The western world shakes its fist in anger. “No more Russian energy! We will not fund this conflict!” is cried by world leaders all over Europe. What has been the effect so far? To answer that question, we have to establish a baseline.

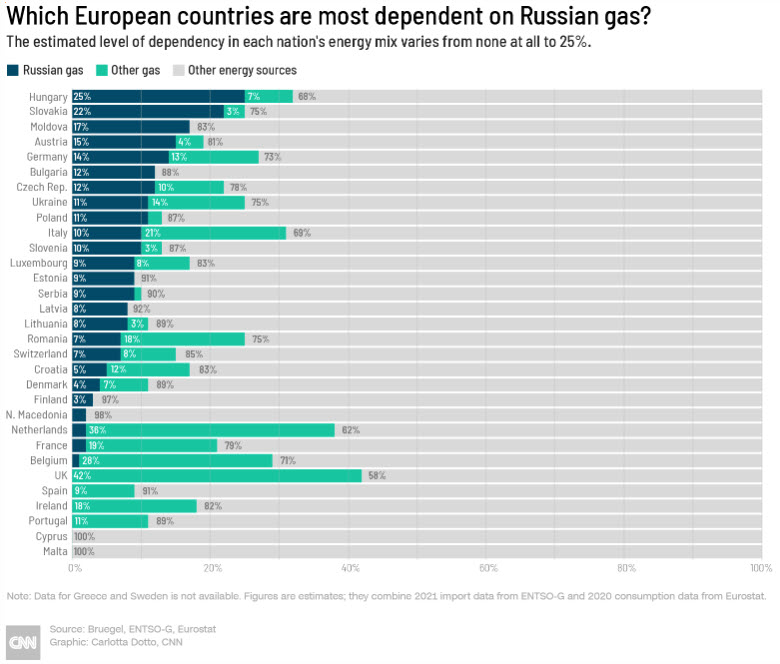

Russia had established itself as a dominant energy provider for Europe. Countries like Hungary have voiced their concern over the limited use of Russian gas, as ceasing to use Russian gas could destroy their economy. If more countries looked like Finland, we wouldn’t have this problem, but the truth of the matter is that Europe needs Russian gas.

So, Russian energy exports have decreased significantly but have not stopped. How is Russia getting oil to the rest of the world?

Super Discounts

Some folks are not as dependent on Russian energy but are still excited to consume it. As Russian Deputy Prime Minister Alexander Novak put it, “If the crude is trading at a discount, people will gladly buy it, like now. We will be looking at the Asia Pacific region, and work with them in terms of loadings and supplies.” Russia is doing exactly that and offering as much as $30 off of a barrel of oil. Places like India and China are snatching up the extra energy because world supplies are becoming tight. If the rest of Europe gets desperate enough for energy, they might just take up Russia on a similar deal.

Blending

What is the best way to publically state you are against Russian energy while simultaneously selling Russian energy? By blending in a majority of other non-Russian substances. Shell has been pedaling what it calls “Latvian Blend.” This diesel blend is no more than 49.99% Russian diesel blended with another locally refined diesel. This way it isn’t technically Russian-based energy on paper and can be taken to markets. Lying about the source of the crude is a trick that has been used by Iran to bypass sanctions on their oil by selling the “Malaysian” and “Singapore” blends. While some feel that this move is immoral, it is technically legal. Europe has not been able to penalize or fully limit those purchasing Russian energy. As a matter of fact, you can sell 100% Russian oil if you follow the current rules. While Shell seems to have no problem conducting business like this, France’s Total Energies and Repsol of Spain have fully banned any “Russian molecules” according to their recent terms and conditions… or at least that is what they have on paper. Who is to say that these companies aren’t in on the cheap energy action as well?

Black Markets

There are certain groups who are buying Russian energy in secret while countries like Hungary openly state their need for Russian oil. A block was placed on Russia’s gold and foreign exchange reserves which have limited legitimate business transactions. This has proven to be a very effective tool for slowing many activities within the country. Still, no economic block or restriction can strip the value of the much-needed Russian hydrocarbon. While clearinghouses are not able to conduct traditional commodity trades, it is highly likely that transactions are going down behind the scenes and under the table. Venezuela was caught sending planes full of gold to Iran in 2020. It turns out that the Maduro regime was paying Iran for oil. The same thing is sure to go down here. Don’t be surprised if a news story comes out about China sending rare earth metals to Russia in exchange for gas.

Ultimately, the world market is a convoluted and complex network with more parties participating than one could ever imagine. Russia has the valuable energy that the world needs. Just be sure to watch world leaders whose hands perform contrary actions to what their mouths claim.

References

https://www.cnn.com/2022/04/04/business/russia-energy-europe-sanctions/index.html

https://www.bloombergquint.com/markets/russia-sees-oil-sales-continuing-thanks-to-discount-interfax

https://www.dimsumdaily.hk/bank-of-russia-embarks-on-legal-battle-to-fight-for-its-frozen-reserves/