This is a wild and fun discussion with Hugo Kruger about the international Energy Markets. I mean we covered oil, gas, coal, nuclear and even geopolitical. Hugo has a great Substack HERE: https://substack.com/@hkrugertjie. He has quite a following, and even Robert Bryce is in the mix of followers. (One of my heroes). I recommend following him.

Hugo has vast experience in geopolitics, contemporary politics, and climate science and is truly an international thought leader. When we recorded this episode, he was in Paris and was taking a bit of a holiday from South Africa.

Thank you, Hugo, for taking the time to stop by my podcast! – Stu

Highlights of the Podcast

2:12 – Introduction of Hugo Kruger and his background in civil engineering, cement manufacturing, nuclear engineering, and insights into the oil and gas industry.

6:03 – Discussion on the impact of political decisions on nuclear energy in France, leading to delays in maintenance, skills gaps, increased costs, and the complex interplay of politics and energy issues.

9:34 – Overview of seven energy sources, including wind, solar, hydropower, nuclear, oil, LNG, and coal, with considerations of constraints, geopolitical issues, and economic factors.

15:07 – Exploration of corruption and cronyism in South Africa’s renewable energy projects, emphasizing the moral argument for African countries to consider a balanced energy mix, including wind, solar, and coal.

17:23 – Comparison of current energy policies to historical colonialism, criticizing restrictions on developing nations, advocating for a balanced approach in Africa, and discussing the challenges and benefits of nuclear energy.

19:33 – Discussion on the economics of nuclear energy, comparing capital and operational costs to coal, advocating for a mix of coal and nuclear in a country’s energy portfolio, and highlighting the challenges and benefits of small modular reactors.

23:14 – Analysis of challenges in the uranium market, emphasizing low prices, Russian control in processing, and the cost competitiveness of nuclear energy after capital expenditure.

27:39 – Advocacy for a revised electricity pricing model, emphasizing fixed charges to cover grid services and infrastructure costs, and skepticism about the viability of a distributed grid.

29:42 – Discussion on the financial challenges of wind farms, highlighting abandoned turbines and the costs of removal, questioning fiscal sustainability without tax subsidies.

31:52 – Proposal for a restructuring of the pricing model in the energy sector, advocating for fixed tariffs to cover services like backup, grid stability, and synchronous power.

34:38 – Emphasis on the need for a revised pricing model, citing California’s Diablo Canyon as an example and advocating for fixed tariffs to reflect the true value of different energy sources.

37:36 – Highlighting systemic issues in the energy sector, emphasizing the need to address problems like corruption and colonialism, suggesting solutions such as eliminating subsidies and improving regulations.

41:17 – Conclusion and information on finding Hugo Kruger on Substack.

Other great resources from Sandstone and Energy News Beat

Real Estate Investor Pulse

1031 Exchange E-Book https://alternativeinvestments.sandstone-group.com/en-us/tax-benefits-sandstone-group-0-1-1-0

ENB Top News https://energynewsbeat.co/top-news/

ENB https://energynewsbeat.co/

Energy Dashboard https://app.sandstone-group.com/enb-dashboard-version-2

ENB Podcast https://energynewsbeat.co/industry-insights-2/

ENB Substack

https://theenergynewsbeat@substack.com

– Get in Contact With The Show –

Hugo Kruger – Conversations in Energy – Final Cut.mp4

Stuart Turley [00:00:08] Hello, everybody. Welcome to the Energy News Beat podcast. My name’s StuTurley, president CEO of the sandstone Group. I’ll tell you, there’s a lot of crazy things going around the world right now. And having a world understanding of energy is very important because so many times Americans, we just sit here and think, oh, I’m going to go to the store. But having people and discussions from around the world is more important now than it ever has been in the past. And today we’re talking with Hugo Kruger, and I have butchered his name up. He is in Paris right now, but we’ve had a little bit of a chit chat right before we get here. And, uh, Hugo, thank you for coming on the podcast. How do you pronounce your name?

Hugo Kruger [00:00:56] Hi. Thank you. Steve. So yeah, I’m South African in origin and I speak my home language was Afrikaans, so my name is pronounced haiku. Career. But Hugo Kruger’s fine for people from English speaking countries. I’ll take no exception to that.

Stuart Turley [00:01:10] Yeah. That’s right. You were saying. Also, your sister is, uh, looking at, uh, becoming a Japanese citizen, and that’s a new thing. So you’re in Paris with your friend, uh, and your wife is Iranian. Is that right?

Hugo Kruger [00:01:25] That’s right. Yeah. So my family’s all over the world, and then my parents still stay in South Africa. And I even had a brother who taught in China, in China at one stage, who taught English there. So it’s it’s a mixed, uh, international family. I can say that with roots still in South Africa.

Stuart Turley [00:01:40] Being Americans, we are so blinders centric that we just don’t even look at anything other than the grocery store or the the next football game. I mean, we’re too stupid. I mean, honestly, um, and to hear this kind of a family gathering and everything else, you just Ron David Blackman’s, uh, the energy question. That was a phenomenal interview as well too. How did you get started as a South African in taking a look at energy around the world?

