Steve Reese is the CEO of Reese Consulting and Reese Training and has significantly impacted the natural gas market for decades. He worked on over 5% of the United States’ natural gas market through his auditing, training classes, and consulting firm.

We need training for the next generation, and his newest projects with exporting LNG to Germany is critical for energy security for both countries.

Please sit back and enjoy listening to my friend and fellow Okie. Steve, thanks for stopping by the podcast. I am looking forward to NAPE!

Also connect with Steve on his LinkedIn HERE: https://www.linkedin.com/in/steve-reese-185a86/

Reese Consulting HERE: https://www.reeseenergyconsulting.com/

00:00 – Intro

01:31 – Steve Reese, CEO of Reese Consulting and Reese Training, shares his 42-year background in the natural gas industry.

04:21 – Reese transitions to online natural gas courses with Energy Rogue, offering affordable pricing and subscriptions, prioritizing youth education, and addressing green energy trends through monthly Q&A sessions.

09:58 – Explores the energy industry’s shift to LNG, challenges in offshore wind projects, the positive role of natural gas, and Texas’ focus on diverse energy sources, highlighting pragmatic hybrid solutions.

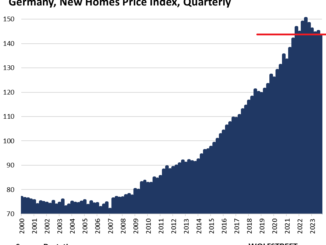

15:46 – Launches American Gas Partners, a German-owned fund supporting U.S. shale gas export to Europe, addressing economic challenges from high electricity prices in Germany, emphasizing LNG’s environmental and economic benefits.

21:50 – Highlights American Gas Partners’ unique investment opportunity, a German-owned LNG infrastructure fund with dual benefits of returns and lower gas prices for European end-users, especially in affected sectors like fertilizer production.

24:33 – Discusses LNG ventures, emphasizing economic and environmental advantages of U.S. shale gas in Europe and noting a shift in investment perspectives within the energy industry.

27:32 – Contact information for Steve Reese.

29:06 – Outro

Other great resources from Sandstone and Energy News Beat

Real Estate Investor Pulse https://realestateinvestorpulse.com/

1031 Exchange E-Book https://alternativeinvestments.sandstone-group.com/en-us/tax-benefits-sandstone-group-0-1-1-0

ENB Top News https://energynewsbeat.co/top-news/

ENB https://energynewsbeat.co/

Energy Dashboard https://app.sandstone-group.com/enb-dashboard-version-2

ENB Podcast https://energynewsbeat.co/industry-insights-2/

ENB Substack https://theenergynewsbeat@substack.com

Michael and I are on a mission to talk about energy. If you are a thought leader, government-elected official, CEO, or author of any energy market, contact us and get your story out on our news and podcast channels.

– Get in Contact With The Show –

Stuart Turley [00:00:03] Hello, everybody. Welcome to the Energy News Beat podcast. My name’s Stu Turley President, CEO of the Sandstone Group. Not only do we have an action packed podcast today, I got truly one of my greatest heroes around. I mean, he is the Steve Reese, right? He is the CEO of Reese Consulting and Reese Training, and he’s also very involved in global LNG markets and natural gas. He has huge reach around the energy space. Welcome. Thank you so much for being here, Steve.

Steve Reese [00:00:42] It’s always my pleasure. And I just love these discussions.

Stuart Turley [00:00:47] You know what, Steve? I have had so much fun interacting with you and really having fun. Some of the cool things about Reese Consulting is that you guys have a lot of huge projects going on. Tell us just a little bit about what your background is, because even though you’re a retread, as I affectionately call people that are brave enough to come on the podcast multiple times, you’ve done a fantastic job. Tell us a hair about how you’ve been in the business a little while. You’ve got more hair than me. For our podcast listeners, he’s a good looking guy, but he I’m jealous of his hairline. So Steve, tell us a little bit about what you got going on.

Steve Reese [00:01:31] Well, I come I come here mostly for for my self-esteem, for my hair lines, too. So I appreciate that. But I’ll take what I get. You know, this is a year 42 for me and the natural gas, mostly the natural gas arena, but the energy arena and the last it’s been almost 30 years to the day that I’ve been an entrepreneur and after my career, said Getty Oil and Texaco. I’ve had the consulting company now during this time, as well as the training materials, my copywriters seminars that that were getting ready to reintroduce to an online platform. We’ve grown now to our staff is phenomenal where we are now literally in every base that we’re doing work in. So from the Marcellus to the Haynesville to the Permian to the mid kind to the D.J. and and you name it. So we’re we’re excited about that. The consulting side right now, it seems like there the project this year, if you will, the thing that’s kind of on fire is our midstream auditing, where we help producers ensure that they’re paid correctly under their gas contracts and also in the field. And I’m proud to say in the last four years, we’ve now audited 5% of all the gas the United States, and we’re still churning. We’ve we’ve audited over five, 5 billion cubic feet a day. We’re engaged with some fantastic clients like Chesapeake and Southwestern Energy and Scout Energy, where we’re heavily involved in our larger basins. And and my staff has just done a phenomenal job, both on the accounting, the commercial side, the contractual side, and also in the field. And so that business right now is really ramping up. I’m hiring, hiring more auditors and more project managers as we speak.

Stuart Turley [00:04:00] I’ll tell you, Steve, also, you’ve got your training and training is so critical for the next generation of kids and the next generation of folks coming around the corner. Your copyrighted training and everything else. Tell us a little bit about that, because that is our future.

Steve Reese [00:04:21] Well, those of you that might watch this that have known me over the years, I taught my courses live from about the mid nineties up until about 2015 to over 20000 hours of trained professionals. And I taught them live at Dover Land Bridge and Chesapeake and Enterprise and all the large companies. And still today it fills my heart. Somebody will say that, you know, one of my course books is still on their desk or I was, I was the first ugly face they saw when they went to work One day they saw him in a training room right in an auditorium. So as as the live training seems to have diminished and diminished in the last five or six years in a lot of the large companies risk consulting, we began to focus on the consulting portion. But I feel in the same way as you, there’s a generational shift. And I was fortunate to two dear friends, Bill Shanahan and Brian Peery with Energy Rogue approached me and said, You know, dude, we’re we’re technical guys, but we know the business. We would like to take your courses online, we want to record, do the recordings. And so we’re right now still in the process of recording the first the last one I won the natural gas basics course of mine. Right? Where next will be? There is a gas transportation course. There’s going to be a midstream course now, a training course on and on. They will excuse me. The road guys will be with us at our booth at night. And that’s kind of when we’re going on now, you know, the rollout of these training courses and we’re going to have them. Our business model is this We’re we’re going to take each course and break it up into 30 minute snippets or 45 minute snippets where people can go on and take those at their leisure, they’re going to be priced. So where, you know, people may not even experience that because we’re going to put them for their very affordable for even just regular individuals. Nice. And also have a premium subscription for a community where once a month they can put all their questions out there and have a Q&A with me, you know, each month, frankly.

Stuart Turley [00:07:10] That’s huge.

Steve Reese [00:07:11] Yeah. And so we are in talks with various channel partners. We want to obviously get in the door with with the chevrons on the shells and ExxonMobil. So really our key is, is the younger generation, whether it’s like the Houston Independent School District or whether it’s the University of Texas or whoever, even if if they’re not in the industry yet. One thing we’re also realizing our market is to with with the green energy push, you know, the administration continues to say, well, we’ll just move a compressor mechanic over and having work on a solar panel, number one, that’s probably not going to happen. That number to those places are logistically correct that we think we really believe that still today. Natural gas is not a bridge fuel. It is the fuel of yesterday, today and tomorrow. We think a lot of young people that are enamored with the green energy, with the wind and the solar and all that will get interested in our natural gas business and realize that’s why CO2 has come down in the last 15 years is because of natural gas. So we’re really excited about it. And in my ripe young age, you know, I look at the royalties from this, something that will help my family still in years to come. So that’s exciting. Yeah, it’s very exciting. And obviously when we see you guys that night, I’ll give you a good intro to to Brian and Bill as well.

Stuart Turley [00:09:03] I can’t wait to see them. I just I get your email every day and I highly recommend the data they put out. But Steve, there’s about 16 things. You know how I can’t stand. You know, when you say something, I’m like, Oh, we’re looking and we’re trying to get it rolled out for homeschool. In your market would be fabulous for home schooling consortiums because as we try to get into that next generation of kids, there’s you’re seeing a major push to go to home schooling. And we’re trying to make sure that all of our CEO’s and all of our materials and I’m gearing up so that we can make tests and quizzes and everything else so we can make all of our hours in on training. But, Steve, when you talk to CEOs of your caliber and everybody else, you learn things.

Steve Reese [00:09:58] Now you do others and you understand you’re preaching to the choir. You know, we homeschooled our children. So, yes, we have thought about that. And obviously, there are going to be we’re very well connected in the homeschool community and all in Oklahoma and some parts of Texas to just our boys. And so I agree with that 100%. And we’d love to help you with that. We know all the principals and the like that homeschool and the Oklahoma City homeschool communities. They’re great people. And that’s an excellent, excellent idea.

Stuart Turley [00:10:36] And it’s my way to give back. And so, in fact, I’ve had so much feedback on this that it was like, your podcasts are great because of my guest and they have great topics, but let’s go back to the natural gas and the move in the future for our kids, and that is I see a huge move, Steve, because it’s the LNG. You know, Europe is in a dire need for energy. Asia, China just did the 27 year LNG contract with Qatar. And then you have and I love the way you phrase it, that it is the fuel. If you have a base load with nuclear natural gas, you can actually get business done at low cost kilowatt per hour. And there is a huge run away from all of the wind farms off shore. They’re bailing on it, orsted’s going bankrupt.

Steve Reese [00:11:39] They’re bailing on. And even with your money and my money being thrown at me so much. But and, you know, sometimes I’ve learned in my career long time certain things have to run their course, good, bad or indifferent. Right. And we’ve we’ve seen that and we’re experiencing that. I hate it on a lot of the offshore wind where on the surface you think that’s a no brainer. The eco is just aren’t there. And now that this administration wants to put billions and billions of our own hard work money towards projects that are failures, you know, it’s sad, but that’s okay. I’m you know, me and my team, we look forward. We’re positive we’re going to just put one foot in front of the other every day and work hard.

Stuart Turley [00:12:36] What about the cool thing about Texas? We have half the cost of the energy for consumers, the you know, half of what New York is, half of what California is. We have wind, solar, nuclear, coal. We love energy. Doesn’t matter what it what it is. But the legislature adding in all those billions of dollars for natural gas plants. What are your thoughts on that? That’s pretty darn cool.

Steve Reese [00:13:04] Somebody woke up and a reality.

Stuart Turley [00:13:10] Show.

Steve Reese [00:13:11] Is like, wow, look at that. Two plus two does equal for. Right. You know, so. No, that’s that’s that’s a step in the right direction. And natural gas. And there are times there’s natural gas have some issues from time to time. Of course, the big freeze in 21. Yeah. There were some things that happened and some other things are needed. I’m not opposed to to really to to especially I’m not opposed to solar in a specific spot. If you fly if you fly to Vegas to look out the window at the desert, there’s a huge solar farm. That’s a great idea. But, ah, you know, you got tons of sun out there, so that works. Or or you know what I think about things? Even ease. Of course, I don’t think they’re worth much. But there are certain scenarios where an electric vehicle, if you’re a commuter in a big city, whatever, okay, that’s fine. But you can sell me a Ford F-150 electric vehicle for for 150 grand. A farmer’s going to just laugh you off the planet. So.

Stuart Turley [00:14:22] And in there, lose it for losing, what, $20,000 a vehicle. And then yesterday, Ram announced, Steve, you and I would I’d pull up at O.U. They would probably laugh both me and you out of there. And that is it has a six v6 in it. And with a six cylinder engine, it all that engine is to do is to charge the batteries. There’s no connection between that engine and in the drive train. So I honestly and so the batteries on this bad dog are it will go 120 miles. That won’t even get you from your house to Tulsa. And and so then you get to drive with your six cylinder engine like a World War Two submarine. And the reason they did that, Steve, was because the the thing will charge it from here to here. And then it qualifies for the loans, the tax deductions and everything else. But what got me is, why don’t we use hybrids? One EV battery will supply the battery tech. Now the battery raw materials for a 190 of the hybrids. I know it’s.

Steve Reese [00:15:46] It’s insanity, but, you know, I. I don’t get it. I understand people have certain agendas, but I’ll let them have those and I’ll say stuff that makes money arrive, you know.

Stuart Turley [00:16:00] And what’s good for the environment. Because the EIA last year, the EIA said the only reason the U.S. reduce you brought this point up and it was fabulous. The EIA said that natural gas was the only reason the U.S. reduced its emissions as pretty strong.

Steve Reese [00:16:22] No, I hear you but you know, it’s it’s we’re excited about the future and and I’ll I’ll I’ll move into the international stuff. You know, I know you and I have had discussions a little bit about our new venture. And I know you’ve talked to a couple of my partners, Ted, Mark Tech and Piers Kirby. So American Gas Partners is live. We’re in Berlin today with we have hired consultants from even a Roland Berger, the largest consultancy in Germany. We’ve got project managers over there. We’re beginning discussions with roughly 150 industrial end users. And so the philosophy is this the philosophy behind this will be a German owned infrastructure fund, and the infrastructure fund will fund assets liquefaction, the shipping and the REGASIFICATION in Europe for U.S. shale gas to be exported from the Gulf Coast. And so our our philosophy goes further in that, you know, our message initially was no one else is really doing this. You know, of course, you’re shell doing their deals or Cutter or whoever it is doing their deals, but that’s fine. But we have the relationships in Germany where we we peers and and a my team over there, they know these people. They’ve worked over there. They’ve worked in Russia, Ukraine and Germany and Western Europe. And what’s happened, as you well know, is with the wind stuff being forced on the German public over the last few years, their electricity prices have got to the point that the manufacturing they’ve lost tens of thousands of jobs. So our message both to the Germans right now is we’re here to save your jobs. We’re here to to bring LNG that’s affordable, cheap, reliable, environmentally friendly. And it works. We’re here to save your jobs. So we’re in discussions with all the guys. You have a large you know, we have a large raise that we need to do. However, we’re confident that we’re going to get a lot of running room and at a certain point we’ll pivot and have my contacts at the big U.S. gas producers and say, Nice, let’s dedicate your gas to this. Maybe you want to invest in this. And our goal is to be doing it anywhere. I’m going to be realistic anywhere from say. 2 to 5 metric tonnes per annum in about three years. So maybe 20, 26.

Stuart Turley [00:19:29] That’s not long. And Germany has had to VW closed. They closed the the oldest steel mill in Germany this year because they couldn’t get enough power. And then they’re buying all their electricity from coal. They took Steve. This is terrible. They had to take a coal. Do you remember, Greta, when she was being hauled off because she was protesting?

Steve Reese [00:19:56] Oh, yeah.

Stuart Turley [00:19:57] Okay. That was that was a photo shoot or a photo or photo op. That same coal plant or mine, scuse me, was right next to a wind farm there. Had there taken that wind farm down so they can dig more coal now.

Steve Reese [00:20:15] So, you know, Pearce and Turner and the guys have done their homework and part of their message to a lot of the Germans over there is they don’t they think the German public right now thinks they’ve been real green with all this waste. However, the data will show Germany has been using six times more coal than any of the surrounding European countries, and their public is waking up. Their government is moving more in a somewhat conservative direction. And we think the next prime minister possibly is that that’s going to be a good thing to be put in, is going to be a huge ally for us.

Stuart Turley [00:21:01] So that’s great.

Steve Reese [00:21:03] But we’re just over there doing our thing. We got boots on the ground, we’re spending money. We’re calling on the right people. We’re trying to get a collaborative effort with the right geopolitical, municipal and industrial forces over there to to come together.

Stuart Turley [00:21:22] Steve, you’re hitting every in dealing with all the investors that I deal with around the world and everything else. You’re hitting some key points, German owned infrastructure. Then you’re also talking about natural gas and LNG. I mean, take a look at the average contracts. Now they’re 20 to 27 years. Talk about an investment with a return. You got guarantee coming back on those things.

Steve Reese [00:21:50] Well, so listen here. Here’s our ears. Listen to this. And I think this is a is a very unique idea, is that we’re letting these end users know go. And you got two things here. You know, if you you can invest and you’re going to make a return on your investment and buy cheaper gas than if you’re buying it at this, the states index here in Germany. So we’re going do and you don’t have to do both. You want a cheaper gas price, then invest in the product because in the infrastructure, because you’ll get a return on that. So it’s twofold for that. We’re giving the opportunity for them to do either or or both.

Stuart Turley [00:22:37] You know what? If they also had to close their fertilizer plant? So if I was I believe it was BSE, a BASF.

Steve Reese [00:22:45] Yeah.

Stuart Turley [00:22:46] And if I was them and I’d sit there and I’d be like, I need the number to one 800 Steve Rice right now. Because if you had the ability to invest in LNG and then guarantee that you could bring your fertilizer plant back online, I’m in.

Steve Reese [00:23:03] Well, we know one thing, and and this is all over Europe. One thing they want American shale natural gas, period. They know it’s reliable. They know these the drill. The producers over here, they know where to drill. There’s no such thing as a dry hole anymore in these shale plays. They know exactly what they’re going to hit. It’s clean, it’s ubiquitous, it’s fungible. And I think, again, it’s another kind of a reality is is you know, is it is finally checking in to our lives. So as soon as is Charlie and Associates is ready to cut us a $25 billion check, then we’re off and right.

