Pakistan’s Energy History

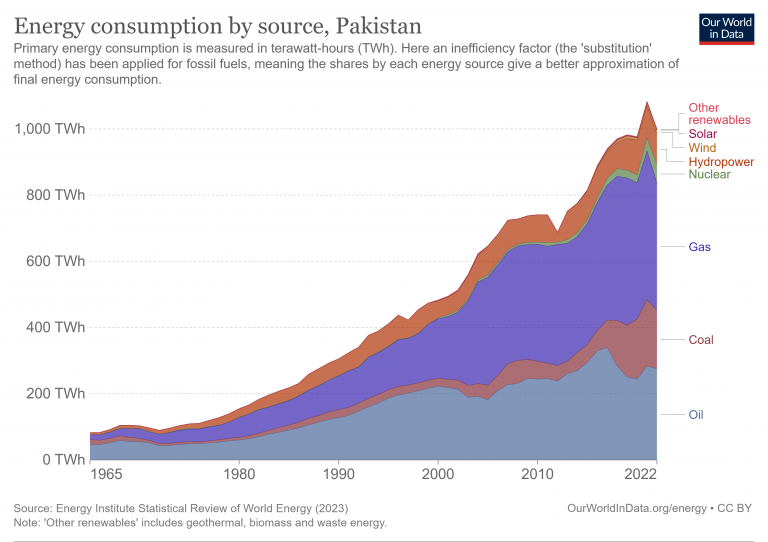

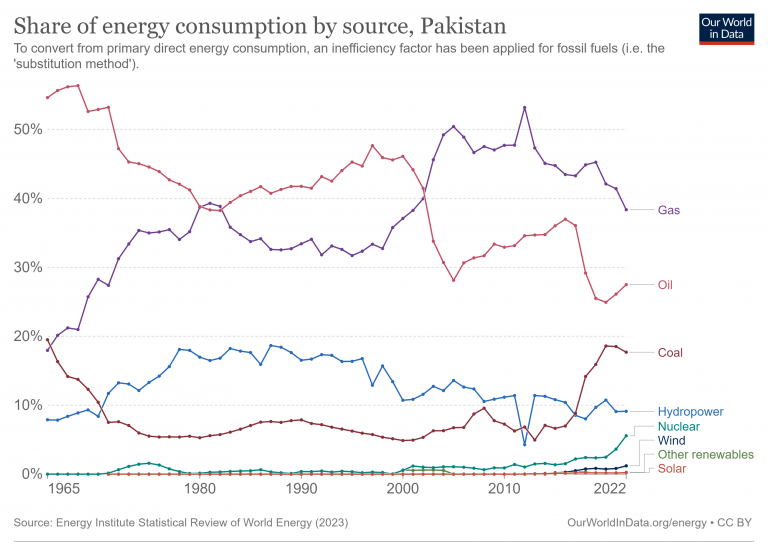

The huge gas reserves discovered and brought online in the 1960s displaced coal and oil in the mix (figure 2) but since the 2000s at least, and due to market distortions and inefficiencies all along the power and gas value chain, profits have been low, discouraging investment in both gas and power. 3

