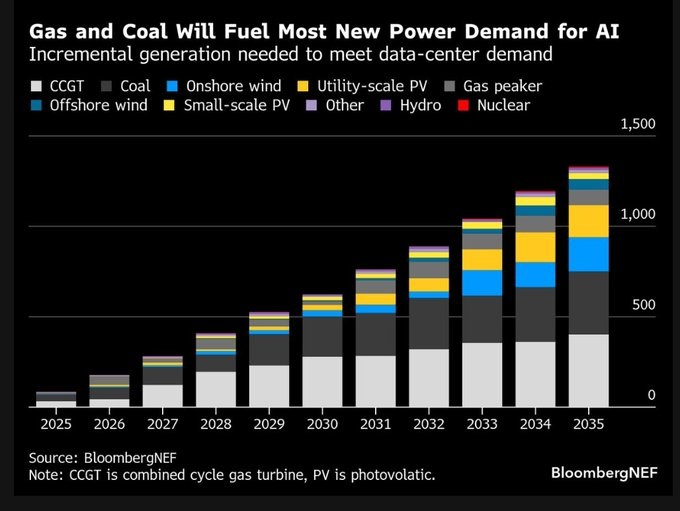

The artificial intelligence revolution is not just transforming technology—it’s reshaping the energy landscape. As data centers sprout across the United States to power AI models, the demand for reliable, high-capacity electricity has skyrocketed. This surge is breathing new life into the gas turbine industry, where manufacturers are seeing unprecedented orders for their massive, jet-engine-like machines that generate power for gas-fired plants. With utilities and tech giants racing to meet this need, gas turbine makers are positioned at the heart of the boom. But as prices soar and backlogs grow, questions linger about sustainability and investment opportunities.The AI-Driven Power SurgeData centers, especially those handling AI workloads, are voracious consumers of energy. In 2023, they accounted for about 4.4% of total U.S. electricity demand, a figure projected to triple by 2028.

This explosive growth is driven by the computational intensity of AI training and inference, prompting a 92% increase in power demand in some sectors.

Gas turbines, which convert natural gas into electricity efficiently and reliably, are emerging as a key solution to bridge the gap between renewable energy intermittency and the always-on requirements of data centers.According to industry reports, the cost of building new gas power plants has roughly doubled since mid-2023, largely due to escalating turbine prices.

This price hike reflects booming demand, with orders extending into the late 2020s. Tech companies like those behind xAI are even deploying gas turbines directly at data center sites, such as in Memphis, Tennessee.

The resurgence of fossil fuels in this context underscores a pragmatic approach to energy: while renewables expand, gas provides the baseload power needed now.

Major Gas Turbine Companies in the United States and Globally

The gas turbine market is dominated by a handful of heavyweights, with three companies controlling about two-thirds of global supply for large-scale turbines used in power plants.

Global Leaders

GE Vernova: As the world’s largest gas turbine manufacturer, GE Vernova offers a wide range of aeroderivative and heavy-duty models. In 2023, it led the market with 34% of megawatt orders globally.

Siemens Energy: This German giant holds a significant share, projected at just under a third of the global market in forecasts from 2017 onward.

It’s known for high-efficiency turbines and has a strong presence in AI-related power projects.

Mitsubishi Power (Mitsubishi Heavy Industries): Accounting for 27% of 2023 orders, Mitsubishi excels in advanced turbine technology and has manufacturing in the U.S., including in Savannah, Georgia.

Other Key Players: Ansaldo Energia (Italy), MAPNA Group (Iran), Rolls-Royce Holdings (UK), and Bharat Heavy Electricals Limited (India) round out the top tier, focusing on specialized or regional markets.

U.S.-Focused Manufacturers

In the United States, the industry blends domestic operations with subsidiaries of global firms:

GE Vernova: Headquartered in the U.S., it’s the top player with extensive manufacturing and service networks.

Mitsubishi Power Americas: A U.S. arm of Mitsubishi, it supplies turbines for domestic power plants and data centers.

Solar Turbines (Caterpillar Inc.): Based in San Diego, California, it specializes in smaller industrial turbines but contributes to the energy sector.

Rolls-Royce Corp.: Operating in Indianapolis, Indiana, it manufactures gas turbines for power generation and aviation.

Capstone Turbine Corporation: Focused on microturbines, it’s geared toward distributed energy solutions for data centers.

These companies are riding the wave, with GE Vernova, Siemens Energy, and Mitsubishi seeing soaring orders tied directly to AI infrastructure.

Where Companies Are Building Data Centers: Energy Regulations and Costs in Focus

Site selection for data centers hinges on energy availability, costs, and regulatory environments. Low electricity prices, favorable incentives, and lenient regulations draw investments, while high costs or strict rules can deter them. Insights from Energy News Beat highlight how data center growth is straining grids and sparking utility investments, often in regions with abundant natural gas or nuclear resources.

Key U.S. regions include:

Northern Virginia (Loudoun County): The world’s largest data center hub, thanks to tax incentives, proximity to fiber optics, and relatively low energy costs from Dominion Energy. However, rising demand has led to regulatory scrutiny over grid impacts and higher bills.

Texas (Dallas-Fort Worth): Attracted by cheap natural gas, deregulated markets, and sales tax exemptions. ERCOT’s grid allows for flexible power deals, but extreme weather poses risks. Companies like Williams are building gas turbine plants here for direct data center supply.

California: Despite high energy costs and strict environmental regs (e.g., carbon pricing), it’s a draw for tech firms due to innovation hubs. Regulations emphasize efficiency, pushing for renewables, but costs can exceed national averages.

Other Hotspots: Arizona (Phoenix) benefits from low costs and solar integration; Oregon and Washington leverage cheap hydropower; Georgia (Atlanta) offers incentives and gas access. Federal sites like Idaho National Laboratory, Oak Ridge (Tennessee), Paducah (Kentucky), and Savannah River (South Carolina) are being developed for AI-specific data centers under DOE initiatives, focusing on secure, energy-rich locations.

Energy News Beat notes that regulatory risks and fuel costs are critical, with diversified energy portfolios.

Stranded gas in oil-producing states like Texas and Pennsylvania is also being repurposed for on-site power, reducing costs.

What Investors Should Look For: Opportunities and RisksThe AI power boom presents lucrative plays, but investors must navigate uncertainties like supply chain bottlenecks and the shift to renewables.

Key factors to watch:

Order Backlogs and Revenue Growth: Companies with extended turbine orders signal strong demand. GE Vernova and Siemens Energy have seen stock boosts from AI-related announcements.

Diversification and Innovation: Prioritize firms integrating hydrogen-ready turbines or hybrid systems to future-proof against regulations.

Supply Chain Resilience: Long wait times for turbines (up to years) could lead to shortages, favoring established players.

Broader Ecosystem: Beyond turbine makers, consider pipeline operators like Williams Companies ($5B+ in behind-the-meter gas plants) and National Fuel Gas, which provide infrastructure for data centers.

Ventures like Engine No. 1’s partnership with Chevron for gas-powered AI centers highlight emerging opportunities.

Risks include overhyped demand—some projections may overestimate needs—and policy shifts toward nuclear or renewables.

Still, with utilities planning massive capex, the sector’s “party” could last through the decade.

As AI evolves, gas turbine makers aren’t just rolling—they’re accelerating into a high-stakes energy future. Investors eyeing this space should focus on resilient, innovative leaders to capitalize on the boom.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack