Sanctions against Vladimir Putin’s war machine won’t really bite until they include energy. However dramatic, this is a step investors would be unwise to rule out.

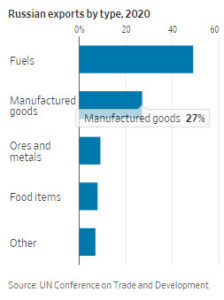

Sanctions on Russia announced since it invaded Ukraine last Thursday have been designed to exclude commodity imports. President Biden and his allies fear the impact of comprehensive sanctions on resource markets and their economies, particularly in Europe where gas supplies are already tight. The West buys about $350 million worth of Russian crude daily and Europe spends another $300 million on gas.

Some sanctions are already having an impact, such as limits on exporting technology to Russia—multinationals such as Dell are already rethinking their local involvement. BP’s decision to sell its Russian assets show that reputational risk is starting to bite too. It would also be significant if the West succeeds in blocking Russia’s central bank from accessing some of its $630 billion in foreign-exchange holdings.

But it is oil and gas sales that matter most. Saudi Arabia’s 2020 oil price war demonstrated the power of energy as a lever over Mr. Putin. Saudi willingness to flood the market despite the hit to its finances sent crude prices below zero, chastening Mr. Putin and restoring cooperation between Moscow and the Organization of the Petroleum Exporting Countries.

European-Russian energy interdependence was intentionally built up in recent decades, a mainly German-led effort to align interests and avoid conflict. Mr. Putin’s latest attack on Ukraine shows how this pipeline diplomacy failed to keep Moscow in check even as it kept Europe reliant on Russian energy.

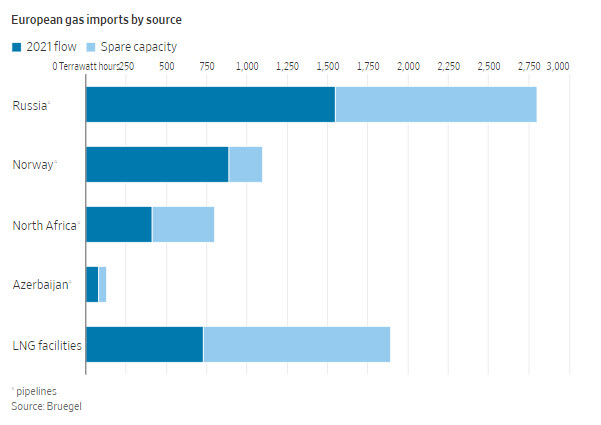

Europeans could go cold turkey. It would be painful and costly for a few years. Existing gas inventories could probably see it through this winter, but the following two or three years would need industrial rationing and have “profound economic consequences” such as higher prices for energy, fertilizers and steel, according to an analysis by think tank Bruegel.

European gas needs can be reduced over time with measures such as replacing gas-fired boilers with heat pumps, renovating buildings to use less energy, extending the life of nuclear power plants, and increasing renewable-energy generation and power storage. Shares in companies that serve the renewable energy sector soared Monday, with those of wind-turbine giant Vestas up 15%. Europe could also agree long-term contracts for liquefied natural gas (LNG) from suppliers such as the U.S. and Qatar, though they would likely take between one and three years to start delivering. It isn’t quick or cheap but it is possible.

A Western oil embargo is another option as “oil is the core of Putin’s economic strength,” says Simone Tagliapietra of Bruegel. However, it can be difficult to hit Russia’s crude sales as it doesn’t face the shipping bottlenecks of natural gas and can sell its oil around the globe to other international buyers. Banking sanctions targeting oil cash flows could make others wary of buying.

Sanctions that carve out energy aren’t likely to work any better than they did after Russia annexed Crimea in 2014. In the intervening eight years, Europe ramped up its renewable investments, increased its capacity to receive LNG and created a web of interconnections that made it difficult for Mr. Putin to shut off any one European country. But Europe also continued to send vast cash flows to Moscow for oil and gas and Germany backed the Nord Stream 2 pipeline Russia can use to bypass Ukraine. Meanwhile, Moscow worked on its own independence, building up sovereign-wealth assets, a SWIFT-type bank-communication system, a gas pipeline to China and more LNG facilities to sell its gas globally.