Biggest Drunken Sailors of all. Average interest rate on the Treasury debt spiked but is still only half of what it was in 2001.

By Wolf Richter for WOLF STREET.

Interest payments as a percent of tax receipts is the primary measure of the burden of the national debt on government finances – to what extent interest expense is eating into the national income. So the ballooning national debt, now at $34.6 trillion, comes together with rising interest rates on that debt. Interest rates have risen because inflation has roared back after decades of slumber. But inflation also inflates tax receipts over the longer term.

So higher inflation is now the third element in the mix – ballooning debt, higher interest rates, and higher inflation. In Q4, 2023:

Interest payments spiked to $256 billion, up by $11 billion from Q3

But tax receipts jumped to $736 billion, up by $57 billion from Q3

And interest payments as a percent of tax receipts dipped to 34.8% in Q4, from 36.1% in Q3, which had been the highest since 1997

Some salient points:

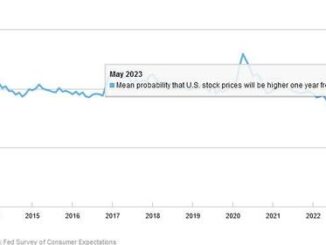

The ratio of interest payments as percent of tax receipts was 20.4% in Q1 2022, the lowest since 1969, driven by ever lower interest rates, including nearly free short-term debt.

In the 15 years between 1982 and 1997, the ratio was higher than today.

In the 10 years between 1983 and 1993, the ratio ranged from 45% to 52%.

Back then, Congress eventually got serious about dealing with the ballooning deficit when interest payments hit 50% of tax receipts.

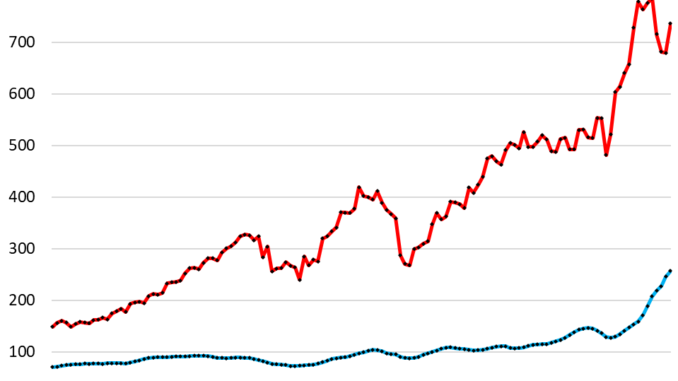

In terms of dollars, interest payments barely rose in the 20 years between 1995 and 2015 despite the debt that never stopped ballooning. The reason was simple: Average interest rates of these Treasury securities kept falling during these 20 years. Interest payments in blue, tax receipts in red.

Tax receipts (red in the chart above).

The measure of tax receipts here is what’s available to pay for regular government expenditures, including interest payments: total tax receipts minus contributions to Social Security and other social insurance, that are paid specifically by contributors into those programs and are not available to pay for general expenditures. This data of tax receipts was released on March 28 by the Bureau of Economic Analysis as part of its GDP revision.

This measure of tax receipts jumped to $736 billion in Q4, as some capital gains taxes made their way into estimated taxes, after the massive returns in stocks, cryptos, and some other investments in 2023.

Tax receipts will also jump in Q1 and Q2 2024, as April 15 is the day by which folks have to send in their big capital gains taxes for the tax year 2023.

But capital gains tax receipts had plunged in Q1 and Q2 2023, following the crappy year 2022 for stocks, bonds, cryptos, and other investments. That plunge in the capital gains taxes in Q1 and Q2 2023 was off the spike in capital gains taxes that had followed the Fed-fueled asset-price spike in 2020 and 2021.

Receipts from regular income taxes will continue to move higher due to growing wages and salaries (wage inflation) and growing employment.

Interest payments (green in the chart above).

Interest payments have spiked for two reasons: the higher interest rates and the ballooning debt.