Hugo Kruger [00:02:11] Sure. So, um, I studied civil engineering. Originally I was into construction, but my grandfather was an expert in what we call fly ash technology. Now, for those who don’t know, we burn coal. The if you pulverize it, you get fly ash, you don’t pulverize. You get what we call clinker, ash, clinker, as you can use in cement, brick manufacturing and fly ash. You can use this in addition to cement. So what used to be known as ordinary Portland cement OPC part of that would become replaced with fly ash. Right. And one of it’s got many advantages. But one advantages, for example, is you don’t need to when you build dams like they did in the Hoover Dam, they put the water into the dam. Will red fly ash to cement? You don’t need to do that, okay. Because the hydration need is lower. So coal has that supplement advantage too. So I always knew something about the coal industry. There’s an entire value chain attached to it. Then I started working in cement manufacturing myself after graduating. Okay. Uh, working for a company called Lafarge, which was a French company. Then at the time, um, when I was studying French, because working for a French company and now lectures and listening on scholarships for people who want to go to study in France. So I got a scholarship to study in France at the time, enrollment closed for cement and materials science. And but I had the scholarship. Okay. So I enrolled for random degree in nuclear engineering, um, without knowing too much about it, because I came from civil background. So it was the construction of nuclear power stations because this was 2015. And at that time, France was rethinking already about the aging nuclear fleet. Oh, what do we do about it? So they had to study and analyze it. So the first training engineers in construction to realize what the mistakes were before they were going to rebuild and upgrade them to life extensions. That’s how you’re supposed to do it, right? So France already started the program going back as far as I can tell, 2013. I was in one of the first classes in 2015. Then I started working in Hinkley Point C, um, on the project in the UK. And the French are always like this. They don’t build the mistakes in another person’s country. Okay, so they built in point C, they built from anvil discussed, exploded, and now they started to say that that project isn’t going to work. So we’re going to do the EPR two and they’re going to rebuild 6 to 7 power stations very quickly. After analyzing the errors and all their coal fleet, I had all the nuclear fleet and just, uh, fixing it. Then about two years I worked in Hinkley in, at E2, the international thermal nuclear reactor, which is a fusion reactor in the south of France. An example was U.S is also involved in the project and um, work. They were actually with a lot of American engineers. Um, then um, afterwards I went into the oil and gas industry because the salaries was just higher, um, frankly. And I thought, well, let me learn how they going to do it, because I learned a bit about coal when working in cement. Then I went into oil and gas and oil and gas, actually, and offshore wind. Surprisingly, that’s what made me skeptical of offshore wind. It’s actually working in the sector. Right. Because, um, what the engineers and the analyst was saying in the companies and what the media was saying is just miles away from. How people think, how fast you can build it. How people think, what they actually cost. Can we do it with without subsidy? Sometimes we can. Sometimes we can. Things of that nature. So I got to learn a little bit that I haven’t worked in solar yet, but I’ve got a good sense of it work. So I’ve worked in many of the major energy sources. And I’ve actually, when I was working in concrete, worked a bit on them construction as well in South Africa. So I know that it’s all energy related, right? So I’ve got a mix. Great experience if you can say that, in particular in the construction of these things and how they work.

Stuart Turley [00:05:35] So this is huge and especially because, uh, let’s go back to, uh, France for just a second. Hmm. Okay. The France I’ve been reading. And so this is why I love, uh, podcasting is because I get to talk to folks from around the world. France, uh, export so much energy from their nuclear fleet. Are they running only 50% capacity because of maintenance? I’ve been reading this that their their fleet is down from its capacity because they had not put much money back into the maintenance of their fleet. Is that.

Hugo Kruger [00:06:13] Yeah. That’s it’s it’s it’s part of the reasons. Yes. Um, first of all, when a plant gets older, its efficiency just goes down with age degradation sets in. And then mid lifetime of any plant you have to do a life extension. But there was a few issues in France when President Francois Hollande got elected a few years ago. He wanted to win the marginal vote. So he appeased the Greens. Okay. And then Greenpeace told him to make a decision to basically to put a target that France will have only 50% nuclear by 2030 or 35 or something like that, right? That decision alone, that pledge wasn’t even a pool decision. A pledge alone made electricity to France, fire the engineers so they couldn’t do life extensions. Okay, so it’s actually systemic sabotage through policy. Fortunately, the French unions rebelled. Okay. And, um, they could they what the French do is they never change their leaders. They change their advisors, and then they show them the guillotine. And basically they say to Macron, who was elected because Macron was elected anti-nuclear, can you believe that? Okay. And pro Thatcher, which means destroy the nuclear field fleet. So they change all these advisors and they say to him, if you do do not recommit to nuclear, we’re going to vote you out. Okay? Now he’s changed his religion and he’s singing along okay. And that’s how you sort your politicians out. So anyways, there was a delay basically in France. They canceled their program, they fired the engineers and they had to retrain them. So when I was working on, uh, Hinkley Point C, it was myself in my 20s, a few people in their 30s, and then people were about into retirement. So there was a skills gap anyway. So to answer your own question, yes, it has to do with a delay to maintenance. But the root causes political. It’s not that they didn’t want to do it, it is that the politicians prevented them from doing it. Now they are fixing it, but it’s going to cost money. So they have to increase the tariff a little bit. And Macron again, before he won the last election, um, he did not want to increase the tariff because it’s price supply and demand correction. Right, right. And then he said well keep it artificially low. So what does that do? It exploited electricity. France’s dept. All right. So now the taxpayer has to bail out what the politician that to win the election. That’s the problem with politics and energy. And important thing is I don’t see how you can ever eliminate it. Because you look at the U.S., you guys have the same issue in a different way, right? Right. Politicians will always try and go for energy because it’s so easy to manipulate prices, you know. Right. To win an election. So there are a lot of systemic issues associated with what you are seeing. So it’s it’s not true what you said, but it lacks context.

