By Wolf Richter for WOLF STREET.

The employment data today poured some cold water on the raging Rate-Cut Mania: The 10-year yield spiked by 17 basis points within a couple of hours.

But surely, they’re going to try to brush the employment data off too, like they’re trying to brush off the FOMC’s push-back statement and Powell’s post-meeting press conference:

The employment data, released today by the Bureau of Labor Statistics, was fine; it was as you’d expect from an economy that is growing at a good pace. The number of payroll jobs created was revised up for the entire year 2023 by 359,000 jobs.

And in January, an additional 353,000 jobs were created, after the upwardly revised 333,000 jobs in December. So businesses are hiring on net at a very solid pace. That acceleration over the past two months is now visible in the chart:

The acceleration can also be seen in the three-month moving average, which irons out some of the month-to-month squiggles. The 3MMA rose by 289,000 in January, the biggest increase since March last year, and bigger than any increase in the years before the pandemic, after it had already increased by 227,000 in December. So this is not just a blip:

On the inflation front: Reheating wage growth.

To be able to hire and retain these workers, employers have re-accelerated their wage increases. We’ve been talking about this for a few months, and it just keeps powering higher, which is great for workers (but not so great for companies, whose costs are rising), and it’s great for consumer spending – these wage increases will power consumer spending nicely, which is great for GDP and overall economic growth. But it’s also one of the potential fuels for consumer price inflation.

Average hourly earnings of all employees jumped by 0.55% in January from December, the biggest increase since March 2022. That translates into an annualized increase of 6.8%.

The three-month-moving average jumped by 0.44%, which translates into an annualized increase of 5.4%, the hottest since May 2022:

On a year-over-year basis, average hourly earnings rose by 4.5%, up from 4.3% in December, November, and October, thereby marking the re-acceleration even on a year-over-year basis:

It’s not just the top 10% or whatever who get the wage increases. Average hourly earnings of “production and non-supervisory employees” jumped by 0.44% in January from December, which translates into an annualized rate of 5.4%.

These “production and non-supervisory employees” – the bulk of total employment but not management types – are working supervisors and all employees in nonsupervisory roles, such as construction workers, plumbers, cleaning staff, factory workers, engineers, designers, doctors and nurses, teachers, office workers, sales people, bartenders, technicians, drivers, retail workers, wait staff, etc.

In terms of the three-month moving average, it jumped by 0.42%, an annualized increase of 5.2%, the third month in a row of acceleration:

These types of wage increases are not, as Powell would say, consistent with 2% inflation. In other words, they’re providing fuel for increased demand from consumers, and for increased consumer spending, which is great, but this increased demand also provides further inflationary pressures.

And then there is the element of rising labor costs in products and services that employers will make every effort to pass on to consumers, and consumers, armed with these wage increases, might be willing to pay them, which translates directly into higher consumer price inflation.

And then Powell gets to re-explain to the reporters why these kinds of wage increases “are not consistent with 2% inflation,” and why “we will be very careful… etc. etc.”

The number of unemployed workers keeps dropping. Unemployment is another key metric for the Fed. The headline unemployment rate remained at 3.7% which is historically low.

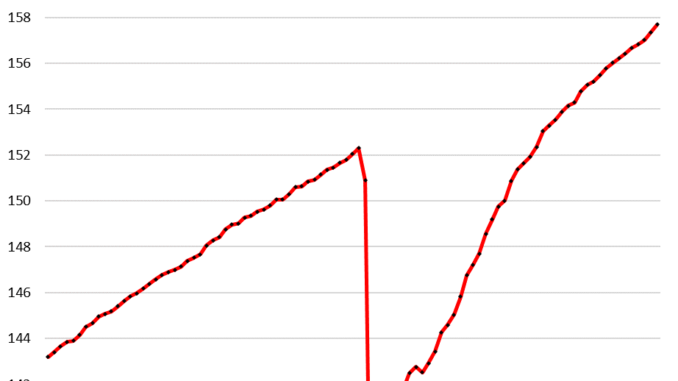

And going a little into the weeds, we see that the number of unemployed people who want to work dipped for the third month in a row to 6.25 million. This is a reversal because it had been rising from very low levels of 5.79 million a year ago to a still low 6.38 million in October. But since October, the number has been dropping again – a sign of the reacceleration of the labor market that we have seen elsewhere, including in wages.

The blue line shows the monthly data, the red line shows the 3MMA. The reversal is now getting clearer, indicating that the labor market is beginning to retighten just a tad:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.