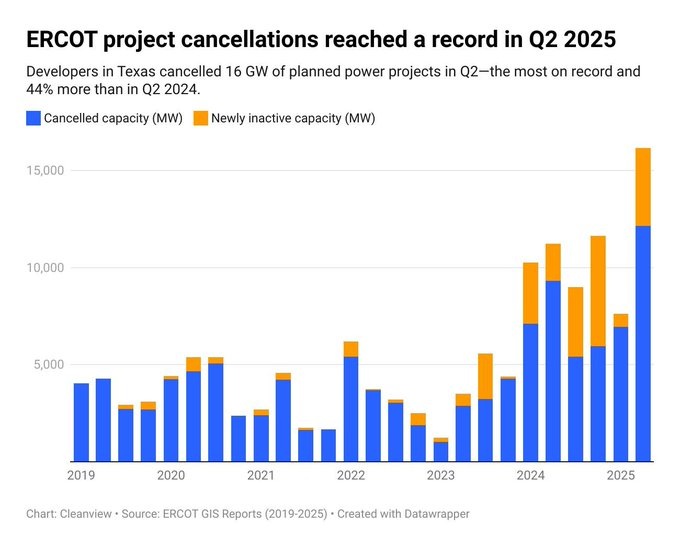

In the second quarter of 2025, the Electric Reliability Council of Texas (ERCOT) witnessed an unprecedented surge in project cancellations, marking a pivotal moment for the state’s energy landscape. With approximately 16 gigawatts (GW) of power generation projects scrapped—predominantly renewable energy initiatives—this record-breaking wave has raised alarms about Texas’s ability to meet soaring electricity demands driven by economic expansion, data centers, and emerging technologies.

This article explores the causes behind these cancellations, Texas’ evolving power requirements, the current energy mix, approved and projected power plants, and the anticipated growth that could reshape the grid.

The Surge in Cancellations: Causes and Immediate Impacts

Are you Paying High Taxes in New Jersey, New York, or California?

Q2 2025 saw cancellations totaling around $22 billion in clean energy projects across the U.S. in the first half of the year, with Texas bearing a significant brunt.

In ERCOT’s jurisdiction, which covers about 90% of Texas’ electricity load, over 10,000 announced jobs were lost due to these scrubs, with more expected if trends persist.

The spike—double the rate seen in all of 2024—has been attributed to several factors, including policy shifts like tariffs imposed under the Trump administration, which have deterred renewable developers.

Many projects, especially solar and wind, were canceled amid calls for additional subsidies and challenges in navigating ERCOT’s interconnection queue.

A deeper look reveals systemic issues: Only about 9% of projects in ERCOT’s queue are projected to come online after 2028, signaling a bottleneck in development.

This has led to over $14 billion in U.S. clean energy cancellations by mid-2025, exacerbating concerns over grid reliability amid extreme weather and demand spikes.

The implications are stark: Reduced capacity additions could strain reserves, potentially leading to higher energy prices and increased blackout risks if demand outpaces supply.Texas’ Power Requirements Amid Explosive GrowthTexas’ economy is booming, but so is its thirst for power. ERCOT’s 2025 Long-Term Load Forecast projects peak demand reaching up to 87.5 GW this summer—enough to power about 17.5 million homes—surpassing previous records.

By 2030, forecasts vary: ERCOT estimates up to 209 GW, while independent analyses like Ascend Analytics peg it at a more conservative 119 GW.

Looking further, demand could hit 218 GW by 2031, driven by population influx, industrial expansion, and tech-driven loads.

Key drivers include:Data Centers and AI: These facilities are the primary culprits, with U.S. data center electricity demand expected to triple from 25 GW in 2024 to 80 GW by 2030.

In Texas, ERCOT’s projections show data center demand surging from 29,614 MW in last year’s forecast to even higher levels, accounting for 43% of load growth by 2030.

A single large data center can consume 100 MW or more, equivalent to the annual power use of 350,000 to 400,000 electric vehicles (EVs).

Cryptocurrency Mining and EVs: Combined with data centers, these sectors are set to boost demand by 60% in 2025 alone, representing 10% of ERCOT’s total load.

EV adoption is accelerating, with Texas’s cheap energy attracting miners and charging infrastructure. We are not there yet, but it the number of charging stations seems to be getting better.

Overall Economic Factors: As the fastest-growing U.S. state, Texas could see total energy demand reach 500 terawatt-hours (TWh) in 2025, per models like UPLAN.

This growth is fueled by urban expansion in areas like Dallas-Fort Worth and San Antonio, where data centers cluster due to affordable power.

These projections underscore the need for robust infrastructure, as unchecked growth could double demand in six years, straining the grid.

The Current Power Mix: A Blend of Tradition and Transition

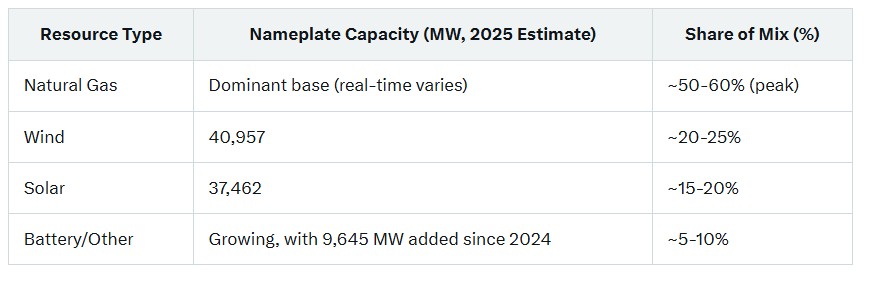

As of mid-2025, ERCOT’s energy mix remains dominated by natural gas, which serves as the primary source during peak periods.

However, renewables are gaining ground: In June 2025, solar and wind supplied 45% of peak demand, up from 36% the previous year.

Total generation connected to the grid grew by 20 TWh year-over-year to 464 TWh in 2024, with solar leading the additions.

This mix reflects Texas’ transition toward cleaner energy, but intermittency issues with renewables highlight the need for dispatchable sources like gas to ensure reliability.

Projected and Approved Power Plants: Building for the Future

Despite cancellations, ERCOT’s pipeline is robust. As of May 2025, 6,874 MW of large flexible loads (LFLs), including data centers, have been approved to energize, with observed peak consumption at 3,489 MW.

The interconnection queue boasts over 400 GW in proposals: 156 GW solar, 39 GW wind, 171 GW batteries, and 33 GW gas.

Notably, developers have proposed over 100 new natural gas plants, totaling 58 GW—enough to power 8 million homes.

This aligns with Senate Bill 388, which sets a goal for 50% of new capacity to be dispatchable, potentially through credits or mandates.

Additionally, initiatives like the Texas Energy Fund are advancing backup power projects, including four outside-ERCOT grants and leased emergency units providing up to 450 MW.

Transmission upgrades, such as AEP Texas’ 765 kV line, are also approved to bolster connectivity.

However, with cancellations eroding confidence, ERCOT’s Capacity, Demand, and Reserves (CDR) report warns of declining reserve margins through 2029 if additions lag.

What’s Next? Navigating Challenges and Opportunities

Looking ahead, Texas must balance growth with reliability. Policymakers are eyeing rules for major users like data centers, incentivizing renewables and distributed generation for sustainability.

Research programs aim to promote eco-friendly data center expansion, optimizing land and water use.

The path forward involves streamlining interconnections, possibly via ERCOT’s “connect-and-manage” approach, and diversifying the mix to include more batteries and gas for stability.

If addressed proactively, Texas could leverage its energy abundance to fuel economic prosperity; otherwise, the record cancellations of Q2 2025 may foreshadow tighter supplies and higher costs. As ERCOT adapts, stakeholders from developers to consumers will play crucial roles in ensuring the grid powers Texas’ future without faltering.

The Bottom line for investors is that you need to make sure your business can operate with power almost independently of the grid in an emergency, and have a plan. We have a lot of guests lined up who are experts in grid management, and data center design.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack