In the ever-evolving landscape of global finance, whispers from Beijing suggest that China may be on the cusp of a groundbreaking move: unveiling a new initiative that could position the yuan as a formidable contender in the international currency arena.

While no official announcement has been made as of September 2025, recent developments within the BRICS alliance—comprising Brazil, Russia, India, China, South Africa, and newly expanded members—point to a concerted effort to erode the U.S. dollar’s long-standing hegemony. This shift isn’t just about currency; it’s deeply intertwined with energy markets, where the petrodollar system has reigned supreme for decades. We have seen some stagnation of the BRICS alliance, and that is why this week’s meetings of the Shanghai Cooperation Organization are so important.

Are you Paying High Taxes in New Jersey, New York, or California?

This is being looked at throughout the global markets as China, India, and Russia have had meetings in China at the Shanghai Cooperation Organization (SCO) this week. Shanghai Cooperation Organization (SCO) is Rolling This Week with India, Russia, and China

In a press meeting after the event in China, President Putin addressed the Power of Siberia II pipeline.

8️⃣Russia will be able to supply China with 100 bcm of natural gas annually once Power of Siberia II reaches full capacity — Putin pic.twitter.com/Owr8ar1uxs

— Sputnik (@SputnikInt) September 3, 2025

As Energy News Beat tracks these geopolitical maneuvers, we delve into how China’s prior BRICS strategies and surging gold reserves are paving the way for the yuan’s ascent, and what it means for global trade in oil, gas, and beyond. I am not sure how BRICS will play into the new mix, but the SCO variance may be more important, leaving out South Africa and Brazil.

The Prior BRICS Blueprint: Challenging Dollar Dominance

The BRICS bloc has been steadily building momentum toward de-dollarization, a process accelerated by geopolitical tensions and the weaponization of the dollar through sanctions. At the 2025 BRICS Summit in Brasilia, leaders reaffirmed their commitment to enhancing local currency trade and developing alternative payment systems, including a blockchain-based platform to facilitate cross-border transactions without relying on the USD.

This isn’t mere rhetoric; intra-BRICS trade has already seen the renminbi (yuan) accounting for nearly 50% of settlements, up dramatically from previous years.

China, as the economic powerhouse of the group, is driving this agenda. With plans for yuan-backed stablecoins and the expansion of the digital yuan (e-CNY), Beijing aims to create a multipolar currency system where the dollar shares the stage with emerging alternatives.

People’s Bank of China Governor Pan Gongsheng has openly envisioned a future where multiple sovereign currencies coexist and compete, signaling the end of unilateral dollar dominance.

For the energy sector, this could mean a rise in “petroyuan” contracts, where oil and gas trades—historically priced in dollars—are increasingly settled in yuan, reducing exposure to U.S. financial volatility and sanctions. A single BRICS currency remains on hold due to political and economic hurdles, such as the need for fiscal union and macroeconomic alignment.

What we are seeing is a massive shift from trading in the petrodollar to individual countries’ currencies. And Stu Turley on the Energy News Beat Podcast has been very vocal that the sanctions don’t work, and that the heavy tariffs placed on India for buying Russian oil would backfire, and it appears this week it has been a major influence on India, China, and Russian relations.

If China unveils a new global currency framework—perhaps tied to its stablecoin plans—it could catalyze this transition, challenging the dollar’s role in 80% of global energy trades.

Gold Reserves: The Backbone of Yuan’s Rise

China’s strategic accumulation of gold is no coincidence; it’s a calculated hedge against dollar dependency and a potential foundation for yuan credibility. As of Q2 2025, China’s official gold reserves stand at 2,298.53 tonnes, valued at over $208 billion, with purchases continuing for the ninth straight month through July.

This buildup, amid gold prices hitting record highs above $3,500 per ounce, positions the yuan as a currency potentially backed by tangible assets, appealing to nations wary of fiat volatility.

Within BRICS or SCO, gold serves as a unifying element. Discussions around a gold-backed or basket-of-currencies system, though not yet realized, highlight how reserves could underpin new trade mechanisms.

For energy markets, this means diversified reserves could stabilize commodity prices, reducing the dollar’s sway over oil benchmarks like Brent and WTI. As China leads this charge, the yuan’s internationalization—already evident in bilateral swaps and offshore hubs—gains traction, potentially reshaping how global energy deals are financed.

Global Trade Reshaped: Energy at the Epicenter

A yuan-led shift would profoundly alter global trade dynamics, particularly in energy. The petrodollar system, established in the 1970s, has funneled recycling of oil revenues back into U.S. assets, bolstering dollar supremacy. But with BRICS nations controlling over 40% of global oil production and consumption, a move toward yuan settlements could divert these flows.

Saudi Arabia’s acceptance of yuan for oil sales to China and Russia’s pivot to non-dollar trades exemplify this trend.

This reshaping extends to supply chains: Reduced dollar reliance could lower transaction costs for BRICS energy exporters, foster South-South trade, and mitigate risks from U.S. interest rate hikes. However, challenges remain, including the yuan’s limited convertibility and the dollar’s entrenched network effects.

Still, as President Xi Jinping unveils visions for a new global order alongside allies like Putin, the momentum is undeniable.

How the Yuan Will Rise: A Step-by-Step OutlookDigital and Stablecoin Advancements: China’s push for yuan-backed stablecoins via Hong Kong and the digital yuan’s expansion will enable seamless cross-border payments, attracting energy importers in Asia and Africa.

BRICS Integration: By prioritizing local currencies in intra-bloc trade, the yuan emerges as the de facto leader, especially in energy deals, with 50% adoption already achieved.

Gold-Backed Credibility: Ongoing reserve accumulation provides a hedge, making the yuan more attractive for central banks diversifying away from dollars.

Geopolitical Leverage: Amid U.S.-China tensions, alliances with oil-rich nations accelerate yuan usage in commodities, potentially capturing 20-30% of global energy trades by 2030.

3 Assets to Buy Now: Positioning for the Shift

As the yuan’s rise gains steam, savvy investors in the energy space should consider assets poised to benefit. Note: This is not financial advice; consult professionals.

Gold (e.g., GLD ETF or Physical Gold): With China’s reserves surging and BRICS and SCO eyeing gold-backed systems, prices could climb further amid de-dollarization. Gold acts as a safe haven in energy market volatility.

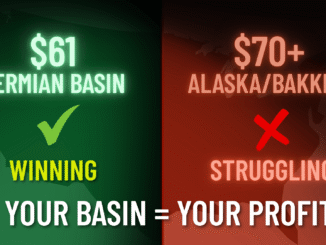

U.S. Energy companies include a mix of utilities, public oil and gas, and private oil and gas companies with tax-advantaged investments. We will be looking at different lists and providing feedback.

Other physical commodities and minerals, including silver.

Some people are investing in digital coins like Bitcoin, and although I haven’t ventured into that field yet, I will be examining the main players.

We recommend that you speak with your financial advisor, tax expert, and CPA when making the final decisions. We have fun providing information and market trends. The key is to diversify, which is why we look to private oil and gas exploration or royalty companies to invest in for one of our main pillars of our portfolio, as we have had excellent returns.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack