By Wolf Richter for WOLF STREET.

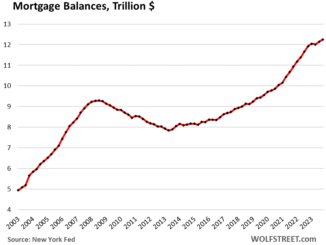

Mortgage balances rose by just $77 billion, or by 0.6% in Q2 from Q1, the smallest percentage increase since the dip in Q2 2023, and the second smallest since 2018, to $12.5 trillion. Year-over-year, balances are up 4.2%, according to the Household Debt and Credit Report from the New York Fed today, as sales of existing homes have been creeping along rock-bottom, new-home sales are also down but not as much, and mortgage applications to purchase a home have collapsed by nearly half compared to 2019, while people with cash are foregoing mortgages altogether.

The slowly rising balance in recent quarters is driven by higher prices and larger amounts financed amid a shift in the mix of homes that sold to the higher end, where sales remain fairly strong.

HELOC balances rise from the ashes.

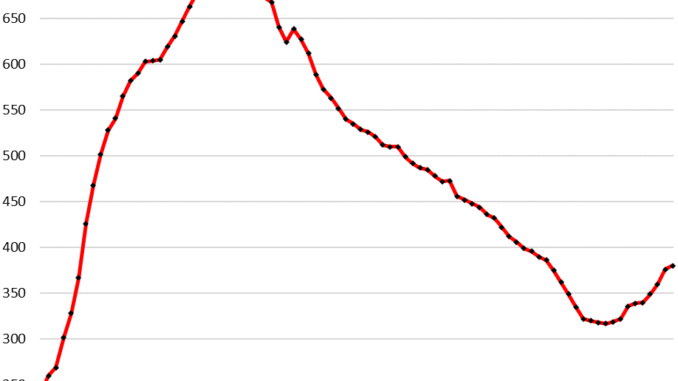

Balances of HELOCs (home equity lines of credit) rose by 1.1% for the quarter, and by 11.8% year-over-year, to $380 billion. But the Q2 increase was much smaller than the jumps in prior quarters. Since the low point in Q1 2022, HELOC balances have surged by 20%.

Despite the surge, HELOC balances remain historically low after 13 years of incessant declines. And they’re still only a tiny 3% of regular mortgage balances. Back in 2005 through 2012, HELOCs amounted to 7-8% of mortgage balances.

HELOCs are a credit line that homeowners can draw on to turn their home equity into useable cash. If a homeowner owns the home free and clear and wants a substantial standby line of credit, such as for home improvements or other projects, a HELOC can be a good solution. HELOCs can get riskier for the borrower in a downturn if they pushed the limits.

Borrowers have to pay Wall Street fees and interest, but that’s a lot cheaper than the primary home-ATM, cash-out refinancing, which these days would replace a 3% mortgage with something like a 6% or 7% mortgage. People still do that, but the payment is going to be a shocker.

Second-lien mortgages are another option to extract cash from the equity in the home, but unlike HELOCs, they come with fixed payments over a fixed term, and both are far less expensive than doing a cash-out refi, where the entire debt gets the much higher mortgage rate.

About 1.8 million HELOCs were originated in 2023 and the first half of 2024, with these credit limits, according to a blog post by the New York Fed:

Below $50,000: 28%

Between $50,000 and $100,000: 29%

Between $100,000 and $150,000: 18%

Over $150,000: 25%

Over $650,000: 1%

The burden of mortgage debt compared to income.

One of the ways to measure the burden of mortgage debt on households is the comparison to disposable income, which is what households have left over from their total income from all sources after payroll taxes and social insurance payments. This includes income from wages, interest, dividends, rental income, farm income, small business income, transfer payments, etc. It’s what they can use to deal with their costs of living and servicing their debts.

Quarter-to-quarter, disposable income rose faster (+0.9%, per Bureau of Economic Analysis) than mortgage balances (+0.6%), and so the ratio of mortgage balances to disposable income edged down a hair and has been roughly flat for the past five quarters at around 60%, a historically very low level.

Note the scary levels of mortgage debt to disposable income in the years before and during the housing bust. In Q1 of 2003, they were still at 60%. But by 2006, they were over 80%, and in 2008, they reached 86% as the housing market was already toppling and homeowners began walking away in large numbers from their mortgages, leading to the mortgage crisis.

Delinquencies mostly edged down.

Serious delinquency: Mortgage balances that were 90 days or more delinquent edged down to 0.57%, compared to 1.0% and higher before the pandemic (red line in the chart below).

HELOC balances that were 90 days or more delinquent dipped to 0.36%, the lowest since 2006 (blue line).

In other words, more borrowers that had fallen behind are catching up again.

Transitioning into delinquency: Mortgage balances that were delinquent by 30 days or more ticked up by just 11 basis points – the smallest increase since the free-money era in Q1 2022 – to 3.3% of total balances, which is at the low end of the spectrum of where it had been before the pandemic. And it seems to be stabilizing (red line in the chart below).

HELOC balances that were delinquent by 30 days or more edged down to 2.1% (blue line).

The frying-pan pattern of foreclosures.

The mortgage forbearance programs and foreclosure bans during the pandemic reduced the number of consumers with foreclosures to near zero. They have risen since then but remain well below the prior all-time lows.

In Q2, there were 47,180 consumers with foreclosures, compared to 65,000 to 90,000 in the years 2017 through 2019. They haven’t even normalized to Good Times levels yet. The post-pandemic frying-pan pattern has cropped up in other data as well:

Foreclosures won’t be a problem until home prices sag by a whole bunch, and simultaneously lots of people lose their jobs. That’s what happened during the mortgage crisis, when the unemployment rate reached 10% and stayed above 7% for five years, as home prices plunged.

In July, the unemployment rate was only 4.3% — still low and now powered by waves of immigrants surging into the labor force, rather than by waves of people losing their jobs. And only some recent homebuyers might be in a position of negative equity.

Homeowners with equity in their homes, when they get in trouble, can sell their home, pay off the mortgage and walk away with some cash, and there won’t be a foreclosure. And homeowners with negative equity can just go about their lives and make their payments, and they won’t even notice it. It’s only when they lose their jobs and cannot make the payments and are trying to sell the home to pay off the mortgage that the problem arises.

And in case you missed it yesterday: Household Debt, Delinquencies, Collections, and Bankruptcies: Our Drunken Sailors and their Debts in Q2

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/