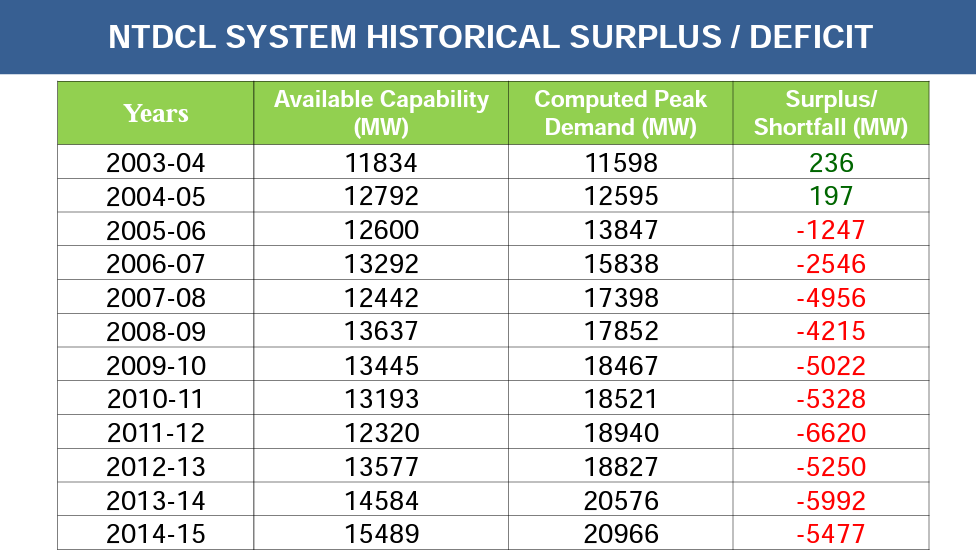

This prevented the country from keeping power capacity growth in line with demand growth (figure 3)4 and the financial fallout of power shortages and troubles meant it has continually had to be bailed out by the IMF.5

With gas reserves facing decline and having plateaued in 2017, coal has had a resurgence (also figure 2) and Pakistan has been importing both natural gas and coal in recent years.6 Yet according to some estimates, Pakistan’s potential coal reserves are estimated at 185 billion tons which would place it second in the world and thus the continued call within Pakistan to turn to domestic coal.7 However, domestic coal production is not on pace to meet the goal of, “more than 70% of thermal power generation [to] be produced by coal-based power plants (45% local coal and 25% imported coal) in 2030,” 8 as their domestic coal production has stagnated to ~10 mtpa the last 3 years.9

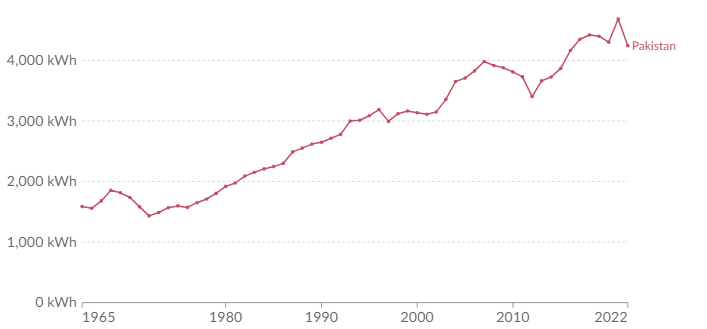

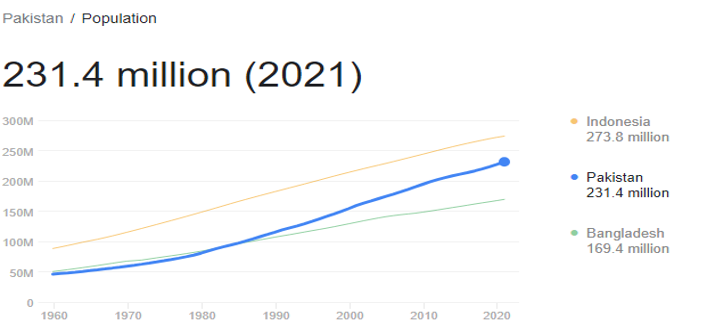

All signs indicate that Pakistan will continue to push for a larger percentage of domestic energy production, primarily through coal, hydro, even syngas,10 but until they make real progress towards energy market reforms and domestic production, they will need to rely on imported LNG and even imported coal to meet the needs of their large and growing population with an energy usage per person which has multiplied to 4 times the value it was in the mid 1960’s.

Energy and Economic Crisis

In the last 5 years, and due to a lack of aforementioned energy market reforms, Pakistan has gotten into a vicious cycle of debt, currency devaluation, inflation, high energy prices and energy crisis, hamstringing the economy.

As per World Bank Report “In the Dark” 11 points out, “The total annual economic cost of power sector distortions is conservatively estimated at about…$17.7 billion (6.5% of GDP) in Pakistan in fiscal 2015. … In Pakistan the impact of the lack of reliable access to electricity on households and firms is the largest source, costing roughly $12.9 billion a year (4.8% of GDP). These results suggest that the potential gains from power sector reform are huge. They include cost savings for utilities; income gains for households and firms; reductions in air pollution and health damage for the population; and lower subsidies to state-owned utilities, higher tax revenues, and lower public health spending for governments.”

It further notes that market distortion in the gas sector created cascading problems from reduced exploration to poorly maintained infrastructure and even fuel shortages, “Underpricing coal and gas contributes to fuel shortages, not only because it encourages wasteful energy consumption but also because it reduces suppliers’ interest in upstream exploration and production. In Bangladesh and Pakistan, several large gas development projects have been abandoned because of the government’s unwillingness to raise tariffs to allow cost recovery with reasonable returns. Because of the dependence on coal or gas for power generation, upstream fuel shortfalls have quickly cascaded into idled capacity downstream. Fuel shortages left an average 10 percent of gas capacity in Bangladesh and 15 percent of coal capacity in India stranded in 2014. In Pakistan shortages of gas for power generation were made up through expensive imported oil, increasing both electricity costs and trade bills.”

Pakistan’s Investment Into Natural Gas

With Pakistan in dire need of reforms to their energy sector, they will have to perform a balancing act of gradually introducing reforms to reduce inefficiencies of both power and fuel, increasing revenues high enough to improve infrastructure and domestic production, while continuing imports to ensure reliable power and energy supplies, especially to the industrial sector to support improvements in exports and revenue, thus reducing foreign debt and becoming more attractive to foreign investors. All the while, politically, they have to keep those increased price rises gradual to appease domestic interests who have enjoyed subsidized energy, albeit quite unreliably.

As for natural gas, so far the market distortions, such as domestic gas priced 36% lower than benchmark prices, have made it difficult to improve and expand their domestic gas infrastructure and fund exploration activities.