Stuart Turley [00:08:39] Wow. You know, I’m a I’m a I read 2 or 3 hours every day on energy around the world. And you don’t pick that up unless you sit down and talk to, you know, someone around the world. It’s not in mainstream media.

Hugo Kruger [00:08:55] No.

Stuart Turley [00:08:56] And it’s like, Holy smokes. Um, now, your background here, though, is absolutely weird. You actually understand a total view of energy that few people. Uh, take a look at, because it’s. You’re not looking at a solar. You’re not looking at a wind. You’re looking at a total piece of the pie. And when you’re taking a look at Coal King, coal was back. I mean, Germany is now firing their coal plants back up. Where do you see 2024 going with coal around the world right now?

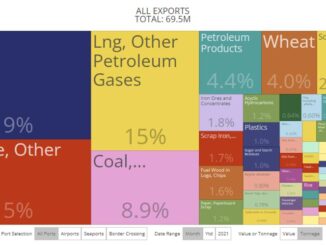

Hugo Kruger [00:09:34] So I’ve got I’m going to list you the seven energy sources in the world. Okay. I think first of all, many people don’t distinguish between energy and electricity. And as you and I both know, electricity is a subset of energy and it is much broader, right? Coal is all value chain attached to a dynamite, for example, is made from coal. Many people will know that the cement industry needs coal. The steel industry needs coal, right? But if you look at the seven energy sources, let’s list them from most green and most environmentally acceptable. These that worked. What would work in California? Okay. To that which will not work in California at the bottom. So first is wind and solar at the top. Okay. Wind and solar have expanded at mass production. That is true. Wind less than solar. But nonetheless solar has because it’s easy to put on your rooftop. Rooftop solar has a high added value when it is for the daytime peak, but as soon as it starts penetrating 10 to 15% of the grid, you need to call on the natural gas guys to start ramping up, right to run their assets more efficiently. So wind and solar is constrained by the availability of gas, or if you’re lucky. Hydropower. Not every country in the world is hydropower. Countries of a large river have a large battery, and they constrained by grid space, because the more wind and solar, the more you have to build out the transmission lines. And that’s becoming a political issue in many countries. So to take a neutral stand, wind and solar is expanding, but they’re going to be constrained by what I just mentioned then. Okay. Then number three on the list is hydropower. We spoke a little bit about it. You do have catchment areas. The will is run out of catchment areas. I also worked for film designing plants. So other plants will just run out of catchment areas. So there isn’t more with a few exceptions. Maybe in Africa, but it’s far away from population centers. Again, transmission line constraints. The average lead time is ten years, right? It’s not going to happen tomorrow. They pump storage, which is related to hydropower, also has a ten year lead time, at least in South Africa. Some countries build it a bit faster and some countries like the US, have access already. So you can easily integrate wind and solar. Okay, so those are the three plus three green ones. Then we go to nuclear power. It’s green depending on who you ask. But nuclear power in the US is a 3 to 5 times the cost of Asian markets, the Chinese and Indian. So building at mass production. But Vogtle is exploded in cost and is politically unacceptable in the United States. The US is the worst political economy when it comes to nuclear France. Given the experiences in Fleming ville and Winkler point C a struggle to get costs under control because they over complicate the plant construction, so they have to sort out that issue. Yet Japan. I saw today where we added eight gigawatt of nuclear. Right. Nuclear can be swung by public opinion. It happened in South Africa three times. So it’s a constraint. Whether I’m for or against nuclear is not. The argument is that those are constraints of public opinions are constraint. If you have a lot of environmental legislations can expand. Okay. So what is then more acceptable. Well oil. Well let’s go to big Issue Middle East. My wife’s from Iran. Um, unless Saudi Arabia plays along and they roll out the red carpet to Joe Biden was hoping oil will be constrained by what OPEC does because Saudi Arabia is this big player in the market, right? They can dictate prices in the US but have less of an issue because most of your oil comes from Canada, but it’s an issue for the rest of the world because most of the world is not North America, right? Right. Then you say, okay, I’ve gone through the six sources. What is it? Oh yeah. Then you’ve got LNG, which is more acceptable than oil, you would argue, and constrained by the availability of infrastructure. There’s not a single import facility in Africa at the moment. I think Morocco might have finished one. Now Africa only exports LNG. We don’t import it. Okay. So we don’t even use it for domestic cooking yet. All the stuff you did in the US in the last 10 to 20 years, we haven’t done it in Africa yet. That is four out of ten of the world’s population. Okay. So we’ve gone through all of them. What is left? The most available dirtiest of them all, which is clean coal. And that is why I say like a heretic. Okay, I’m not making myself popular saying these things. I do not see a stoppage to the expansion of coal. It might stop at a reduced rate in. India or maybe in China now because China’s adding pumped hydro to the scale. But nonetheless China is upgrading their coal plants. They’re not expanding new ones. Many countries, I believe, is going to upgrade their coal plants for another 20 years. And in Africa, Botswana, just build a new coal station last year. South Africa is thinking of overhauling the entire coal fleet. We’re the most coal dependent country in the world, you know, and the rest of Africa hasn’t even developed yet. So even if you add wind and solar and all the other sources to the mix, unless they can speak to those major constraints and there are others as well, I do not see why coal will not stop expanding. Simple as that.

