In an era where artificial intelligence (AI) is reshaping industries, one often-overlooked beneficiary is the U.S. electric grid—a system that has suffered from decades of underinvestment and neglect. As data centers powering AI consume ever-greater amounts of electricity, the push for grid modernization is accelerating. But this isn’t just an AI story; it’s about addressing long-standing infrastructure deficiencies that have left the grid vulnerable to outages, extreme weather, and surging demand from electrification trends like electric vehicles (EVs) and renewable energy integration. According to recent analyses, global grid spending has already risen 16% this year to $479 billion, with projections reaching $577 billion by 2027.

This creates a fertile ground for grid-related stocks, which are set to thrive well beyond any potential AI hype cycle.

The Bloomberg article “Grid Tech Stocks Are Poised to Soar Even Further Amid AI Bubble Fears” highlights how AI’s energy demands have propelled grid tech stocks upward by about 30% year-to-date, outpacing broader markets.

Companies providing essential hardware like transformers, inverters, and energy storage solutions are seeing explosive growth, driven not only by data centers but also by broader electrification in the U.S. and global energy security needs. Historical neglect—stemming from slow regulatory approvals, limited capital allocation, and a focus on short-term efficiencies—has left the U.S. grid aging and overburdened. For instance, transmission projects can take 10-15 years from planning to completion, exacerbating bottlenecks as demand surges.

With U.S. data center power demand potentially reaching 106 GW by 2035—equivalent to powering tens of millions of homes—the grid must expand rapidly to avoid shortages.

U.S. Companies Positioned to Capitalize on Grid Growth

Several U.S.-based or U.S.-listed companies are well-placed to benefit from this multi-year upgrade cycle. These firms span utilities, equipment manufacturers, and infrastructure providers, leveraging the grid’s need for resilience against climate events, integration of renewables, and support for high-demand users like AI data centers. Here’s a look at key players:

Vertiv Holdings Co. (VRT): A leader in microgrids and energy storage for data centers, Vertiv has seen its stock surge ~60% year-to-date, trading at a premium due to robust growth prospects. Its solutions address the immediate power needs of AI infrastructure while enabling grid stability.

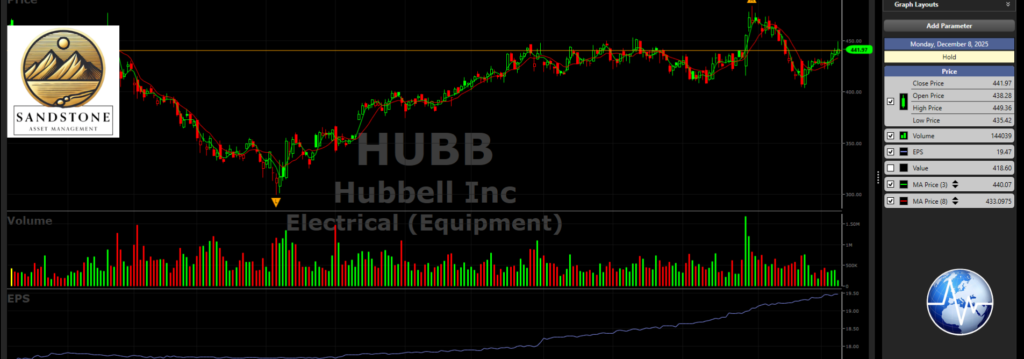

Hubbell Incorporated (HUBB): Specializing in electrical components for utilities, Hubbell provides end-to-end solutions for substations and smart grids, enhancing resilience to extreme weather. It’s poised for gains from modernization investments amid rising demand.

Monolithic Power Systems (MPWR): This company offers power-management solutions, including smart meters, renewable converters, and EV chargers. Its tech supports grid efficiency and stability, capitalizing on electrification trends.

GE Vernova (GEV): As a market leader in turbines and grid analytics, GE Vernova provides AI-powered software for optimization and cybersecurity. It’s benefiting from the shift to balanced energy sources, with strong exposure to U.S. grid upgrades.

NextEra Energy (NEE): A top U.S. utility with a vast renewable portfolio, including wind, solar, and storage. It maintains the electrical grid and is set to grow from data center demand, with a strong pipeline for low-carbon projects.

American Electric Power (AEP): Operating the largest U.S. transmission system, AEP has secured deals with tech giants like Google, Amazon, and Meta for data centers. It expects 9% EPS growth through 2030 from hyperscaler demand, addressing grid neglect with massive investments.

Constellation Energy (CEG): A zero-emission power supplier, CEG aids decarbonization and meets clean energy needs for utilities and data centers, positioning it for sustained growth.

Vistra Energy (VST): As a major power producer, Vistra benefits from wholesale price spikes due to data center-driven demand, enhancing grid reliability in constrained markets.

Other notable mentions include SolarEdge Technologies (SEDG) for inverters, Willdan Group (WLDN) for engineering services, First Solar (FSLR) for renewable infrastructure, and Plug Power (PLUG) for hydrogen-based energy storage—all of which stand to gain from the grid’s evolution.

These companies are not limited to AI; they address systemic issues like the grid’s under-expansion over the past decades, where investment lagged behind demand growth, leading to vulnerabilities.

What Investors Should Look For

When evaluating grid stocks, investors should prioritize companies with:Exposure to Key Growth Drivers: Look for firms involved in substations, transformers, transmission lines, smart grids, and data center support. Companies like those above with direct ties to AI and electrification offer high potential.

Strong Financials and Valuations: Seek attractive EV/EBITDA ratios (e.g., below sector averages), consistent dividend growth (3-5% annually), and robust cash flows. Utilities with A+ grades in profitability and growth, like AEP, provide stability.

Long-Term Contracts and Projects: Prioritize those with power purchase agreements (PPAs) or secured data center deals, ensuring revenue visibility. Grid projects’ long timelines (10-15 years) favor established players.

Resilience to Pullbacks: As noted, dips in share prices are buying opportunities, given the structural demand.

Overall, utilities have outperformed in 2025, with electricity demand growing 2.5% annually—five times faster than historical rates.

Diversification across utilities, renewables, and tech providers can mitigate risks from regulatory delays or economic shifts.

Impact on Consumers

While grid upgrades promise a more reliable and efficient system, they come with short-term costs for consumers. Utilities are projecting $16.6 billion in expenditures from 2025-2027 just for data center-related power in regions like PJM, potentially leading to higher electric bills as these costs are passed on.

Rising demand from AI and EVs could strain supplies, risking outages if upgrades lag—especially in winter or during peaks.

However, long-term benefits include lower energy costs through efficiency, reduced outages, and integration of cheaper renewables. Delaying upgrades could cost billions and endanger health via unreliable power, but timely investments—spurred by this boom—may save consumers tens of billions in avoided disruptions.

As electricity usage grows 5.7% annually over the next five years, consumers in high-demand areas may see rate hikes, but a modernized grid supports economic growth and sustainability.

In summary, the AI boom is a catalyst, but the real story is the grid’s overdue renaissance. Investors eyeing these stocks could reap rewards from a trillion-dollar opportunity, while consumers brace for costs but gain a more robust energy future. Stay tuned to Energy News Beat for more insights on this evolving sector.

Want to get your story in front of our massive audience? Get a media Kit Here. Please help us help you grow your business in Energy.

https://energynewsbeat.co/request-media-kit/

We have specials going on, so ask Stu for details.