At its core, when stripped away of all rhetoric and technicalities, the Fed’s QE is just one big bond-buying operation by the so-called Lender (and Buyer) of Last Resort, an operation meant to stabilize the market and restore order and price transparency even if it means creating an artificial market (as the Fed found out the hard way 12 years of QE will do). And if one goes by that simple definition, last night China – which has so far been against replicating the Fed’s repertoire of market intervention amid concerns it would exacerbate the country’s giant debt bubble – quietly launched QE.

According to Bloomberg, Chinese regulators asked the nation’s biggest insurers to buy bonds being offloaded as retail customers pull their cash from fixed-income investments. At a meeting on Wednesday, Chinese regulators told top insurers to backstop the market and buy bonds sold by wealth management units at banks to prevent further volatility. Some banks also proposed to use their proprietary trading desks to scoop up bonds, one source said.

Of course, in China where virtually every major financial enterprise is a SOE – i.e., state -wned – there is no such thing as “big independent insurers”: they are all essentially government entities, and just one-step removed from official state apparatus to preserve some semblance of a private market (with state characteristics). But at the end of the day, what the regulators just greenlighted is nothing shy of QE, and what’s more, unlike the US where at least there is some pretense of an asset swap as banks exchange bonds for reserves, in China the flow of funds is much simpler: someone, anyone, buys bonds to calm down the market. And since this is a step that is usually taken as a last-ditch resort, one can confidently say that we may have very well seen the bottom in Chinese assets.

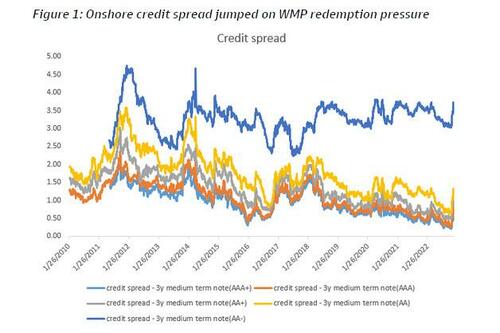

The guidance, handed down at a meeting that was also attended by big (state-owned) banks and lenders, comes as Chinese traders and retail investors have been ditching fixed-income assets and pouring money into stocks on growing economic optimism as China rolls back its strict Covid Zero approach. The turmoil last month, which saw large withdrawals from bond-backed wealth management products, earlier also prompted regulators to ask banks to report on their liquidity situation.

According to the report, some insurance firms, whose investment products are less vulnerable to short-term redemptions, have already heeded the call and “purchased bonds on a positive market outlook” even before the latest guidance. The biggest insurance firms include China Life Insurance Co. and Ping An Insurance Group of China. The asset management arms of just those two manage a combined 8.74 trillion yuan ($1.3 trillion), according to their websites. Both are, of course, majority state-owned, and thus all that is taking place, is China’s state now actively buying up bonds to stabilize the market.

Some more background: in an effort to increase transparency of risks and instill more discipline in China’s 29 trillion yuan wealth management market (yes, don’t laugh), authorities had embarked on a multi-year reform to have banks ditch a fixed-return model and move to mark-to-market pricing. However, this spooked investors who for years have been used to steady, guaranteed returns, causing large outflows and forced selling by money managers.

As a result, China’s benchmark bond yields surged the most in six years on Nov. 14 as signs China is loosening its Covid Zero policies caused a rapid shift into stocks. Yields continued to climb since, before easing a bit on Wednesday as news of the unofficial QE spread. China’s one-year government bond yield has risen to near the highest this year at 2.25%, after a spike of more than 50 basis points since November.

And, lo and behold, as always happens central bank/state buying of bonds commences, the market immediately stabilized and Chinese bond futures surged on Thursday, posting their biggest gain in two weeks. Futures contracts on the 10-year note rose as much as 0.4% to 99.855, the most since Nov. 23. Yields on 10-year and one-year notes both declined after having blown out in the past month alongside repo yields.

Meanwhile, daily redemptions on largely bond-backed wealth management products could have peaked at as much as 200 billion yuan, according to an estimate from Everbright Securities.

In other words, those insurance giants will be busy. Or may not: after all, the mere hint that the state will buy bonds if they drop enough should be sufficient to prevent further selling: we saw just that in March 2020, and we saw it all again in September, when the BOE scrambled to restart QE following the liability-driven investment crash when all fixed income assets were dumped after the mini-budget fiasco.

And if that’s not enough, Beijing slapped even more measures to preserve market stability: Banks and asset managers have also moved to limit redemptions. Bank of China, one of the four big state banks, has set a daily quota on what customers can redeem at 10,000 yuan starting mid-December. Suyin Wealth Management and Bank of Guiyang have also capped real-time redemption on some products at 10,000 yuan per day, according to their latest mandates.

More than 95% of outstanding wealth management products sold by banks and asset managers are marked to market, according to official data as of the end of June. Bonds account for about 68% of the total underlying assets.