Stuart Turley [00:14:14] I your here you are just in about a two minute time period. Gave one of the best world energy discussions I’ve had. Well done now. But when we sit back and take a look at nuclear, I’m a nuclear fan. Uh, you know, again, I’m I’m energy agnostic. I it’s let’s get the lowest kilowatt per hour to everyone on the planet. Let’s eliminate poverty. And the only way to do that is low cost energy. Why is Africa having to take money from the International Monetary Fund? Uh, for renewable projects only? Why don’t we get them natural gas, um, things and get them all the low cost of their natural resources and help them come along using clean technology. That, to me, makes more sense.

Hugo Kruger [00:15:07] It makes a lot more sense to us. And there’s a few issues with what you just highlighted. The I give you an example. The South African presents a man by the name of Cyril Ramaphosa. Okay. So Ramaphosa as a brother in law by the name of Patrice Motsepe, he’s the third or fourth richest guy in the country. And he happens to be the biggest beneficiary of renewable energy. So the country is literally taking out loans to expand transmission infrastructure to basically connect the president, brother in law. Okay to the grid. I mean, there is daylight corruption in South Africa. We are not alone in this. Mexico’s ambassador to the president. The last he was announced as the ambassador for heat for the UN. I don’t know what he’s going to do. Sell heat pumps or air conditioners. It’s ridiculous. And what is means is cronyism being entrenched through these policies because they don’t make intuitive sense. My view is, if you ask me, should North America or Europe Biltmore cold? My answer would be probably no. I don’t think they should build anything except maintain the infrastructure. Electricity demand has been more or less stagnant if not falling. But should Africa build coal in the absence of anything else? That is. It’s a moral argument. Yes they should. Countries like the DRC as majority of the population still in fuel poverty. And then John Kerry flies there in his greenhouse gas spewing plane and says to them, we are all in this together, guys.

Stuart Turley [00:16:26] Really not so.

Hugo Kruger [00:16:29] Slow at the problem. If this is going to come when the Chinese and the Indians don’t seem to care too much about these policies, because I understand it, because they recently developed these societies. They are opening up geopolitically. They are giving away us, and Europe is giving away Africa geopolitically to those countries.

Stuart Turley [00:16:46] Yes.

Hugo Kruger [00:16:46] So yes, we need wind and solar and we have lots of those reserves and we will exploit them. We will not follow the same path that America and Europe will follow through only coal. Right. But we still will need coal. Okay. So our policy is still directional. If you care about decarbonization, but it should not impede our expanding because we have different priorities. Two thirds of all South African men are out of work at the moment. 6,070% of them are black. So by restricting the expansion of coal or just the mine maintenance of the coal fleet, which is what the world Bank one South Africa do, it’s just a callous and racist policy. There’s no other way to put it.

Stuart Turley [00:17:23] Racism is alive and well in energy. Yeah, that could almost be a T-shirt. And that makes me airsick. That just makes me puke. To think that our the world leaders are racist and I’m okay.

Hugo Kruger [00:17:38] Well, the thing is, they come and I preach, and they say it’s for the greater good of everyone else. But that is exactly what Cecil John Rhodes and the great colonialists in the beginning of that century did. They also believed they were spreading the gospel when they killed populations in indigenous populations. Here we are saying we’re going to restrict your energy consumption. Uh, we’re just not going to allow you to exploit the resources underneath your feet. You know, and again, I’m not saying a country should expand coal willy nilly. Um, most will not, because solar and wind and nuclear and all these things are now part of the mix, the power of the tools. Finally, at Cop 28, the world came around to accept nuclear. Africa is building a new nuclear plant in Egypt. We are going to build a new one in South Africa. We already have one. Another one maybe. And I suspect Kenya is going to do it. But nuclear has never expanded in a country that is highly poor. It’s expanded in countries that are sort of middle income. And that’s where the base business case at the moment. So I don’t see why a country with illiteracy like, uh, Niger, for example, those 1,890% illiteracy would be able to expand nuclear, okay, because they don’t have the technical know how. I maybe want to say it, but coal is easy for unskilled labor.