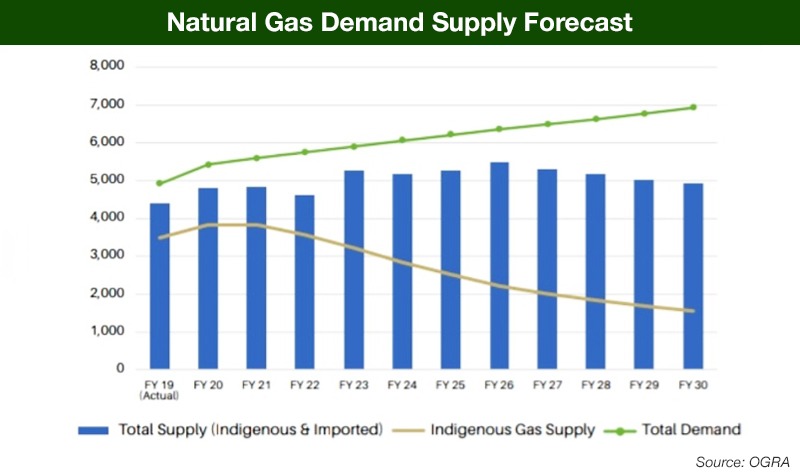

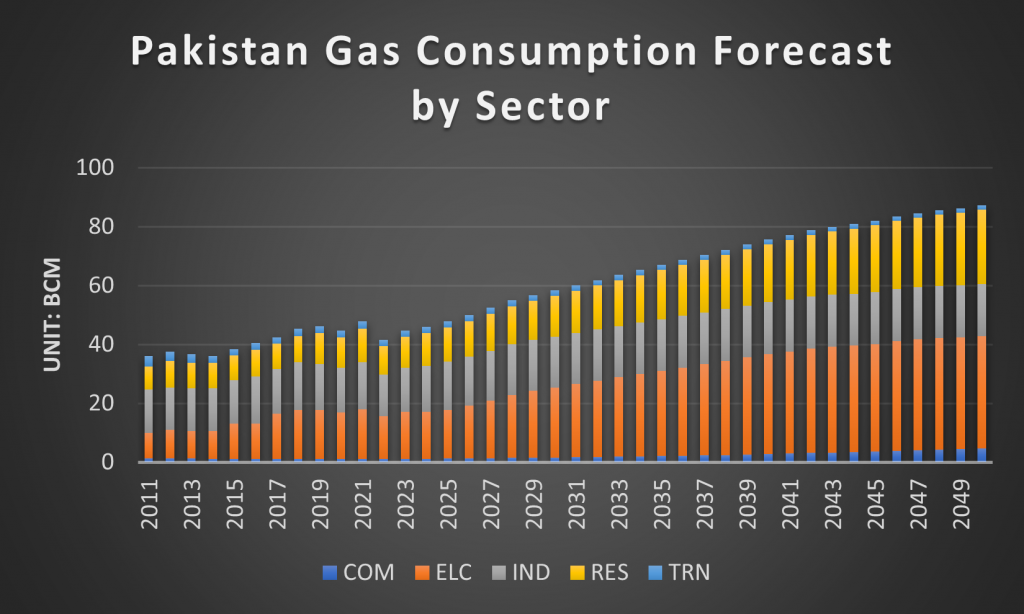

Also, their production of gas has been unable to keep pace with the growing demand from the increasing population and per capita energy use. Their gas production plateaued after peaking in 2017, which also happens to be the year when coal began significantly increasing its presence in the energy mix. Yields from domestic natural gas fields are decreasing by 9% annually. Hence, by the year 2030, a significant supply shortfall of 35 mtpa is expected.

Certainly, if Pakistan were able to further develop their own gas assets and increase reserves then they could lessen their reliance upon energy imports. There have been several attempts to explore new oil and gas reserves, both onshore and offshore, within the country. In 2021, Pakistan opened bidding for 14 exploration blocks 12 potentially holding 15 TCF of natural gas and 180 million barrels of oil. However, the 18 exploratory wells that were drilled a few months later did not prove fruitful. 13

Due to concerns of fuel shortfalls and lack of success with domestic exploration, Pakistan began importing LNG in 2015,14 and currently has 4 long-term LNG contracts with Qatar, ENI, and Gunvor. There are now two FSRUs (~5 mtpa) at Port Qasim, with three more LNG terminals being proposed in the same area, and another to be built in the city of Gwadar 15

Additionally, two international pipelines 16 are currently under construction which could bring more gas and revenue to the country: the TAPI pipeline (1,342 mmcf/d to Pakistan) connecting Turkmenistan, Afghanistan, Pakistan, and India which we recently wrote about here; and the Iran-Pakistan pipeline (750 mmcf/d to Pakistan).

However, both pipelines are stalled while Pakistan and Turkmenistan are debating over gas tariffs and the pricing of the pipeline,17 and progress had been slow on the Iran-Pakistan pipeline due to US sanctions on Iran. 18

How Investing in Natural Gas can Help Pakistan’s Economy

The Russian invasion of Ukraine in February 2022 caused Europe to abandon Russian pipe gas and they bid up LNG on the spot market tightening global supply and causing dramatic increases in global gas prices and, in Pakistan’s case, coupled with a steeply devalued local currency, caused Pakistan to be priced out of the market. Due to such high prices, they had to turn down LNG imports earlier this year,19 and have struggled to receive bids for new contracts as LNG suppliers are hesitant to make a deal with Pakistan due to their “[perilous] economic situation, poor credit standing and very limited foreign currency reserves.” 20

Luckily for Pakistan, they were recently able to come to an agreement with State Oil Company of the Republic of Azerbaijan (SOCAR) in which, “SOCAR will each month offer PLL [Pakistan LNG Limited] the option of buying a shipment of LNG at a price below the prevailing global price.” However, details regarding the exact volume and pricing of these LNG cargoes have yet to be announced.21

