Second-lien mortgages to the rescue of the battered mortgage industry. It’s expensive to benefit from your home equity unless you sell the home.

By Wolf Richter for WOLF STREET.

The problem for Wall Street is that homeowners are said to sit on $11 trillion in “tappable” home equity after years of surging home prices.

The actual home equity won’t be known until the homeowner sells the home and pays off the mortgage with the proceeds; the cash that’s left over is the actual home equity. In that situation, the homeowner cashed out and can now use the cash for other things, bet it on cryptos to become a billionaire overnight, buy Treasury bills to earn 5.3% in interest, fund their own startup, or blow it in some other way.

But without a sale, the home equity is a theoretical value that you can turn into cash only by borrowing against it, thereby paying Wall Street interest and fees to get to your own money.

Which is of course the promised land for Wall Street – especially as they can see and smell that $11 trillion in “tappable” home equity in front of them, ripe for exacting their pound of flesh. And now it’s just a matter of promoting this to homeowners — “this” being the opportunity to pay interest and fees to Wall Street in order to get to their own money.

Home equity overall is $16.9 trillion , of which $11 trillion is “tappable” equity (including a 20% equity cushion), according to ICE Mortgage Technology, a subsidiary of Intercontinental Exchange (ICE). About 48 million homeowners have some tappable home equity, it said.

And it’s just so juicy: two-thirds of the tappable home equity is held by homeowners with credit scores of 760 and higher, which make them low-risk borrowers, paying interest and fees to get to their own money.

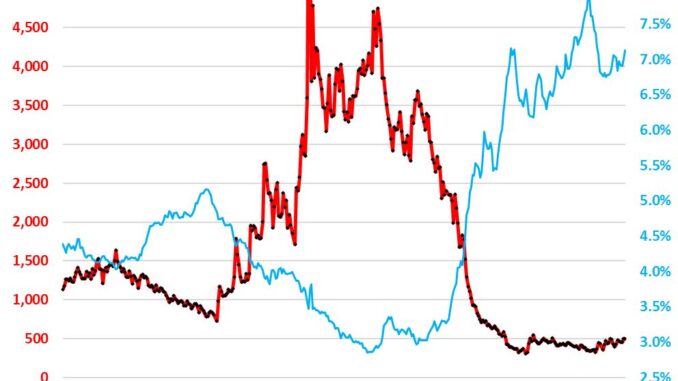

So the mortgage industry is trying to make this the next new thing after it got crushed by the collapse of refinance-mortgage originations – including cash-out refis – starting in late 2021 when mortgage rates began to rise, and homeowners didn’t want to refinance their 3% mortgage into a higher rate mortgage.

HELOCs are rising from the ashes, but the volume is still small. These are lines of credit secured by a second lien on the home, but homeowners with a HELOC only pay interest on the actual balance they withdrew. For now, this is still just small potatoes for Wall Street:

Second-lien mortgages to the rescue.

The mortgage industry has been super-eager to find other avenues to make money off the “tappable” home equity. And so they’re promoting second-lien mortgages, where the borrower takes out a second mortgage on the house, with a fixed payment, to where the borrower now has two mortgage payments to make, instead of one, paying Wall Street interest and fees to get their own money out of their home.

After a lot of pressure from the mortgage industry on the government to get behind this opportunity to get homeowners to pay interest and fees on their own money, Freddie Mac has come out with a proposal to buy second-lien mortgages from mortgage originators – from banks and non-banks alike – in order to securitize them with government guarantees into MBS and sell them to investors.

Banks can carry second-lien mortgages on their balance sheets, and banks have money from their depositors, so they can do that; but non-banks don’t have depositors, they need to borrow the money from somewhere else, and that has been getting in the way of second-lien mortgage originations.

Nonbanks are now the dominant mortgage originators. They can sell their regular conforming mortgages to Fannie Mae, Freddie Mac, the VA, Ginnie Mae, and other government entities, thereby getting those mortgages off their books. But they cannot sell second-lien mortgages so easily. So Freddie Mac is trying to make that easier, and once Freddie Mac pulls this off, the other Government Sponsored Enterprises (GSEs) and government agencies are going to follow, at least that’s the industry hope.

The hope is that being able to offload the second lien mortgages to the government entities and from there to investors will open the floodgates for that $11 trillion in tappable home equity to start generating fees and interest income.

And so this opportunity for homeowners to pay fees and interest to get to their own money has been hyped everywhere, on YouTube, on TikTok, even in the comments here.

For most people, when they think about it, paying fees and interest on their own money is absurd. But it’s hard to get to this money. They’d have to sell the home to get to it; or they can borrow against it, in which case they’re using their own money as collateral and paying interest and fees out of their nose to turn it into cash.

There are few situations where this – paying interest and fees to turn your own money into cash – might be, I don’t know, justifiable? Such as funding your kid’s startup company; funding the down-payment of a rental property; funding a big remodeling project; betting on becoming a billionaire via a big crypto investment, etc. You’re leveraging the house – you’re taking on more risk and more expenses – to accomplish something with it.

Multiple risks for the homeowners.

Homeowners might not be able to maintain their income (due to layoff, etc.) to make those two mortgage payments.

Even in the 12 states with non-recourse mortgages, such as California, where homeowners can walk away from the home and let the lender take the loss if the housing market tanks, second-lien mortgages may be recourse loans, and if homeowners walk away from the home, the lender of the second-lien mortgage can go after them personally for the deficiency. In the 38 recourse states and DC, lenders can go after them personally to collect any deficiency on both mortgages. A second-lien mortgage makes a deficiency more likely when home prices are heading lower.

Home prices are already heading lower in many markets, and may head lower in more markets. This overpriced market is primed for a reset. And it’s happening in enough markets already to where, despite prices still heading higher in other markets, prices of existing homes have at least flattened out on a nationwide basis since the high in June 2022 (the national median price is down from the peak in June 2022), and prices of new houses have dropped sharply. Chart shows six-month moving averages of the median price of new single-family houses (red) and existing single-family houses (green):