Stuart Turley [00:18:48] Let me. Okay. You bring up a great point. Um, small modular, you know, the pebble bed modular reactor. The small reactors can be made and shipped in. And so the small, they can be, uh, like Copenhagen Atomics, uh, is making modular reactors, and they’re going to be able to ship them around the world. That, to me, would be a stepping stone for smaller countries to be able to bring in a, uh, ship in a nuclear reactor and then have local resources build it, because you’re going to need concrete, you’re going to need coal. You’re going to need all that. But supplementing it with small, uh, SMR makes a lot of sense, doesn’t it?

Hugo Kruger [00:19:33] It does. Um, I would just say this with nuclear. Generally speaking, it might not be the case for a small space because it’s difficult to find costs. But generally speaking of nuclear, the capital expenditure is higher than coal but operational expenditures lower. Okay. So you build it for long term to replace coal. I would argue countries must have coal and their nuclear. But asum also can be an intermediary step or even a leapfrog step. The challenge with a small step is this. The first one is being connected in Russia and China. Okay. The U.S. is not building any yet until 2028 or 9, which is the pebble bed model reactor X energy Copenhagen Atomics is molten salt reactors. They I spoke to some of them. They still need, um, to solve some R&D issues with the salt control process. It can be done, but they say it needs time. It’s sometimes more time of money to understand the thing. So I don’t believe small things are going to scale on Mars within this decade. I might be wrong with the Chinese coming in, but, um, that’s just sort of a. So what do you do for the next ten years? Okay. Yes, we should prepare ourselves. So my argument has always been this. Countries that can afford it do what Egypt in South Africa is doing now, which is just 1 or 2 more nuclear stations, not the entire grid. And then you use that to scale people and use it as a springboard for larger reactors, for SMEs to come in online.

Stuart Turley [00:20:53] I love that. Now the UAE just fired up theirs. Uh, I just interviewed, uh, Grace Stankey, the Miss America. How cool is that? We have Miss America running around the world as a nuclear engineer. She just got her degree, and, uh, it’s providing, I believe. Uh, Ugo, forgive me, but I think it’s around 20%.

Hugo Kruger [00:21:13] Uh, it’s a cool down. 25%.

Stuart Turley [00:21:16] 25% of their power on one nuclear reactor. That’s cool. And that is a good example of what you describe Hugo as a, uh, society that’s further along in their economic. Here’s a nuclear for a baseload that allows you to do so many other things.

Hugo Kruger [00:21:37] That’s right. And you should. What’s interesting about that reactor is I looked at the cost and curves. South Korea was building it. So the three countries that are leading the race for nuclear construction at the moment is South Korea, Russia and China and India within their own market. And Japan and Spain bought us. And France has unfortunately lost. At least France might be back again. I hope the U.S. gets back in the game, because I hope one of thousands of good reactor. I just need to learn how to build it properly. Um, but what the South Koreans did is very remarkable. So the cost of a nuclear reactor at the bottom of the S curve is about $3,000 per kilowatt, or 3 billion per gigawatt. Okay. That is more literally to come in. The South Koreans built the first one at 4.5, the first reactor. And then I got off at the fourth reactor. They were building out of the country at the same cost of a building inside of South Korea. That’s the first every act in the export market. They outperform the Russians on that reactor. Wow. So South Korea is really the country that’s carrying the flagship for the democratic countries. They better than the Russians at the moment with their first ever reactor.

Stuart Turley [00:22:37] Well, now, uh, Russia, the uh, uranium is a huge issue. Uh, when you take a look at the uranium, you know, and you and looking at who’s supplying all of that, um, besides, uh, our political problems with uranium, I mean, we have a huge uranium deposit that our Biden administration does shut down. So, you know, we have an anti energy policy, but who controls uranium is also going to control where those out.

Hugo Kruger [00:23:14] Yeah. So uranium I uh slight disagreement. The, um, uranium prices crashed after Fukushima because Japan closed so many reactors and the replacement of gas, and now they’re restarting them. So prices might go up a little bit. France, for example, had 2 or 3 mines in Niger. Um, and then there was a coup de tar recently. But what they don’t tell you is this French Senate wanted to close down some of those mines because they were an economic burden on the French fiscus. And the reason France kept them there is because Niger is such a poor society, it is not to work for the population. So the uranium price is so low, it’s questionable if countries should even exploit because you just buy it on a market. But I think what you’re referring to there is the processing, the end of the process. So there’s a consortium in France from many countries around that does it. And then the Russians and the Russians control most of that at the moment, because most of the reactors in Europe are Russian. But it’s easier to revert that process to a European process, or even the US can get into it. The US are talking about restarting that domestically, but the question is who’s going to pay for it? And it’s going to be a taxpayer again. Okay. So do they want to fund it right. So it’s a little bit of this politics. But the cost of operating uranium and processing is so tiny. I mean it is it’s not even a question. It’s it’s something like $5 per kilowatt of per megawatt of electricity. It’s really remarkably low. So the operational cost of a nuclear plant, once the capital expenditures paid off, is, in my view, more competitive than wind and solar. For Germany to restart the, um, a nuclear reactors would be something like $25 per megawatt hour, right? That can even outperform natural gas under certain conditions. Right? So why aren’t they doing it? And the answer is there’s a fear of nuclear power. And humans have to overcome this fear. And the Germans have to admit they made a mistake. But that’s never going to happen, right? In politics, you never lose face.

