Singapore — China is poised to receive about 21 million barrels of the new Iraqi crude grade Basrah Medium by mid March, with most of these shipments expected to be processed by the country’s integrated refining complexes and newly built plants, according to latest shipping data and refining industry sources with close knowledge of the matter.

In January, Iraq’s State Oil Marketing Organization introduced the new Basrah Medium grade to split Basrah Light into two crudes to support the stability of its crude export streams.

Having a gravity of around 27.9 API and sulfur content of 3%, Basrah Medium has attracted plenty of buying interest from China’s state-owned refiners Sinopec and Sinochem, as well as privately held Hengli Petrochemical (Dalian).

Sinochem’s 15 million mt/year Quanzhou Petrochemical on Feb. 1 received a VLCC cargo of Basrah Medium, a company source told S&P Global Platts.

The cargo was likely the country’s first ever Basrah Medium crude shipment. The VLCC Front Empire shipped the new Iraqi crude and loaded the cargo from Al Basrah on Jan. 10, data intelligence firm Kpler showed.

The refiner is going to receive its second Basrah Medium cargo in March, the company source added.

Kpler data showed that the VLCC Spring Splendor has loaded 1.92 million barrels of the medium-heavy sour grade at Al Basrah on Feb. 16.

Sinopec appetite, attractive OSP

Sinopec, the world biggest refiner by capacity, has expressed keen appetite for the new Iraqi crude grade.

“Many of the Sinopec refineries along the coast, which have tanks for blending, have procured Basrah Medium,” a Sinopec refiner in eastern China’s Shandong province said.

“We would like to try the new grade, and have taken an April cargo,” a company source with Sinopec Guangzhou Petrochemical said.

The oil company had fixed at least eight VLCCs of Basrah Medium crude to be delivered to Zhoushan, Caofeidian, Zhanjiang, Ningbo and Maoming, and three cargoes have so far arrived, Kpler data showed.

Most of the cargoes delivered to Zhoushan, Zhanjiang, Ningbo and Maoming are expected to feed Sinopec’s refineries in eastern and southern China, while the barrels landed in northern China’s Caofeidian are likely to be stored in Sinopec’s commercial storage tanks, information collected by Platts showed.

The private 20 million mt/year Hengli also is expecting to receive its first Basrah Medium cargo in late March, a company source said.

Hengli finds Basrah Medium attractive due to the grade’s competitive price, the company source added.

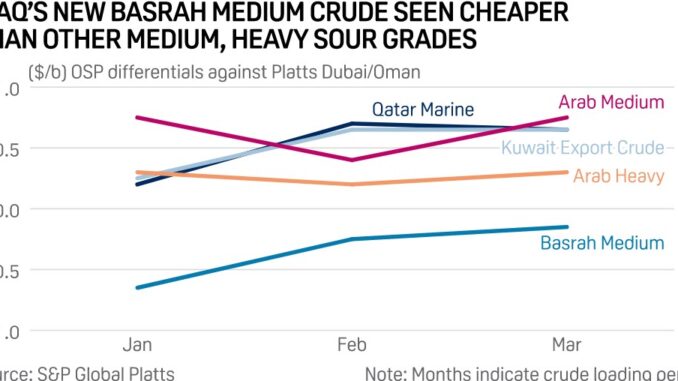

Earlier this month, SOMO set the official selling price for Basrah Medium crude loading in March and bound for Asian customers at a discount of 15 cent/b to the average of Platts Dubai and Platts Oman crude assessments in the month of loading.

The 15 cents/b discount works out much cheaper than other major Middle Eastern medium and heavy source crude OSPs. Saudi Aramco has put a price tag on its Arab Medium crude for loading in March at Platts Dubai/Oman plus 75 cents/b and Arab Heavy crude at a premium of 30 cents/b. Qatar Petroleum and Kuwait Petroleum Corp. have set their flagship medium sour export grades Marine crude and Kuwait Export Crude, or KEC, at a premium of 65 cents/b to Platts Dubai/Oman.

Another state-run refiner PetroChina’s relatively new refineries, including the Guangxi Petrochemical complex in southern China, were considering to take their first Basrah Medium crude for testing in the near term, a company source said.

Quality concerns

However, relatively older and simple refineries are unwilling to process the new Iraqi crude for now.

“It’s sulfur content is too high for us, which only our younger peers are able to process,” said a source with Sinopec Luoyang Petrochemical in central China.

The 8 million mt/year Luoyang Petrochemical was designed and constructed in 1977 and currently is able to refine crudes with average sulfur content of 1.2%-1.3%, even as it has kept upgrading and reconfiguring its facilities for years.

It is the same case for the small-scale independent refineries in eastern China’s Shandong province, which have hesitated in buying Basrah Medium due to high salt content in addition to high sulfur, local independent refiners said.

Most of these small-scale refineries were built up bit by bit in line with market changes, and as such are less integrated than the well-designed complexes.

“Compared with Basrah Light, quality of the new grade is poorer,” said a source with Norinco’s Huajin refinery in northeastern China, and added the refinery will not consider taking the barrel until it completes maintenance in end August.