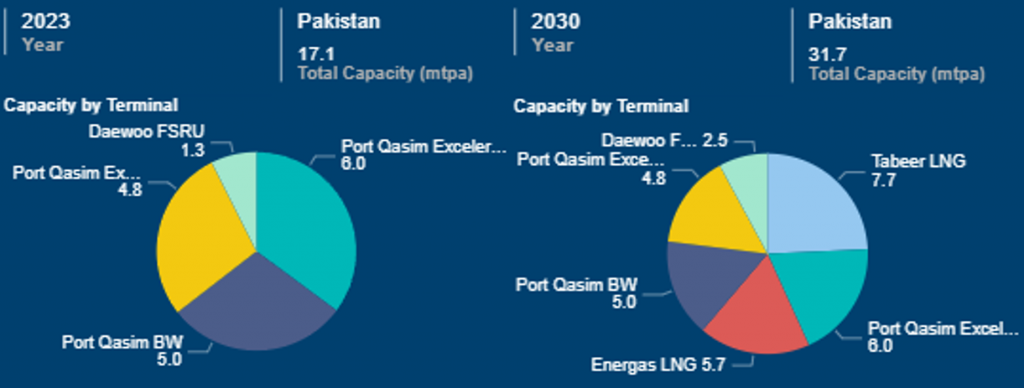

Despite difficulties in securing LNG contracts, Pakistan remains committed to increasing their natural gas supply. Pakistan’s Energy Outlook Report 22 published by their Ministry of Planning Development and Special Initiative detailed different ways in which this could be accomplished, including increasing capacity of current LNG terminals and constructing new ones, importing gas from neighboring countries, and constructing a north-south gas pipeline. Pakistan’s LNG import capacity is expected to almost double over the next two years from 17.1 mtpa in 2023 to 31.7 mtpa in 2030 (Figure 10) as two new facilities, Tabeer LNG and Energas LNG, are expected to come online soon.

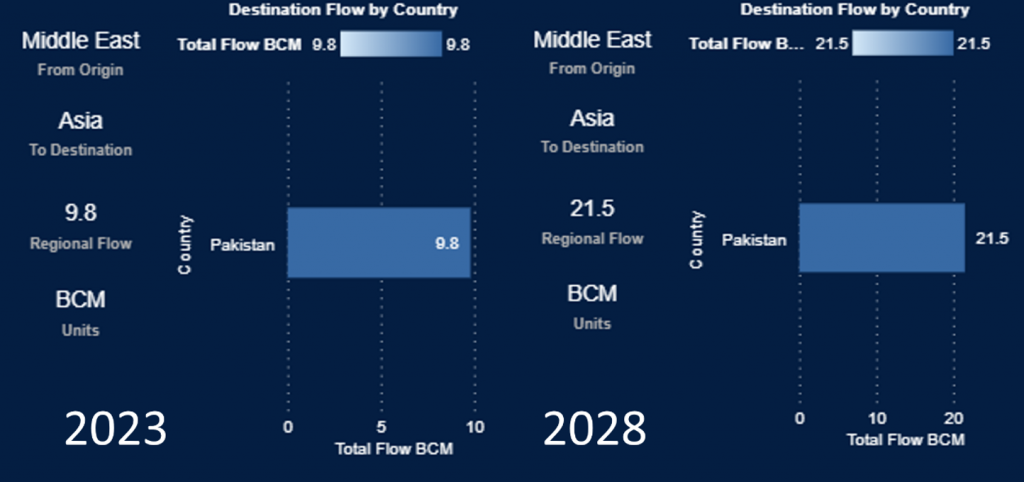

Pakistan is also expected to receive more LNG from Qatar, increasing from 9.8 bcm in 2023 to 21.5 bcm in 2030 (Figure 11).

Natural gas is positioned to remain the backbone of Pakistan’s energy mix for the foreseeable future. and securing reliable supply whether through investment into exploration of domestic reserves and/or securing long-term LNG contracts should be a priority if Pakistan wishes to avoid having to continuously import costly fuel supplies that is subject to the volatility of the spot market.

It’s presence within Pakistan’s economy cannot be understated as it is not only used for the purpose of power generation but for use in industry, household, and fertilizer sectors of the country.

China has been heavily investing into Pakistan’s economy since 2015 with the creation of the China-Pakistan Economic Corridor (CPEC). 23 They have committed billions to develop infrastructure, including a network of natural gas pipelines within the country, LNG facilities, and modernization of power and transportation infrastructure; however and although “the project gave a boost to job creation in Pakistan, promises that it would bolster Pakistan’s industrial sector and increase exports remained largely unrealized into the early 2020s.” 24

Thus, it would well behoove Pakistan to tread carefully and ensure that investments from China and loans from the IMF are well spent on development which results in increased production across the various sectors. Meanwhile, regulatory and policy changes which support such production and decrease inefficiencies and waste will help stave off a return to economic crisis with an even larger pile of debt.

Emerging economies such as Pakistan can often find themselves between a rock and a hard place trying to secure sometimes expensive energy supplies to power their industries and communities, supplies without which can break the back of the industries that could lead them up the path of economic development. Thus, it is arguably even more important to emerging countries than more developed ones to have a reliable outlook of the global energy market to make informed decisions and create a solid energy strategy.

Whether it is gas pipelines, LNG import terminals, long-term contracts or spot pricing, G2M2® Market Simulator for Global Gas and LNG™ help executives and policy makers make better investment decisions for a better energy future.

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack