Ok, being an oilman all of my life, I have never seen a pricing matrix mess like the one the world is facing now. OPEC had lost its iron fist control over pricing, and only to regain and strengthen the grip with good long-term policy management. Being led by Saudi Arabia, they are making informed decisions around ESG, Saudi Aramco’s production limits, and the Saudi Arabia budget requirements to fund their social and long-term energy plan. They are funding some of the largest hydrogen and green energy exports through the increased profits they are planning on for the next 5 years.

Saudi Arabia

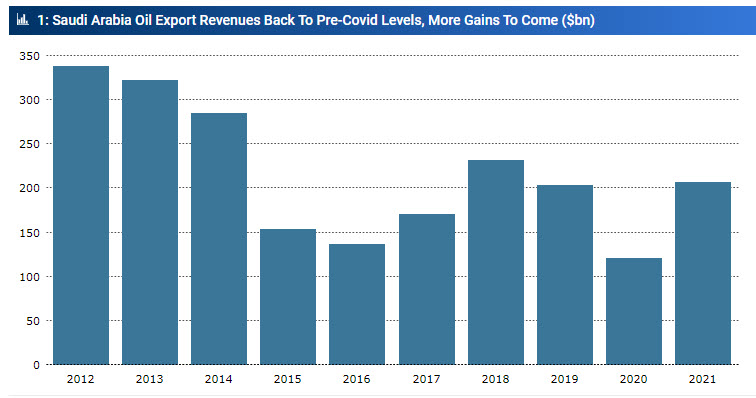

Saudi Arabia has enjoyed their highest revenues since 2018 and is expected to take advantage of the geopolitical issues facing the world today. Their oil export revenues dramatically increased by an estimated 70% since 2014, even with oil production dipping to an 11 year low of 9.12mn b/d for 2021. Saudi Aramco, just like their worldwide counterparts has been held to reduce CapEx spending to increase profits. In order to meet the lofty ESG goals set by the Saudi leadership, their CapEx budgets need to be increased just to maintain current decline curve production. Saudi Arabia is limited in its desire to increase production as its profitability required is at the $120 oil price.

Russia

Russia on the other hand started their plan of world pricing domination in 2014 and are on the right track to make Putin the “Energy Czar” of the world. The ESG movement in Europe played right into the master plan of world Russian energy pricing domination. Like Saudi Arabia, Russia has also published budget numbers of increasing their portion of their energy exports from 32% of their GDP to over 35%. With the willful dependency on Russian gas, Germany is forced into not supporting sanctions for Nord Stream 1. Nord Stream 1 is the existing pipeline that has the capabilities of supplying the EU with enough gas to get a good start on replenishing their natural gas storage prior to next year. Russia has also followed Iran’s proven formula to keep cash flow moving when sanctioned by the western countries: Make a deal with China.

Sanctions by the West will not deter Russia from its mission of world energy pricing dominance. While Putin may have undercalculated the Ukrainian resolve, the war is not over. As a leader in the OPEC + organization, Russia has a close relationship with Saudi Arabia and is aligned with its strategic long-term plans.

United States

The U.S. was crippled from remaining an oil-pricing world power by the ESG energy policies, and the areas of the country that import Russian or Chinese oil rather than use oil and gas products produced in the states. WTI was brought to the limelight because of the shale boom and put OPEC on its heels setting up the decline of the OPEC grip on pricing they enjoyed. The North-East portion of the country imports oil and LNG from Russia adding to the increasing energy rates for consumers. New York and other eastern states have some of the highest energy prices in the country, and they are giving huge profits to Russia even though there are low-cost U.S. energy sources less than a day’s drive away.

California has the third-highest energy cost in the United States, and its ESG policies have also been at the forefront. They are importing oil from China’s oil companies and devastating the rain forests in the name of “ESG”. Over 70% of the oil produced in the rain forests is imported by California shipped in by Chinese companies. This is funny as China is buying oil from Iran and is helping them survive sanctions that have been placed on them by the United States.

The U.S. consumers are paying high prices for energy and doing more harm to the environment than buying from the U.S.-based oil companies following the strict regulations already in place.

Last week CNBC published in a portion of an interview they had with me.

“Jay Young, founder of King Operating Corporations, said lack of supply is the key driving force now. “We have a supply problem,” he said. “We’re not drilling for oil and gas in the United States, and that’s going to hurt us.” He said prices could jump to $140 by the summer, during peak demand season.”.

Not only do I stand behind my statement, but I will also put my money on it. Investing in United States oil and gas companies is the only way we can get ahead of the world’s energy price wars.

Europe

The ESG movement in Europe has a gigantic role to play in the Russian invasion today. Not having a good energy transition plan and implementing large renewable projects while printing money have set them up for inflation, and dependency on imported energy. As mentioned above, Germany is not able to impose sanctions on Russia as they are held at gunpoint if you will on natural gas imports.

The Bottom Line

ESG is one of the most important items that face our world today. Climate change hypocrisy is one of the biggest problems facing actual gains in reducing carbon emissions on the way to Carbon Net-Zero. We can see that the current administration does not understand what it will take to keep energy prices low to the consumers. Asking Saudi Arabia to pump more oil won’t lower gas at the pump.

Our current administration is not capable of putting the key energy policies together. Jen Psaki’s comments are only just one example.

“We need to reduce our dependence on foreign oil, on oil in general, and we need to look at other ways of having energy in our country and others,” Psaki said during an interview with ABC This Week Sunday. “We’ve seen over the last week or so… a number of European countries are recognizing they need to reduce their own reliance on Russian oil.”

Doubling down on proven bad energy policies will only double the problems. For the consumers, it just means that there will be more pain at the pump and the world’s investors are looking at places to invest their money that has the potential to survive the world energy crisis.

As always check with your CPA if alternative investments are good for your portfolio Take the assessment and see if it is right for you HERE.

Please reach out to our team at any time for answers to your questions.

Jay R. Young, CEO, King Operating

And visit the King Operating Website for more market information and insights.