Stuart Turley [00:25:00] But they’re taking down wind farms and and opening reopening their coal plants.

Hugo Kruger [00:25:06] Yeah. And the thing about that coal is that people are saying, yes, they are burning less coal. That’s true. But what they don’t tell you is for a coal plant to operate efficiently. Right? Um, it needs to run almost all the time just to recover its cost. It’s not a very profitable business to be in. And the problem now is, if you run a coal plant only for 2 or 3 days of the year, what happens to your price of electricity? It should go through the roof. So what are the Germans doing during this doing? Flout the area of no one knows Sunday. Just saying. Well, we’re going to impose a low electricity price. What it converts to dept. So the Germans are making the same mistake that the Japanese in the 1970s and 80 made, which was all they bad decisions are being converted to debt. And who’s going to pay for the public dept in the future? Well, that’s your children. Okay, so yes, the coal people would tell you coal graves Europe is burning. Let’s call let’s all true. But it’s an economically inefficient usage of the asset. And what I my biggest critique against this energy transition is this. Um yeah okay fine. You have more wind and solar, but electricity consumption in Europe has been falling since 2005. Okay. And in North America, it’s also been stagnating. So who’s going to pay for that? You adding all these assets. You cannot recover the cost of electricity. Where’s it going to come from? It’s going to come from public debt. So you have an economically inefficient assets at the moment. And Europe has at the moment the highest electricity prices, the highest gasoline prices. Okay. And, you know, some of the highest LNG prices. So somebody in Europe has to ask the question, are we doing something that’s economically sane? I don’t believe they are know.

Stuart Turley [00:26:49] So I got, uh, I got kind of, um, in trouble. Several years ago, I, I made a meme of a dog in the dog is doing this, and I put it in there and it says, you mean the greener we go, the more fossil fuels we use. And everything I’m saying is that was actually a true statement. That meme went nuts. So, I mean, I we had actually all the numbers I was showing was the more we go greener, quote unquote renewable energy, the more fossil fuels we use, which was also coal, everything else. And it’s we just need all forms of energy. But your description you go of using the best methodology is what’s missing from all these discussions.

Hugo Kruger [00:27:39] Yeah, it comes down to the cost. Right. And maybe we should jump on the issue. There’s another issue here, which is how do you price electricity in particular. Okay. So at the moment we sell it in kilowatt hours in the US and North America, many countries, Indonesia and Spain and the Netherlands in my view, have the right model where they say we have a fixed charge, which we used to call a capacity charge. I think farmers in the US have something similar and we have a variable charge, because if you buy electricity, whatever your price, in kilowatt hours, it’s usually 10 to 15% is only energy. Now somebody comes and says, I’ve got a solar panel on my roof. I’m going to offset the entire right in kilowatt hours, right. In my view, he’s not allowed to do that. It should only offset 10 to 20%. Okay. Why? Because somebody has to pay for the service to the interconnection to the house. So as long as you are grid tied, you should be paying a fixed tariff for the utility to recover its cost. Unless you go fully off grid, then you shouldn’t buy it. But very few people can afford a full battery installation in their house, even in Europe, in North America. So as long as you’re tied to the grid, utility should not be bankrupt. And the the state I’m looking at in the US at the moment is California is a very interesting thing. It recently happened when they just added the service cost to the electricity and what’s happening. A lot of people have put PBS on their homes, realized that they have stranded assets. And the reason for this is simple. It makes no sense for me to grow my own food and compete against the Portuguese grocer. Okay, yes, it feels nice to make your own food and all of that, but let’s face it, the grocer is more efficient economically. I have the same feeling about energy. I don’t believe I should be generating my own power. Okay, large companies should be doing it and they should have a market between them. So I’m skeptical against this idea of a distributed grid where everyone is its own producer. I think that thing is eventually going to come, you know, to an end when many utilities wake up and add this fixed tariff and it’s coming, you know, and I think it’s coming in Texas as well, because the price of backup has to be reflected.

Stuart Turley [00:29:42] Absolutely. And so you bring up some, some great point. I my head’s kind of spinning here. Um, and, you know, it’s the total cost of energy when you take a look at also, uh, wind farms when you drive through West Texas, I mean, Texas, uh, to my office in West Texas, uh, there’s wind farm after wind farm after wind farm. And there are some of them that are just, uh, being abandoned. Uh, when you do, you cost, uh, out the removal of that wind farm when it hits the end of its life after eight years. I’m. I’m kidding. No, I’m not, uh, you know, and fiscally, without tax subsidies, they’re not fiscally sustainable from day one. Um, and so, uh, how who takes that out of that farmland? Uh, it’s about $420,000 just to get the steel and concrete out of the ground. Yeah. Does that go into the kilowatt per hour at the beginning?

