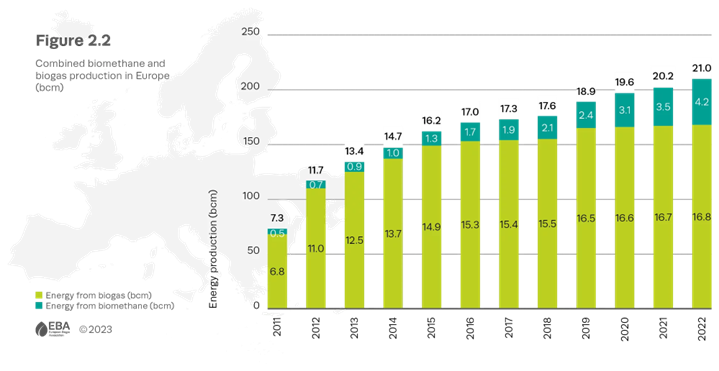

The European Green Deal, presented in 2019, aims to handle the climate crisis by reducing net greenhouse gas emissions, with the ambitious goal of achieving net zero emissions by 2050. One of the plans under this initiative is REPowerEU, announced in May 2022. REPowerEU focuses on saving energy, diversifying energy supplies, and producing clean energy. Biomethane is regarded as one of the most important clean energy sources by the European Commission. Consequently, they set an ambitious target for biomethane production of 35 bcm per year by 2030. With that, the estimated investment needed for this period amounts to €37 billion.

Current RNG production in Europe:

In 2022, the total production capacity of biomethane was 4.5 bcm, and actual production of biomethane in Europe increased to 4.2 bcm, a 20% growth compared to production in 202 (3.5 bcm). And in April 2023 the number of biomethane-producing facilities reached 1,322 units.

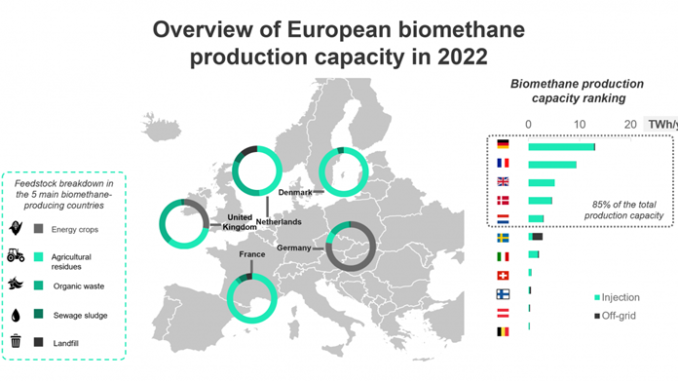

While there are more than 20 countries in Europe planning RNG expansion, just a few of them dominate total production of RNG in Europe. The top five biomethane producers in Europe are Germany, France, Denmark, the Netherlands, and the United Kingdom. These countries account for 85% of the total biomethane production capacity in 2022 and will, no doubt, play vital roles in achieving the 35bcm goal in 2030.

While Germany remains the largest RNG producer in Europe and the second largest in the world, they have been experiencing stagnation in their biomethane production. Germany’s production was growing the fastest before 2017 but has significantly slowed down in recent times. The president of German Biogas Association, Horst Seide, stated that legal obstacles and slow approval procedures are hampering the expansion of biogas use in Germany.

Denmark, on the other hand, has been staying on track with their ambitious biomethane production goal which it set in 2021. The goal states that biomethane will account for 39% of its gas consumption by 2023 and will replace 100% gas demand in 2030. The share of biomethane in the Danish gas demand had reached almost 40% in 2023, slightly exceeding the original target.

Other countries that are worth close attention are France and Italy. Both have been rapidly expanding their biomethane production. Italy is projected to produce 4 bcm of biomethane per year, while France experienced a 61% growth rate in biomethane production in 2022.

These countries are expected to be major contributors to Europe’s biomethane production and are crucial for achieving the 35 bcm goal by 2030.

The Impact of RNG on the Natural Gas Market and Obstacles

According to a July 2022 Guidehouse report, “Gas for Climate”, in 2030, the total RNG production in EU-27 will reach 41 bcm, which is more than 10% of Europe’s total gas demand in 2030. It further predicts that EU-27 would have the potential to produce over 151 bcm of biomethane by 2050. However, this prediction appears challenging and hard to envisage with the current slow growth rate and stagnation in countries like Germany.

The growth rate in 2022 is approximately 20%. To achieve REPowerEU plan’s 35 bcm target, the total growth rate in EU-27 must reach more than 33%. While countries like France are expanding faster than the 33% growth rate, the share of biomethane in their overall gas consumption remains relatively low: biomethane only takes 1.6% of gas consumption in France. Thus, the impact they make on the overall biomethane production is limited.

Price is also an important factor hindering the potential growth of RNG in Europe. In 2022, biomethane demonstrated potential economic benefits due to the soaring price of natural gas. However, as gas prices declined in 2023, these economic advantages gradually diminished. According to the G2M2 Price Forecast, in Europe’s major gas hubs, only in 2022 did the price exceed $19/mmbtu, the average price of biomethane. Predicted gas prices are expected to remain lower than the price of biomethane, further limiting its economic benefits in the near future.

Opposition parties have made notable gains in the recent EU elections, possibly upsetting the power balance; and some experts have expressed concern about the pressure on the European Union’s green transition. Bas Eickhout, head of the European Parliament’s Greens lawmaker group, states that existing policies will remain unchanged, but passing new green laws is likely to become more difficult. Growing opposition groups in EU parliaments argue that current climate policies impose a significant financial burden on industries and citizens, leading to higher inflation, and living expenses. While there is no major shift in EU policy for now, it is foreseeable that passing ambitious EU climate policies will become more challenging after the recent election.

Conclusion

With the current state of biomethane production, it is quite difficult to achieve the goal of 35 bcm production by the end of 2030. They mentioned not only the growth rate and price but also the environmental impacts and sustainability that would be re-evaluated. The new European Parliament will also have a significant impact on climate policy and targets. As a result, given the current trend, biomethane is unlikely to have a significant impact on the overall gas market in Europe by 2030.

Take the Survey at https://survey.energynewsbeat.com/