Stuart Turley [00:23:50] And my credit card will go that high. So my my wife actually has tried, so, you know, we’re okay there. But I.

Steve Reese [00:24:01] Yeah, we’re we’re excited about the.

Stuart Turley [00:24:03] Status this so cool because it’s a win for the German people. It’s a win for the United States. It’s a win for both consumers. Sure. Sure. I mean, it is a win win win. Now you’re your folks over there in. Germany. I visited with him one time and I can’t wait to visit with him again. So when the time is right, you know, maybe they’ll come in for nap. You know, you never know.

Steve Reese [00:24:31] Yeah, we’re we’re.

Stuart Turley [00:24:33] We’re.

Steve Reese [00:24:33] We’re really close. Should we? Like I said, we have made initial contact at our Berlin office with 150 of the prime targets that we have and starting to get some good feedback. And it’s it’ll be a long process. But yeah, we’re we’re we’re anxious to to see you guys at night. I got a big stake a deal first frescoes with your name on it on Thursday night.

Stuart Turley [00:25:02] Well, that sounds fantastic. I’ll see. When you and I were talking about Owusu and. Oh, you, I. You did was bet you for a cup of coffee. So you know that we’ll take the cup of coffee off of the steak and then I.

Steve Reese [00:25:16] Yeah, I think I rather feed your rib. I’ve seen some stale coffee from Starbucks. Personally.

Stuart Turley [00:25:23] I, I normally don’t buy Starbucks. I’m not. Yeah, I’m not a fan of their policies, but I agree. You know the one thing as we roll around the corner here, Steve, I cannot wait to give you a hug and I can’t wait to hear more about what you have going on with your training when you’re ready for investors and stuff like that, let us know. We want to get the word out because if you’re taking a look at 5% of the U.S. natural gas and ordering it and putting in mechanisms, that’s a lot of gas. That’s a lot of expertise. And if you the investors that I have been talking to, I mean, if you take a sit back and take a look, Larry Fink has now said that it’s okay to invest in an Oxy. And the reason he’s doing that is because he lost $1.7 trillion last year in the first half of the year. Oops. So and even Bill Gates said, oh, climate change is not real. Now you’re on that wagon. Good.

Steve Reese [00:26:36] Hey, Manning talks, my friend. And at the end of the day, all of these boards and all of these people, they were pushing them. You got to have an ESG score. You got to have a high score. You got to know your CO2 score and all of this. At the end of the day, it’s your pocketbook. And people.

Stuart Turley [00:26:56] Actually.

Steve Reese [00:26:57] People want to retire. People want to have a nice car, you know? And at the end of the day, these money managers that wear woke, they’re get a wake up call. You know, and it’s I call it hashtag karma, right? That’s what it is.

Stuart Turley [00:27:17] Well, Steve, your company is Steve Reese Consulting and Reese training. And then the other one is the American Gas Partners. People can get a hold of you on LinkedIn. What are other ways people can get a hold of you?

Steve Reese [00:27:35] LinkedIn is they are so fortunate to have a lot of followers, but there’s always Reese energy consulting dot com and Reese energy trading dot com. And the next time we get on here Stu I’ll bring in my Larry Curly and I’ll get I’ll get Bill and Brian on and talk training with you. And we will definitely swing by the booth. I love to do the live podcast and meet with you, so I’ll be in touch before the end and we can sit down and make fun of all the all the funky looking people at night one afternoon.

Stuart Turley [00:28:16] You know, you can’t buy that kind of entertainment. I would just as a side note, I was over in the Permian Oil Show doing live and it was so fun. I actually was doing a live podcast to Africa. Cyrus Brooks was there visiting with the he was the secretary general for the African Petroleum Producers Organization, the OPEC of Africa. And they have 18 members. And there’s all these people lined up. A live podcast is kind of cool and.

Steve Reese [00:28:52] That estate is full of all the. I’ll make sure I’m not wearing my jammies. I’ll put some decent on.

Stuart Turley [00:28:59] Oh, but I got to see them slippers. As long as I see you going by and some, you know, some bunny slippers, we’re all good. [00:29:06]So, Steve, thank you so much for stopping by the podcast. [2.5s]

Steve Reese [00:29:10] My pleasure, buddy. I’ll see you soon.