhouse,” per analysts. Policies like the EU’s Carbon Border Adjustment Mechanism (CBAM) prompted China to expand its carbon market (adding steel/cement in 2024), aligning with global standards while boosting domestic green tech.

These benefits peaked pre-Trump 2.0, as U.S. tariffs and EU de-risking (e.g., subsidies for domestic manufacturing) began curbing reliance on China in 2025.

Implications of Trump’s Greenland Pursuit Amid Canada-China Ties

President Trump’s renewed interest in acquiring Greenland—first floated in 2019 and intensified in 2025—stems from national security concerns, including countering Russian/Chinese Arctic influence and securing critical minerals (e.g., rare earths). Greenland’s vast reserves (27,000 miles of coastline) are vital for clean tech, with China historically eyeing projects like rare earth mines.

This push complicates Canada’s deepening ties with China, as evidenced by Carney’s “new world order” partnership focusing on energy, agri-food, and trade. If the U.S. succeeds in acquiring Greenland (via purchase, treaty, or force—options Trump hasn’t ruled out, potentially costing $700B), implications include:Resource Control: U.S. ownership could block Chinese investments (e.g., lobbying prevented a 2025 Chinese-linked rare earth sale). China relies on Greenland for ~10% of global rare earth potential; exclusion would strain its supply chains, forcing diversification and heightening U.S.-China rivalry.

Canada-China Strain: Canada’s partnership, including EV tariff cuts (to 6.1% for 49,000 units) and energy cooperation, positions it as a bridge. But U.S. tariffs on non-compliant allies (Trump threatened this) could pressure Canada, risking its oil exports to China (now 70% of British Columbia shipments).

Arctic Geopolitics: Trump’s claims of “Russian/Chinese ships everywhere” justify force, but annexing a NATO ally’s territory could fracture the alliance. China, urging respect for sovereignty, might exploit divisions, defending its Arctic ops (e.g., research) while portraying U.S. moves as “imperialist.”

Broader Ties: Close Canada-China relations could face U.S. backlash, with Trump viewing them as undermining “America First.” If Greenland falls to U.S. control, China might pivot to other Arctic partners (e.g., Russia), escalating tensions and disrupting global mineral flows essential for Net Zero.

As Stu Turley said on the Energy News Beat Podcast, the world is bifurcating into new trading blocs. Those that follow Net Zero, deindustrialization, and moving manufacturing to China, and those that follow energy-first policies dedicated to energy made for the lowest cost to consumers with the least impact on the environment, without subsidies.

In summary, while China’s oil import surge and clean tech dominance fuel its rise, Trump’s Greenland ambitions could redraw Arctic lines, testing Canada-China bonds in a multipolar “new world order.”

How Did President Trump Change the Oil Markets?