By Ven Ram, Bloomberg markets live reporter and analyst

Here are the broad contours of what the markets expect from the European Central Bank’s policy review:

Decision:

For quite some time now, interest-rate traders have used a working assumption of a 50-basis point increase this month, with pricing for additional tightening waning and waxing as a tail risk every now and then. Given that there hasn’t been a chorus of dissent from ECB speakers against that central pricing, it would make sense to expect a switch to a slower pace of hikes

Statement:

It is possible that the ECB may make a reference to the neutral rate, stating that its benchmark is approaching levels that are no longer accommodatory, though it won’t reveal more. That is especially so given that opinion even within the ECB as to what level constitutes that rate is fairly splitIf the decision and statement are along the lines delineated above, market reaction should be fairly orderly given that the markets are still looking at a terminal rate circa 3%, give or take a few basis points depending on the mood du jour. Which is to say that front-end German bonds face higher yields, while the euro may enjoy some kind of a revival in the months to come

Economic outlook:

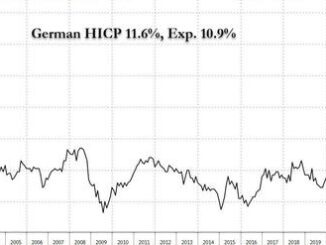

We get a new set of forecasts, and it is likely that the outlook for inflation in 2023 will be revised higher from 5.5% in September. However, the margin of revision will hold the key to the market’s reactionWe will get the inflation outlook for 2025 as well this time, and traders will want to know whether HICP inflation will converge to the ECB’s target by thenThe ECB was already estimating that GDP growth next year would be just 0.9%, but even that may be revised lower

Quantitative tightening:

Of keen interest to traders will be the ECB’s road map for tightening, especially the timing and quantum of it. While there seem to be different schools of thought within the monetary authority on when it should commence the process, what looks fairly certain is that it will begin in the first halfAlso of interest will be whether the ECB will decide between passive and active QT, though it may opt to let maturing bonds roll off its balance sheet as a crucial first step

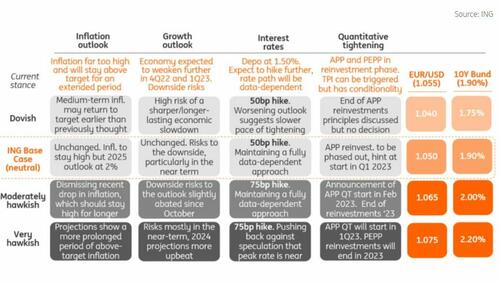

Finally, courtesy of ING Economics, here is the scenario matrix of what the ECB could say and what it would mean for markets.

Loading…