By Wolf Richter for WOLF STREET.

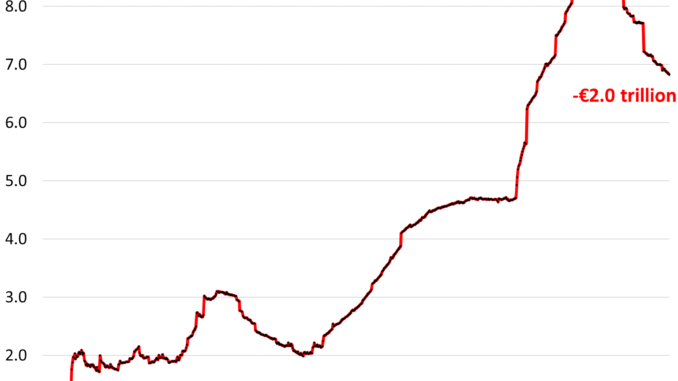

The ECB has shed €2.0 trillion of its assets since QT began, as of the latest weekly balance sheet. Its total assets are now down to €6.83 trillion, the lowest since November 2020.

In USD, the ECB has shed $2.17 trillion in assets at the current exchange rate, while the Fed has shed $1.34 trillion in assets.

During the pandemic QE, the ECB added €4.15 trillion in assets, a crazy huge amount; it has now shed 48% of that pile.

During QE, the ECB had piled up two very different types of assets, and both are getting unwound, but at a very different pace:

It offered loans under very favorable conditions (free money) to banks, and it was up to the banks to deploy this cash.

It purchased government bonds, corporate bonds, covered bonds, and asset-backed securities, thereby handing the financial markets this cash, under two programs: APP (asset purchase programme) and PEPP (pandemic emergency purchase programme).

Loan QT: -€1.80 trillion

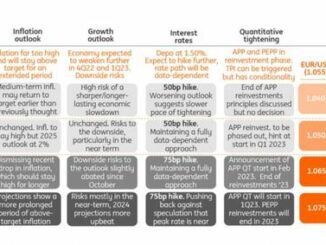

QT was announced in October 2022. As the first step, the ECB made loan terms unattractive, and it opened more windows for banks to pay back those loans, which banks did in big waves, which removed liquidity from the financial system via the banks.

By now, banks have paid back €1.80 trillion in loans since the peak, and only €401 billion in loans remain on the balance sheet, the lowest since 2015.

The ECB has always handled QE via waves of loans, at first during the Financial Crisis, then the Euro Debt Crisis, then the period of no-crisis, and finally the pandemic. The waves had names: Longer-Term Refinancing Operations (LTRO), and then Targeted Longer-Term Refinancing Operations (TLTRO); and the waves were numbered. During the pandemic, the ECB’s lending operations were called TLTRO III.

TLTRO III loans amounted to €1.6 trillion at the peak, on top of the still outstanding prior loans, for a total of €2.2 trillion at the peak between June 2021 and June 2022, now down to €401 billion.

Bond QT: -€319 billion

The ECB had bought bonds under two programs: APP (since 2014) and PEPP (since March 2020). Bond QT started slowly in March 2023 and has since accelerated, and further accelerations have been announced.

The initial roll-off of APP bonds in 2023 was capped, but the cap was removed in July, and APP bonds have been rolling off without cap. Whatever matures, rolls off. In January, €33 billion in APP bonds matured and rolled off, in February €25 billion will mature and roll off; in March, €31 billion will mature and roll off.

Since the peak, €319 billion in bonds rolled off – all of them APP bonds. PEPP bonds won’t start rolling off until July 2024.

The entire bond portfolio is now down to €4.64 trillion, the lowest since November 2021:

Years of QT to control inflation with moderate interest rates.

QT is designed to run for years without fanfare on automatic pilot in the back ground, just calmly removing liquidity in a predictable manner, so liquidity can still flow to where it’s needed, attracted by the higher yields that those who need liquidity are willing to pay.

The interest rate decisions get all the media attention. But QT is complicated, and people don’t really understand it, and their eyes glaze over and they don’t click on the articles, and so it gets little media attention, and that’s how central banks want it.

The expectation is that removing this liquidity methodically from the markets in bits and pieces over the years, it will remove fuel from the inflationary fire, allowing central banks to not lift rates as high as in the past, but keep them at moderate levels.