In his farewell speech to the Democratic National Convention Monday evening, lame duck President Joe Biden tripled down yet again on the false claim that former President Donald Trump is calling for a national “bloodbath” if he doesn’t get elected in November. It is an irresponsible, inflammatory claim that is beneath the office of the president.

As a reminder, the “bloodbath” statement Biden was referencing came in a March speech Trump delivered in Dayton, Ohio, to workers in the auto industry. Here is the full context of what he said:

“We’re gonna put a 100% tariff on every single car that comes across the line and you’re not going to be able to sell those cars if I get elected. Now if I don’t get elected, it’s going to be a bloodbath … that’s going to be the least of it. It’s going to be a bloodbath for the country. That will be the least of it. But they’re not going to sell those cars.”

The truth is that Trump’s predicted auto industry “bloodbath” has already begun to arrive, as I have pointed out in several previous pieces here. Outside of Tesla, the heavily subsidized electric-vehicles sector is in a state of collapse, and the losses from EV divisions are doing great harm to the profitability of integrated carmakers like Ford and General Motors. This is no longer even arguable — it simply is what it is.

Biden’s remarks came barely a month after he was forced out of the race by Democrat power brokers like former House Speaker Nancy Pelosi in what New York Times columnist Maureen Dowd acknowledged over the weekend was a “coup.” They also came as others in the legacy media are starting to detail the reality of the mess Biden and Vice President Kamala Harris are making of the country’s energy sector with their ruinously costly set of authoritarian energy policies.

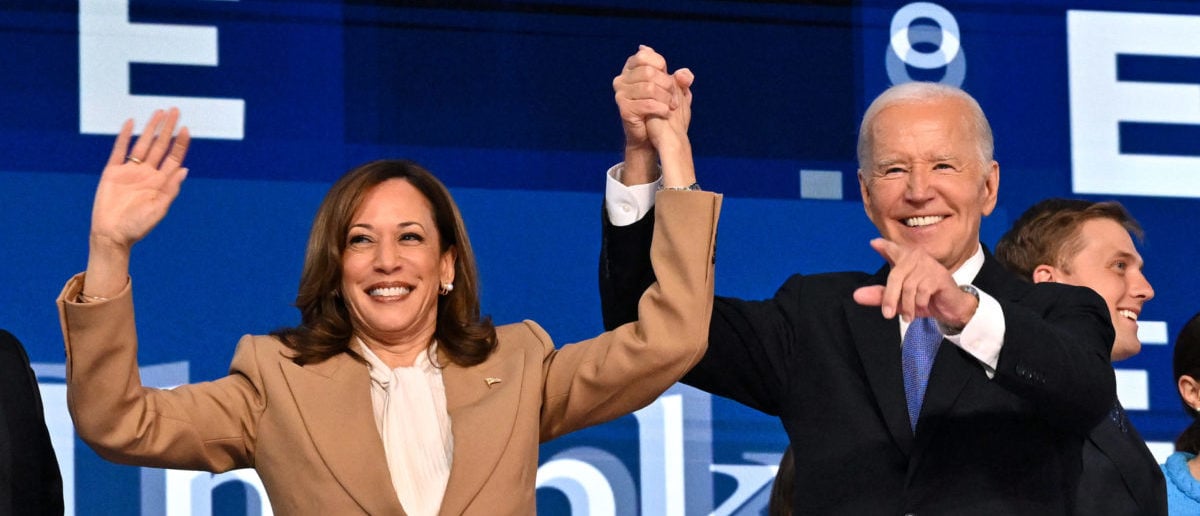

TOPSHOT – US President Joe Biden holds US Vice President and 2024 Democratic presidential candidate Kamala Harris hand after delivering the keynote address on the first day of the Democratic National Convention (DNC) at the United Center in Chicago, Illinois, on August 19, 2024. Vice President Kamala Harris will formally accept the party’s nomination for president at the DNC which runs from August 19-22 in Chicago. (Photo by ROBYN BECK/AFP via Getty Images)

The Wall Street Journal published a pair of outstanding analyses in recent days. The first came on Friday, detailing the fact that mushrooming electricity demand from AI and data centers is now forcing regional grid managers and power providers to delay plans to retire older coal and natural gas power plants. That will also inevitably force a re-thinking of stated carbon-reduction goals, which will in turn force delays in stated timelines for achieving the magical (and unattainable) net-zero commitments.

Starting about a year ago, I made a prediction that grid managers would soon be rolling out plans to keep coal-fired power plants running longer, and they and power generators would shortly thereafter begin touting the need to permit and build additional coal-fired plants just to keep up with demand. We are halfway there now, and it seems increasingly likely we will see the second half of that prediction materialize within the coming 12 months unless we suffer a strong recession that forces a drop in demand.

On Monday, the Wall Street Journal published a second excellent analysis detailing the collapse in the U.S. biofuels and hydrogen sectors. “The excitement of the early days has not lived up to the hype,” Andy Marsh, chief executive of Plug Power, a green hydrogen startup, told the Journal. It is a real understatement.

The Houston Chronicle on Monday published a piece by writer James Osborne detailing the reality that high inflation and higher interest rates are forcing major oil companies and others in high-emitting industries to delay or cancel planned carbon capture projects, not just in the United States but around the world. It turns out that project costs still matter even when companies have access to big subsidies and tax breaks. Go figure.

“You would have thought with (the carbon capture tax credit) more projects would have gone (ahead),” said Paola Perez Pena, an S&P Global analyst. “We’re hearing from developers that the figures they budgeted in 2021 are now completely different.”

So, what caused all that inflation and high interest rates? Many economists, including some leading Democrat economists, have placed the blame at the feet of Biden himself, and his two major legislative accomplishments: The 2021 Infrastructure Investment and Jobs Act, and the 2022 Inflation Reduction Act.

Oh.

It’s all so ironic, isn’t it?

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.