EOG Resources Inc., a multi-basin exploration and production firm, said its strong fourth quarter and full-year 2022 results were powered by robust natural gas and oil demand, price spikes and steady production activity.

For the year, EOG said, the natural gas prices it fetched jumped 49% from a year earlier, while crude prices increased 42%.

Houston-based EOG said natural gas production increased 4% in 2022 to 1.5 Bcf/d. Total equivalent production, including oil and natural gas liquids, increased 10% to 331.5 million boe.

[Want today’s Henry Hub, Houston Ship Channel and Chicago Citygate prices? Check out NGI’s daily natural gas price snapshot now.]

Gas prices have since retreated because of a mild second half of winter across much of the Lower 48 and elevated production. Oil prices, too, have come down amid recession concerns.

Even as rumblings mount about production activity scaling back — Chesapeake Energy Corp. and Comstock Resources Inc., for example, said on recent earnings calls they would drop rigs this year – EOG said it would forge ahead and expects output growth in 2023.

“Looking ahead to 2023, EOG is in a better position than ever to deliver value for our shareholders and play a significant role in the long-term future of energy,” CEO Ezra Yacob said Friday during a call with analysts to discuss earnings.

EOG’s Lower 48 footprint includes operations in the Permian, Williston, Powder River, Denver-Julesburg (DJ) and Anadarko basins, along with the Eagle Ford and Barnett shale formations, among other areas.

“Our multi-basin portfolio provides numerous high-return investment opportunities, and we remain focused on disciplined investment across each of our assets,” Yacob said.

EOG estimated at the midpoint of a guidance range that its natural gas volumes in 2023 would be 1.74 Bcf/d, eclipsing full-year 2022 actual volumes of 1.49 Bcf/d.

The company estimated at the midpoint of its guidance that oil and condensate production would be 473,800 boe/d, above the 2022 actual of 461,300 boe/d.

The company expects to maintain steady drilling operations in the Permian’s Delaware sub-basin and the Eagle Ford. It sees steady activity or growth in the Powder River Basin, Utica Shale, and DJ, among others.

President Lloyd Helms estimated the average EOG rig count for this year would increase by two, with one additional fracturing fleet.

Helms said on the earnings call that 2022 capital expenditures (capex) were $4.6 billion, 2% above the company’s original guidance midpoint.

“We forecast a $6 billion capital program to deliver 3% oil volume growth and 9% total production growth” this year, he said. “We expect total volumes on a boe basis to grow each quarter through the year.”

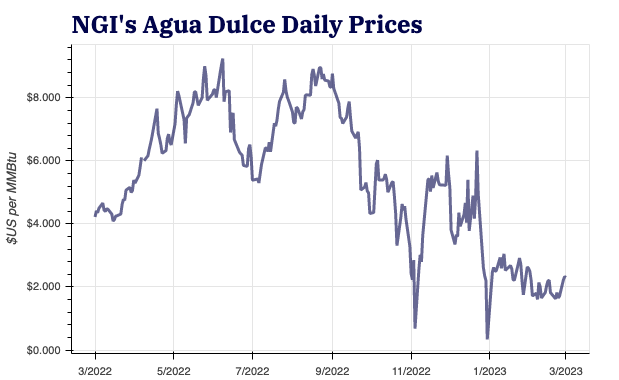

Helms said the company’s funding for facilities and other infrastructure projects typically comprises 15% to 20% of the capex budget, and this year he expects that number to be close to 20%. He noted EOG commenced construction late last year on a new 36-inch gas pipeline from the Dorado field – a massive natural gas play in the Austin Chalk and Eagle Ford in South Texas — to the Agua Dulce sales point near Corpus Christi, Texas.

“This pipeline will help ensure a long-term takeaway, fully capture the value chain from the wellhead to the market center, help support expanded LNG export price exposures due to come online around 2026, and broaden our direct interstate pipeline capacity to reach markets along the entire Gulf Coast corridor,” Helms said.

Long-Term Demand Strength?

The optimism comes against the backdrop of enduring demand amplified by activity in 2022.

During 2022, natural gas demand surged domestically amid harsh summer and winter weather, while global consumption ballooned following Russia’s invasion of Ukraine. The war galvanized countries across Europe to curb calls for Russian gas and buy more liquefied natural gas from the United States and elsewhere.

New York Mercantile Exchange prompt month futures reached 14-year highs near $10.00/MMBtu last summer. West Texas Intermediate crude climbed to the highest level in nearly a decade, topping $120/bbl at the peak in 2022.

In response, U.S. oil production reached a pandemic-era high last year and ticked up further to 12.3 million b/d in January, according to the Energy Information Administration. Oil output held at that level through the first half of February, too. Natural gas production, meanwhile, hit a record above 102 Bcf/d late in 2022 and has held near that level since, according to Bloomberg estimates.

Even with natural gas futures prices relatively weak to start the year – hovering around $2.50/MMBtu recently – Yacob said the company can selectively drill across its footprint, identifying the most efficient areas and capitalizing on them.

“In addition to our premium well strategy, in which wells must generate a minimum of 30% direct after-tax rate of return at a flat $40 oil and $2.50 natural gas price for the life of the well, we invest at a pace that allows each asset to improve year-over-year, lowering the cost and expanding the margins generated by each asset,” he said.

“Disciplined investment means more than just expanding margins at the top of the cycle. It means delivering value for the life of the resource and through the commodity price cycle. It’s not only developing lower-cost reserves, but also investing strategically to lower the operating cost of these resources, which positions EOG to generate full cycle returns competitive with the broad market,” Yacob added.

EOG reported 4Q2022 net income of $2.3 billion ($3.90/share). That compared with $2 billion ($3.42) a year earlier. For the full year, the company posted net income of $7.8 billion ($13.31/share), up from $4.7 billion ($8.03).