Inflation is back in a big way for the first time in decades, and higher interest rates are working themselves back into the debt as new debt with higher interest rates is added, and as maturing debt with lower interest rates is being replaced by new debt with higher interest rates.

The government on Thursday sold 28-day T-bills at an investment yield of 5.38% and 56-day T-bills at an investment yield of 5.39%. Both issues combined totaled a monstrous $155 billion.

Yields are still lower in longer-term debt. For example, earlier in March, the government sold $39 billion in 10-year notes at a high yield of 4.17%.

The average interest rate on Treasury debt.

The average interest rate that the government is paying on all its interest-bearing debt – much of it issued years ago with much lower interest rates than now – has been rising ever since it hit the historic low of 1.57% in February 2022.

In February this year, the average interest rate on national debt rose to 3.20%, according to data from the Treasury Department. This was the highest since 2010.

But obviously, in a historical context, and given the magnitude of inflation currently, 3.20% is still a very low rate, it’s less than half of what it was in 2001. But it will keep moving higher inexorably as old debt gets replaced with new debt, and as additional new debt is being added to fund the deficits:

Interest payments as % of GDP: The burden of interest payments on the economy.

Interest payments as percent of GDP rose to 3.6% in Q4, the highest since 2000, based on today’s revised nominal GDP for Q4.

(The ratio is figured on an apples-to-apples basis: quarterly interest expense in current dollars, not adjusted for inflation, not seasonally adjusted, not annual rate; divided by quarterly nominal GDP of $6.93 trillion in current dollars, not adjusted for inflation, not seasonally adjusted, not annual rate).

So, this is a spike off very low levels, and it’s still quite a bit from the nightmare levels of the 1980s. But it’s decidedly heading in the wrong direction at a very fast pace:

Inflation…

Inflation also inflates nominal GDP (not adjusted for inflation). Nominal GDP in Q4 was up by 5.7% from a year earlier. Inflation inflates wages and salaries. Average hourly earnings at the end of 2023 were up by 4.5% from a year earlier. Inflation also inflates pre-tax business profits, as we have seen. And all these and other factors inflated tax receipts.

By inflating tax receipts, inflation helps servicing the debt; and it devalues the purchasing power of the existing debt; when the debt matures, holders will be paid off with devalued dollars. In this way, enough inflation over the longer term reduces the burden of the debt, even as higher interest rates over the term cause interest payments to rise.

It’s not interest payments that matter in a vacuum, but interest payments as a percent of tax receipts.

So we know where this reckless fiscal policy of today is going: higher inflation and higher interest rates for years to come.

Yield solves demand problems – but it’s costly.

The government is selling unspeakable amounts of new debt every week. Just on Thursday before markets closed for the Easter Weekend, it sold $155 billion in 28-day and 56-day T-bills. Someone has to buy this debt, and when interest wanes at the current yield, new buyers emerge at a higher yield, and when those buyers bought all they wanted, and no buyers at that yield materialize, then the yield rises further until more buyers emerge.

As we have seen, when the 10-year yield got closer to 5% last October, huge demand emerged, and that demand pushed the yield back down. That’s what yield is for, that’s its function, and it does that effectively: it makes sure there’s demand.

So it’s not an issue of there not being enough buyers – there will be enough buyers because the yield will rise to attract them until every last one of the Treasury securities is sold. But it’s an issue of those higher yields causing interest payments to shoot higher.

The curse of easy money.

The Fed’s interest rate repression from 2008 until 2022, obtained via near-0% policy rates and years of QE, caused borrowing for the government to be nearly free, with T-bill yields being close to 0% and longer-term yields falling to very low levels. Low interest rates encourage borrowing – everyone loves free money, and no one loves free money more than Congress. And then, debt really didn’t matter because interest payments were so low. But now the huge pile of debt does matter.

This debt binge by Congress was a result of the Fed’s reckless easy-money policies starting in 2008 with interest rate repression and QE. But now, easy money has turned into a curse of the worst inflation in decades, and a massive debt problem that won’t go away.

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.