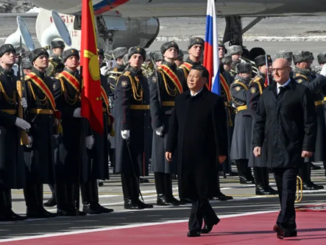

In the midst of ongoing peace negotiations aimed at resolving the Russia-Ukraine conflict, China has emerged as a key beneficiary in the global energy landscape. As U.S. President Donald Trump pushes for direct talks between Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy, the uncertainty surrounding potential sanctions relief has reshaped oil trade flows. China, already the world’s largest importer of Russian crude, is ramping up purchases of discounted Russian oil, filling the void left by India, which is facing intensified U.S. diplomatic and economic pressure to curb its reliance on Moscow’s exports.

The Status of Russian Peace Talks

The peace talks have gained momentum in August 2025, with Trump actively mediating. On August 18, Trump hosted Zelenskyy and European leaders at the White House, where discussions focused on security guarantees for Ukraine without deploying U.S. troops on the ground.

Are you from California, New Jersey, or New York and need a tax break?

Trump subsequently phoned Putin to arrange a potential direct summit, expressing optimism but warning of a “rough situation” if Russia does not engage constructively.

Zelenskyy has stressed the need for a full ceasefire before deeper negotiations, while Russia demands territorial concessions from Ukraine.

These developments have injected volatility into energy markets. Oil prices have dipped, with Brent crude falling as markets anticipate possible easing of Western sanctions on Russian energy exports if a deal is reached.

Analysts suggest that a successful accord could lower global fuel prices by normalizing Russian supply chains, but any stalemate or escalation would benefit oil producers by sustaining high prices and discounted exports to non-Western buyers.

U.S. Pressure Mounts on India

The U.S. has ramped up its efforts to isolate Russia’s war economy, targeting countries like India that have increased purchases of Russian crude since the invasion began. In early August 2025, Trump imposed an additional 25% tariff on Indian exports to the U.S., effective August 7, as a punitive measure for India’s “opportunistic” dependence on Russian oil.

This brings total duties on some Indian goods to as high as 50%, threatening livelihoods in export-dependent sectors.

White House trade adviser Peter Navarro has been vocal, stating in a Financial Times op-ed that India’s reliance on Russian crude—rising from 1% to over 30% of its total imports since the war—undermines global efforts to pressure Putin.

The tariffs are framed as “reciprocal” and aim to deter support for Russia’s economy, with warnings of further measures if peace talks falter.

As a result, India’s imports of Russian Urals crude have halved in August 2025, dropping to around 400,000 barrels per day (bpd) from over 1 million bpd earlier in the year.

Major Indian state-owned refiners have halted spot purchases for future cargoes, redirecting surplus Russian volumes elsewhere.

China’s Surging Imports of Russian Crude

China has swiftly capitalized on this shift, absorbing the discounted Russian oil that India is relinquishing. In August 2025, China’s imports of Russian Urals crude surged to nearly 75,000 bpd, nearly double its year-to-date average of 40,000-50,000 bpd.

While China traditionally favors the ESPO grade from Russia’s Far East, the increase in Urals—typically shipped from western ports—reflects opportunistic buying amid lower prices and reduced competition from India. Broader data for 2025 shows China as Russia’s top oil buyer, with seaborne crude imports rising 5% month-on-month in June to significant volumes, despite some year-on-year value declines due to deeper discounts.

Total China-Russia trade hit a 2025 high in July, with energy imports playing a central role, even as Trump hints at potential tariffs on China over similar issues.

Analysts from Vortexa note that while China can take more, it may not fully absorb all surplus if India’s retreat persists, potentially pressuring global supply dynamics.

The peace talks add another layer: If sanctions ease, Russia could normalize exports, but current uncertainty allows China to secure cheap supplies, bolstering its energy security and supporting domestic refining amid economic headwinds.

Implications for Global Energy Markets

This realignment underscores the geopolitical chess game in energy trade. Russia’s oil exports, redirected to Asia since Western bans, now hinge on peace outcomes. A deal could flood markets with Russian crude, depressing prices, while failure might intensify U.S. sanctions, forcing more discounts to buyers like China.

For India, the tariffs strain U.S. ties and could raise domestic fuel costs if alternative suppliers prove more expensive. As Trump navigates these talks, China’s strategic positioning highlights how energy flows are intertwined with diplomacy.

One key point for the peace talks is the potential US/Russian collaboration in oil and gas development of the Arctic for LNG and oil. This is the best path forward, allowing us to monitor the Arctic while generating revenue and reducing energy costs. We saw this as a massive topic for last Friday’s summit in Alaska, with President Putin opening the door for Exxon to work again on the Sakhalin project through decrees.

For oil investors, this is a great thing, as Russian oil and natural gas production appears to have reached its maximum capacity. So having the U.S. look to export Energy Dominance as a Service is a good thing to make money on the global, fungible, oil and gas markets.

The Energy News Beat will continue monitoring these developments, as they could reshape oil prices and supply chains in the coming months.