Making predictions, especially about the future, is dangerous. That didn’t stop Elon Musk, the chief executive of Tesla and SpaceX, from making a rather startling one recently: U.S. electricity demand will triple by around 2045, in part due to widespread adoption of electric vehicles.

That estimate puts him way out ahead of utilities like PG&E, which is forecasting a 70% rise over the next 20 years and consulting firm McKinsey, which expects demand to double by 2050. A National Renewable Energy Laboratory scenario from 2018—assuming 88% of light-duty cars in the U.S. are electric by 2050—put electricity demand that year about 60% above the level reached in 2022. Nearly all the increase in the NREL scenario is from vehicle electrification: EVs made up only about 7% of vehicles sold in the U.S. last year.

Musk’s specific figures may turn out to be off the mark, and he certainly has a vested interest in faster electricity supply growth. But his general point—that the U.S. power supply risks falling seriously behind the curve—is starting to look prescient.

In theory, the U.S. has an enormous pipeline of power projects in the works: over 2,000 gigawatts of planned capacity and storage, nearly all of it renewable, were in the grid connection queue at the end of 2022, according to the Lawrence Berkeley National Lab. Incentives in the newly minted Inflation Reduction Act and the 2021 bipartisan infrastructure law should help dramatically boost clean power construction: Total generation capacity of all types, including gas and coal, was only about 1,200 gigawatts in 2022.

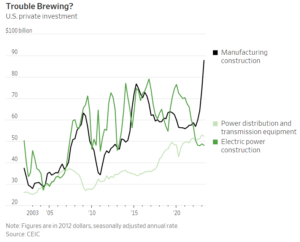

But in reality, investment in electric power construction has slowed sharply this year—just as overall U.S. manufacturing investment is ramping up, in part due to tax credits from the IRA and other related industrial-policy legislation like the CHIPS semiconductor law. Real, annualized private manufacturing construction investment rocketed higher in the second quarter of 2023, according to figures from data provider CEIC. But private power-sector construction investment actually fell. Total clean power installations were down 19% year over year in the first half of 2023 according to the American Clean Power Association, and newly announced purchasing power agreements were down 47% in megawatt terms.

A big part of the problem appears to be rising waiting times for grid connections—an issue that is part politics and part a consequence of the nature of wind and solar plants, which require more grid development because of their intermittency and oft far-flung locations. A lack of clear legal guidelines on who should pay for long-distance transmission lines and how to resolve permitting disputes could strangle the renewable build-out in its crib, unless Congress or federal regulators act quickly.

This year’s unexpectedly strong surge in manufacturing investment raises further uncomfortable questions. The 2018 NREL scenarios assumed that U.S. industrial energy demand growth would remain tepid through 2050, even as EV power demand soars. But if U.S. industrial policy succeeds, for better or worse, in triggering a sustained manufacturing investment boom over the next decade, those projections could prove too conservative. And that is before accounting for a potential artificial intelligence arms race or other electricity-intensive new technologies that could come out of left field.

To be sure, plenty of new technologies will help save power and use existing grid resources more efficiently too—for example, idle EV batteries might one day help balance a grid more dependent on intermittent wind and solar farms.

But unless legal barriers to new electricity infrastructure are resolved, America’s plan to recharge manufacturing—to say nothing of the transport sector—may fall short.