Hugo Kruger [00:30:46] I very much doubt it. I don’t believe they are profitable even. Look, onshore wind in Texas might be some of the few places where they might have a business case, but I know offshore wind in particular. Um, I don’t believe they have a business case in many jurisdictions across the world. The ones in France we worked out in the north of France could not have a business case. So eventually the European government said, we’ll give you subsidies. And then, of course, as a contract USA, we will accept subsidies for those things. Why, why, why wouldn’t you? You know, it’s just my bread and butter. But I don’t believe if you cut the subsidies away that many of these things have a business case. And now you ask another question. What if the wind doesn’t blow? Okay. What is going to happen? And then in Texas, you have to start up your gas turbines, right? Because you guys are gas state. Now we run into the same argument we have with the cold. If I have to run a gas turbine for only a few days of the year, right, what happens to the cost recovery of the gas? Gas price. Right. It goes. It cannot recover, Scott. So I have to shoot up the price. And that means the consumer, at the end of the day, is going to pay for a very expensive battery.

Stuart Turley [00:31:51] Exactly.

Hugo Kruger [00:31:52] Okay. So it’s economically inefficient use of assets. My view has been this the price of backup has to fall on the one producer. He has to pay for that.

Stuart Turley [00:32:02] And that makes sense, because, uh, Ercot is its own, um, grid in Texas, and the balancing authorities through the United States have to sit there and they pay for standby power as they’re going through this. And so even if it’s a, uh, uh, energy storage battery sitting there, they get paid to sit there and not deliver energy. Um, and so that is actually the business scam going on on these things. Is that the only way to make money as a battery is to sit there and tie it to the grid so that you get paid not to have to have battery? I don’t get this.

Hugo Kruger [00:32:45] Well, I think the issue is this we have in the US, we have a price in kilowatt hours when we put like auctions, right? Most countries in the world that made sense in the days of vertically integrated utilities, or when you only had the special power plants compete against each other when you had to call against nuclear. Even then, it didn’t make fully sense, but it made some sense. Organs guess. But here’s the problem. What does natural gas do to your grid? It provides synchronous power. It provides ramping. It provides grid stability. You’ve got all the other functionalities right. I argue that is a service cost right. So my view is that must be priced in fixed terms. People must pay $100 a month for whatever the price in Texas would be, but then the variable price will be much less. It will be 10% or 15% of what it is now in Texas. So your price per kilowatt hour will be less, but you’ll have a fixed price. So at the end of the month you still pay the same amount. It’s just a structuring of the thing is different. And then what would happen is the wind and solar guys can still compete in an auction, but they’d be competing for much fewer dollars per kilowatt hour. And that is the market correction that is necessary. It’s a regulatory failure, I forget. So I argue the regulator hasn’t woken up yet. And the regulated it’s woken up. Strangely enough, I didn’t expect that it’s California because they had to add this fixed tariff to cover to cover the cost of utility. So the price of back up, the price of sync power, the price of the grid, the price to guarantee an end service to your house should be a fixed tariff. And then you’ll have a variable market associated with that. And when you do that, I suspect the market will be much more in correction. And we will end the debate, because then we have the correct incentive structure for them to still make a competition. And what I suspect is during the day and at night when the business case and solar will have one, but they’d be far less competitive than they look at the moment because the backup is not priced correctly into the market, into the model.

Stuart Turley [00:34:38] Oh, you mean you brought up some great points, but let me throw this. I’m sorry. This is a great conversation. I’m getting excited because you sit back and take a look. California is twice as expensive as Texas. Uh, and it’s. You said that they may have just broken into that new, new realm of price pricing, getting it fixed, but the consumer is going to pay for it. Uh, because they have now extended. Uh, is it Diablo Canyon to eight years? So they’ve now got a reactor that’s going to last up to 80 or even longer. Um, and it’s 10%, I think, of their power. They’d be dead meat without that. Um.

Hugo Kruger [00:35:22] Yeah. But you see, under the current pricing model before the reform, California Diablo Canyon is losing. It’s probably losing money. I wouldn’t be surprised, because why the wind guys can auction.

Stuart Turley [00:35:32] Right?

Hugo Kruger [00:35:33] Uh, and they auction in zero, and then they switch off and on. Diablo can switch off and on. That’s an issue. But Diablo provides baseload instability and it’s not being paid for that through the current pricing model.

Stuart Turley [00:35:45] No it’s not.

Hugo Kruger [00:35:46] So my view is the service that Diablo provides is a fixed price. The electricity is not all that it provides. It provides a stability and a service, and that the regulators in California got it by accident. They got the right answer. That is my belief. And I explain to people like a cell phone okay, so I started my career also in cell phones, by the way. It’s my first six months job, very short career. All right. And when you have a cell phone, you pay a fixed tariff and you have a variable price for data rights. I would like for my mom the five or 6 or 10 times a month. It doesn’t matter. It’s a fixed price and data. I really have to draw a lot of data before it becomes a problem. In most countries in the world. Why is it priced that way? Because there’s a cell phone tower that’s on all the time, right? And when lightning hits that cell phone, what happens is guys with a pickup truck and a diesel generator running because they don’t want to lose all those people. So the fixed tariff is determined by your worst case scenario, the price of emergency fuel. And what is the price of emergency you feel? What is emergency fuel in the electrical system? It’s the price of natural gas in the USA, all in Germany. Two days of what we would call or call in South Africa depends on jurisdiction. So in other words, your battery price should be your fixed tariff. And that is what we’re not pricing right at the moment. And I believe if you have that reform, you’d fix the incentive structure and then you would not see data centers leaving California anymore because people would say it just makes no business sense. Probably many of the solar panels on the roof would be stranded assets, or they would pay themselves back in 10 to 20 years or 20 to 30 years, and they’ll be like, okay, we’ll get something that pays back in 20 years. Then the business sense comes into proportion. But for a large company, it might still make sense to have solar panels, because I do believe they have a business case. I just think that we are not we’re not playing it right, because they should not be allowed to drive the utility into bankruptcy. And currently they doing that. They still providing a service.

Stuart Turley [00:37:36] I think corruption we come back to corruption is why these regulations are not being, uh, changed. If you want my honest opinion. Because who’s making the money?

Hugo Kruger [00:37:47] Yeah. I mean, in South Africa, the renewable industry is resisting these reforms. Um, I know people from Eskom, our nationalized utility, will say to them, look, we are incurring a loss every year. The government’s giving us dept extensions, right? This cannot go on or we will sink the national fiscus. South Africa is going to run bankrupt if they don’t have to reform. Every year all these renewable guys say and we totally agree with you. I totally agree in principle everything and what happens thing when the regulator has to make the reform, there’s a public outcry, there’s a media attack, the killing, the solar and wind industry, etc., etc..

Stuart Turley [00:38:18] Right.

Hugo Kruger [00:38:18] And eventually we will run out of money. South Africa is close to a fiscal cliff at the moment. California is running out of money, and it’s usually when people run out of money when reality sets in. And I reckon what happened in California recently is what’s what’s that saying? When what California leads, America follows, I reckon something like that is going to happen at the moment. Okay. And it’s interesting that the green states are figuring it out. I mean, this is not Texas, you know, so it’s not fossil fuel industry. They can’t blame you and me for corrupting the system.

Stuart Turley [00:38:47] Um, uh, no, I, I, I hate it when you’re right. And, boy, you’re in conversations making a lot of sense. Uh, wow. Um. I’m sitting here kind of going, oh, Hugo, you’re brilliant. Um. And when the greens get it right, and then we get debate. Never mind. Okay. I had a joke. Well, this is before we get totally canceled on that as part of a solution though. Corruption in the US, corruption in Africa, and corruption in eliminating poverty is, I think, one of the biggest problems. But how do we, as average citizens articulate what we just talked about and what are our next steps? What do you think we we can do to help get this word out there, to get this under the next step?

Hugo Kruger [00:39:40] Well, the first point is to have conversations like this. And for people to recognize the issue is systemic. This is my view. Um, it makes no sense. As we say, the public data is exploding and apparently electricity is getting cheaper, right? There’s a difference. And my view is just we need to recognize first the system has got issues with it attached to it. And any system in energy, unfortunately, is prone for colonialism and corruption and things because of a large sum of money. And I would add, even the oil and gas industry, even the nuclear industry, they are no exceptions to corruption. We try and eliminate that as much as possible and a way to eliminate corruption. I mean, there are various ways. It is generally to argue for rules that will make it less likely for middlemen to climb in and pretend to be entrepreneurs or for government subsidy. You know, all those things you and I do. So I would say eliminate the subsidies as far as possible. Right. Or if you have a country like South Africa with a nationalized utility, that’s fine. It can work. But then it needs to be structured well. We currently have a problem where our Minister of Energy can determine subcontractors for nationalized utility. Okay. That’s obviously going to result in corruption. So, you know systems like this. Me too. There’s always red flags in systems. And I think also if we learn from different countries what not to do, it’s sometimes a good it’s sometimes a good strategy if you just avoid all the red herrings, you know, all the red flags, you’d be fine.

Stuart Turley [00:41:03] Well, I’ll tell you what, uh, Hugo, I cannot wait. I’d love to have you back again on the podcast, I was abs. This felt like about three minutes to me. Because of your knowledge in this conversation, how do people find you on your Substack? It’s, uh, uh, have it in the in the link. But, uh, how do you pronounce your own Substack?

Hugo Kruger [00:41:27] So the Substack to the US audience, it’s Hugo’s newsletter, but it should be Hikaru’s newsletter, too, if you speak the other languages. And then I’ve got a small channel on YouTube as well, uh, where I do interviews like this. Goes in-depth on energy stuff, other topics as well. And, you know, I write on geopolitics as well, middle East, because my wife’s Iranian. I know that country very well. And, um, you know, if things, things of that nature have done a lot of interesting research on interesting topics of this nature.

Stuart Turley [00:41:54] Well, fantastic. Well, thank you so much for stopping by the Energy News Beat podcast. My name’s Stu Turley and Hugo. We will see you again soon. Thank you, thank you.

Hugo Kruger [00:42:04] Thank you Stephen. Thank you to the listeners.