Authored by Preston Brashers via The Epoch Times,

Just because the government raises taxes, doesn’t necessarily mean it will raise more revenues. The Biden administration is discovering that the hard way.

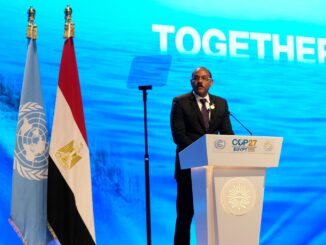

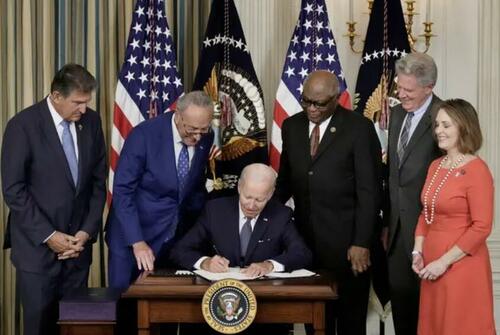

In August 2022, President Joe Biden signed the misnamed Inflation Reduction Act into law, which included a new tax on companies’ financial statement income, new IRS funding to increase audits, an excise tax on stock buybacks, and more taxes on natural gas, oil, and coal. To top it off, certain Trump administration business tax cuts simultaneously have been phasing out.

On paper, that adds up to more than $60 billion in tax hikes in 2023.

Yet, as of July 31, tax revenues are down almost $400 billion from the same time last year, representing a 13 percent drop in tax receipts–even larger after accounting for inflation.

It’s unusual for tax revenues to drop from one year to the next, as it’s happened only eight times since 1960. And only once in that 63-year period–from 2008 to 2009–did revenues fall by more than 7 percent.

It’s too early to fully account for why tax revenues are down in 2023. However, there are some factors that are clearly at work, even if it’s unclear how much of the drop in tax receipts each factor explains.

The following are five such factors.

1) Slow Economic Growth

Economic growth has cooled substantially over the past year and a half, leading to stagnant real incomes, which in turn have diminished income-tax and payroll-tax receipts.

Reduced capital gains taxes may especially be dragging down revenue collection. Stocks fell in 2022, and while most market indices recovered in 2023, dividend payouts and stock buybacks have dropped. Existing home sales have also tanked in 2023.

The slowdown in the U.S. economy can’t explain the full drop in tax receipts, though. At the start of the year, the Congressional Budget Office forecasted slow economic growth for 2023, but it only modeled a very slight decline in tax revenues compared with last year.

2) Explosion of Green Tax Credits

The Inflation Reduction Act carved a large hole out of the tax base for the crony green economy. While green companies have long enjoyed generous tax treatment, the 2022 law took things to another level.

Not only can companies in politically favored fields now avoid federal tax liability through nearly two dozen generous green tax credits, they can also sell many of the tax credits they accrue to other companies, giving many green companies negative effective tax rates.

When the legislation was debated and passed, official estimates suggested that the bill’s tax hikes would more than offset these green carve-outs. There was reason to be skeptical even then. And sure enough, more recent estimates show that the green tax credits will ultimately cost two to four times what government forecasters led the public to believe, possibly carrying a price tag of a trillion dollars or more over a decade.

3) IRS Regulatory Activism

Part of the explosion of green tax credits was predictable. Some companies will chase government subsidies like children going after candy thrown at a parade.

But the IRS and the Biden administration have also been playing fast and loose with regulatory interpretations of the new tax provisions. By devising expansive definitions for certain terms written in the statute, the IRS has greatly expanded the size of some of the green tax credits.

In one of numerous egregious examples, the IRS wrote regulations that allow foreign vehicles to circumvent strict domestic-production and battery-content requirements by defining “commercial vehicles” to include any vehicles that are leased, including to consumers.

Because of this regulatory workaround, leases now account for a nearly 500 percent larger share of electric vehicle sales than they did last year, despite the recent spike in interest rates.

4) COVID-19-Era Employee Retention Credits

If you’ve listened to the radio, watched television, browsed the internet, or answered a call from an unknown telephone number in the past year or two, chances are you’ve come across marketing for the employee retention credit (ERC).

The ERC is a refundable federal tax credit that was created in March 2020. It was designed to pay certain employers whose businesses were disrupted by government shutdowns if they kept employees on payroll.

While it may have been well-intended, implementation of the ERC has proven disastrous, delivering more fraud and abuse than the pandemic relief it was meant to provide.

Despite paying out as much as $20,000 per employee, the initial take-up of the ERC was light in 2020–the time when businesses were most impacted by onerous government shutdowns. Then in 2021, Congress made the ERC more generous, paying up to $26,000 per employee while expanding eligibility.

Meanwhile, across the country, a cottage industry of ERC mills formed, companies created solely to market and churn out ERC claims. In many cases, these companies fraudulently persuade small businesses they qualify for the credit, setting them up for IRS disputes down the road.

Even though the ERC expired after 2021, claims have since skyrocketed, with ERC companies pushing businesses to file forms to retroactively change prior tax filings.

The IRS paid out about $10.9 billion on about 120,000 ERC claims through 2020, the period during which it was originally intended to provide relief. But through July of this year, it had processed well over 1 million claims, paying out an estimated $220 billion so far, with an additional half-million unprocessed claims in the backlog.

More ERC claims continue to pour in even now, long after the pandemic.

Instead of a lifeline to help businesses survive the shutdowns, the ERC increasingly looks like a bungled and belated giveaway to the businesses the government didn’t kill.

5) Flaws in Budget-Scoring Process

The Joint Committee on Taxation and the Congressional Budget Office produce budget scores of significant tax and spending legislation. In theory, these agencies’ analyses should be tools that help lawmakers write fiscally responsible laws.

But the budget models are far from perfect. Because they don’t account for economic growth, they’re biased against legislation that would grow the economy and in favor of spending bills that pay people not to work.

Meanwhile, lawmakers game the system, using gimmicks to claim artificial deficit reduction on bills that clearly do the opposite.

How do they do this? By not spending money they were never actually going to spend.

Next, they can use the buy-now-pay-later method: Front-load government handouts in the years when they’re expecting to be in office and back-loading the spending cuts and tax increases for future lawmakers to deal with.

This is how the White House and members of Congress can claim credit for a quarter of a trillion dollars of “deficit reduction” from the Inflation Reduction Act and $1.5 trillion from the recently passed Fiscal Responsibility Act, even as the deficit has doubled since last year.

Congress and the White House are spending at a breakneck pace, and now tax revenues have fallen significantly as generous tax credits and a slowing economy outweigh the revenues from Biden’s economically harmful new taxes.

The net result is that Washington is burying Americans under a sea of debt.

In four short years, lawmakers have managed to add $80,000 of debt per U.S. household, and the budget picture looks much, much darker ahead.

Politicians’ gimmicks won’t change the fact that the American middle class will be the ones left to pay history’s largest tab, run up by D.C. lawmakers on your behalf.

Reprinted by permission from The Daily Signal, a publication of The Heritage Foundation.