Welcome back to the Energy News Beat Channel, where we break down the latest developments shaking up the global oil markets. Today, we’re diving into the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report, released on August 6, 2025, for the week ending August 1. The headline? U.S. crude oil inventories shrank by a surprising 3.03 million barrels, reversing the previous week’s hefty build and sending ripples through the futures markets.

This draw was larger than analysts expected, who had forecasted a modest decline or even a slight build, making it a classic case of supply tightening just when demand signals are heating up. Let’s crunch the numbers straight from the EIA’s report to give you the full picture. Total U.S. commercial crude oil stocks now stand at 426.7 million barrels, which is about 6% below the five-year average for this time of year—a clear indicator that inventories are leaning leaner than usual.

Breaking it down further:

Are you from California or New York and need a tax break?

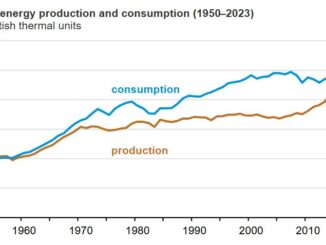

Crude Oil Production: Held steady at around 13.3 million barrels per day, showing U.S. shale producers are maintaining output without aggressive ramps.

Imports and Exports: Net crude imports dropped by 0.5 million barrels per day, while exports ticked up slightly, contributing to the inventory draw.

Refinery Runs: Utilization rates climbed to 93.5%, up from 92.8% the prior week, as refiners cranked up processing to meet summer driving demand for gasoline and distillates.

Product Inventories: Gasoline stocks fell by 2.1 million barrels, and distillate fuels (like diesel) decreased by 1.4 million barrels, underscoring robust end-user consumption.

This isn’t just a one-off blip. Last week, inventories had ballooned by 7.7 million barrels due to temporary import surges and lower refinery activity, but this sharp reversal suggests underlying strength in domestic demand—think peak summer travel and industrial activity picking up steam.

Overall, Cushing, Oklahoma—the delivery hub for WTI futures—saw its stocks dip by 0.8 million barrels to 34.2 million, further supporting a bullish narrative.

Now, what does this mean for oil investors?

In short, it’s a green light for upside potential. A larger-than-expected inventory draw typically signals tighter supply relative to demand, which can push crude prices higher. We saw this play out immediately: WTI crude futures jumped over 2% post-report, hovering around $78 per barrel, while Brent climbed to $81.

For investors in oil ETFs like USO or stocks in majors like ExxonMobil and Chevron, this could mean short-term gains as margins improve for producers. However, keep an eye on the bigger picture—OPEC+ production cuts are still in play, and if U.S. draws continue, we might see prices testing $85 by fall. On the flip side, if global economic slowdowns (hello, recession fears) curb demand, this bullish momentum could fizzle. Diversify with options hedges or look at midstream plays like pipelines for stability.

But hold on—the oil story doesn’t stop at U.S. shores. Enter President Donald Trump’s latest trade salvo: an additional 25% tariff on Indian goods, slapped on as punishment for India’s persistent imports of discounted Russian oil amid the Ukraine conflict.

This move, effective August 7, 2025, builds on existing duties and could effectively double tariffs to 50% on some Indian exports to the U.S., targeting everything from textiles to pharmaceuticals—but not directly oil.

Will this ripple into oil markets? Absolutely, though indirectly. India is now Russia’s top oil buyer, snapping up over 2 million barrels per day at bargain prices, which has helped keep global supply flowing despite Western sanctions.

Trump’s tariffs aim to pressure New Delhi to cut back, potentially disrupting Russian export routes. If India blinks and reduces purchases, Russia might flood other markets or curtail output, tightening global supply and boosting prices—bullish for U.S. producers but a headache for consumers. We’ve already seen knee-jerk reactions: oil prices spiked on the announcement, and the Indian rupee tanked, which could inflate India’s oil import costs (since oil is dollar-denominated).

On the flip side, Indian officials are digging in, vowing to continue Russian buys to shield their economy from high energy costs.

A prolonged standoff might slow India’s growth, curbing its oil demand (currently ~5 million bpd) and exerting downward pressure on prices.

For investors, this geopolitical wildcard adds volatility—watch for escalations like secondary sanctions on Indian refiners. It could favor U.S. LNG exports as alternatives, benefiting companies like Cheniere. Bottom line: The EIA draw is a near-term win, but Trump’s India tariffs inject uncertainty that could swing markets either way.

Stay tuned to Energy News Beat for updates as this unfolds. What do you think—bullish breakout or false dawn?

Is Oil & Gas Right for Your Portfolio?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack