In a move that underscores the deepening energy ties between Beijing and Moscow, Russia and China have signed a legally binding memorandum for the Power of Siberia 2 pipeline.

This ambitious project, routed through Mongolia, promises to deliver 50 billion cubic meters (bcm) of natural gas annually from Russia’s western Siberian fields to China, effectively redirecting supplies once destined for Europe.

Analysts warn this could displace the equivalent of one-third of China’s current LNG imports, sending shockwaves through the global liquefied natural gas (LNG) market and reshaping energy dynamics worldwide.

The Power of Siberia 2 Agreement: Details and TimelineThe agreement, formalized during Russian President Vladimir Putin’s visit to Beijing, builds on existing energy partnerships like the original Power of Siberia pipeline, which has already delivered over 100 bcm of gas since its inception in 2019 under a 30-year, $400 billion deal.

Are you Paying High Taxes in New Jersey, New York, or California?

Power of Siberia 2, with its 50 bcm annual capacity, represents a strategic pivot for Russia amid Western sanctions and reduced European demand following the Ukraine conflict.

The pipeline will span approximately 2,600 kilometers from Russia’s Yamal Peninsula through Mongolia to northeastern China, enhancing Moscow’s eastward energy focus.

While the memorandum is binding, key commercial details—such as pricing, financing, and exact budgets—remain unresolved.

A full contract could be signed later in 2025, but construction timelines are uncertain, particularly for the Chinese segment.

Analysts project the pipeline could come online after 2030, with full operations potentially in the early 2030s, aligning with Russia’s plans to expand total gas exports to China to over 100 bcm per year when combined with existing routes.

This development is part of a “new gas world order,” where Russia compensates for lost European markets by bolstering ties with Asia.

Potential LNG Displacement: Scale and Sources Affected

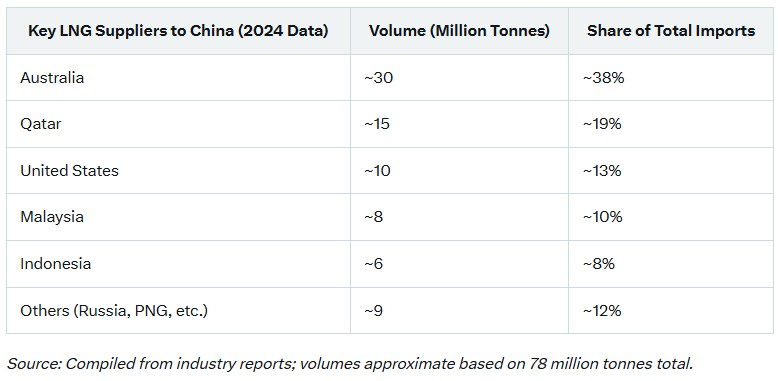

China, the world’s largest LNG importer, saw imports rise nearly 9% in 2024 to 106 bcm (equivalent to 78 million tonnes).

However, 2025 has brought a downturn, with imports plummeting 20% in the first half due to high prices, ample domestic supplies, and economic slowdowns.

Major suppliers include Australia (top provider, though shipments fell 24% in early 2025), followed by Qatar, the United States, Malaysia, and Indonesia.

The Power of Siberia 2’s 50 bcm capacity equates to roughly 36 million tonnes of LNG (using the conversion where 1 bcm of gas ≈ 0.73 million tonnes of LNG).

This could displace about one-third of China’s 2024 LNG imports, reducing reliance on seaborne supplies and providing Beijing with leverage in negotiations.

Analysts predict softer spot LNG demand, potentially accelerating China’s peak LNG import levels and impacting long-term contracts into the 2030s.

Exporters like the U.S., Qatar, and Australia face the brunt, as cheaper pipeline gas undercuts LNG’s volatility.

Implications for the EU and European Countries

For the European Union and its member states, the Power of Siberia 2 pipeline exacerbates an already precarious energy landscape.

Europe has drastically reduced Russian gas imports since 2022, relying instead on LNG from the U.S., Qatar, and Norway to fill the gap.

By sourcing from fields that previously supplied Europe via pipelines like Yamal-Europe, Russia is permanently redirecting flows eastward, solidifying the loss of cheap Russian gas for the continent.

On the flip side, China’s reduced LNG demand could free up global supplies, potentially lowering prices and increasing availability for Europe.

This might ease Europe’s hunt for new sources, but it doesn’t eliminate the need for diversification. European countries must accelerate investments in renewables, hydrogen, and additional LNG terminals while securing long-term contracts with reliable suppliers like Norway and the U.S.

Geopolitically, the deal strengthens the Russia-China axis, raising concerns over energy weaponization and prompting Europe to bolster ties with alternative producers.

Investor Outlook:

Opportunities in LNG Suppliers and NorwayInvestors eyeing LNG suppliers should brace for headwinds from Power of Siberia 2, particularly for those heavily exposed to China.

Australian firms like Woodside Energy and Santos, QatarEnergy, and U.S. players such as Cheniere Energy may see softer demand and contract renegotiations, but opportunities lie in pivoting to Europe and emerging Asian markets like India and Southeast Asia.

Look for companies with flexible portfolios, low-cost production, and exposure to spot markets that could benefit from redirected LNG flows.

Norway, as Europe’s top gas supplier via pipelines like those from Equinor, stands to gain stability.

With fields in the North Sea and Barents Sea, Norwegian exports could see increased demand if global LNG prices dip, making pipeline gas more competitive.

Investors should focus on Equinor and other Norwegian assets for their reliable dividends, government backing, and role in Europe’s energy security. Key watchpoints include long-term contract renewals, carbon capture initiatives, and resilience to price volatility.In summary, Power of Siberia 2 marks a tectonic shift in global energy, favoring pipeline economics over LNG for China while challenging exporters and forcing Europe to adapt. As the project progresses, its ripple effects will define investment strategies for years to come.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack