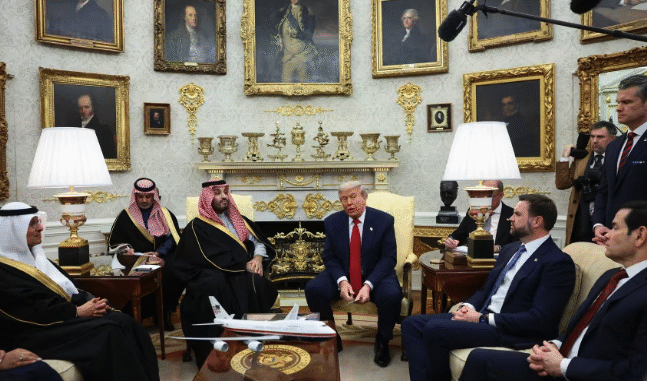

In a landmark diplomatic and economic event, U.S. President Donald Trump hosted Saudi Crown Prince Mohammed bin Salman (MBS) at the White House on November 18, 2025, marking a significant escalation in bilateral ties. During the high-profile meeting, MBS announced that Saudi Arabia would ramp up its investment commitments in the United States from an earlier pledge of $600 billion to nearly $1 trillion.

This pledge underscores Saudi Arabia’s confidence in America’s economic future and aligns with the Kingdom’s Vision 2030 diversification efforts, while bolstering U.S. infrastructure, technology, and defense sectors.

The Announcement: A Boost to U.S.-Saudi Economic Partnership

The White House meeting built on prior engagements, including a May 2025 trip by President Trump to Riyadh, where initial commitments totaling $600 billion in U.S. investments were secured alongside $142 billion in arms deals.

MBS, addressing reporters alongside Trump, emphasized Saudi Arabia’s belief in America’s potential, stating that the increased investment—now approaching $1 trillion—would focus on “real” projects to drive mutual growth.

Trump hailed the deal as a “historic” achievement, highlighting its role in creating jobs and advancing “America First” priorities.

This announcement comes at a time when Saudi Arabia’s Public Investment Fund (PIF), the Kingdom’s sovereign wealth fund, is on track to reach $1 trillion in assets under management by year’s end, having grown from $941 billion earlier in 2025.

PIF serves as the primary vehicle for these investments, with U.S. Treasury Secretary Scott Bessent recently discussing expanded opportunities with PIF Governor Yasir Al-Rumayyan.

The fund’s strategy emphasizes global partnerships, with the U.S. as its largest foreign investment destination, already exceeding $170 billion in commitments.

Social media buzz on X (formerly Twitter) amplified the news, with posts detailing potential deals in AI, infrastructure, electric vehicles (EVs), and space exploration. For instance, one prominent thread noted involvement from companies like NVIDIA, OpenAI, BlackRock, Amazon, and SpaceX, framing the investments as a “$1 trillion power move” for tech and security.

Another post highlighted Trump’s role in securing these funds, contrasting it with past administrations’ approaches.

Breaking Down the Investments: Sectors and ScaleSaudi Arabia’s $1 trillion pledge is expected to span multiple sectors, with a strong emphasis on high-growth areas that align with both nations’ strategic goals. Key highlights include:

Infrastructure and Manufacturing: A significant portion will target U.S. infrastructure projects, including EV factories and advanced manufacturing hubs. This builds on PIF’s existing $23.8 billion in U.S. equity holdings as of mid-2025, which saw shifts toward chips and healthcare.

Recent deals, such as up to $12 billion in partnerships with U.S. asset managers like Franklin Templeton, Neuberger Berman, and Northern Trust, aim to funnel capital into these areas.

Technology and AI: MBS has expressed ambitions for AI chips and fighter jets, with PIF eyeing investments in semiconductors and emerging tech.

This could involve collaborations with U.S. firms, countering China’s global influence and positioning Saudi Arabia as the “AI capital of the Middle East.”

PIF’s portfolio already includes stakes in companies like Visa and Pinterest, though recent adjustments show a pivot toward high-impact sectors.

Energy and Sustainability: Given the Energy News Beat focus, it’s noteworthy that investments may extend to sustainable energy, hydrogen, and rare earths. PIF’s strategy integrates six core ecosystems, including sustainable energy and infrastructure, supporting Saudi Arabia’s shift from oil dependency.

This could mean U.S.-Saudi joint ventures in renewable projects, leveraging competitive energy costs in the Kingdom to attract reciprocal investments.

Defense and Nuclear: In exchange for investments, discussions include $100 billion+ in U.S. weapons sales and support for a Saudi nuclear program.

This ties into broader geopolitical aims, such as isolating Iran and strengthening Sunni alliances.

Phase 1 deals, potentially worth $500 billion+, are anticipated in the coming days, focusing on defense, AI, and energy.

Overall, PIF’s U.S. footprint has grown 19% in 2024 alone, reflecting a deliberate expansion.

What Investors Should Look For: Opportunities and Considerations

For investors eyeing this influx of Saudi capital, the $1 trillion deployment presents both lucrative opportunities and risks. Here’s a breakdown:

|

Sector

|

Key Opportunities

|

Potential Risks

|

Companies to Watch

|

|---|---|---|---|

|

AI & Semiconductors

|

Capital for chip manufacturing and AI development; partnerships with U.S. tech giants.

|

Geopolitical tensions; supply chain disruptions from global trade wars.

|

NVIDIA, OpenAI, Intel.

@adugbovictory

|

|

Infrastructure & EVs

|

Funding for factories and urban projects; job creation boosting related stocks.

|

Delays in execution due to regulatory hurdles; oil price volatility impacting Saudi funding.

|

Tesla (via SpaceX ties), BlackRock, Amazon.

@adugbovictory

|

|

Energy & Renewables

|

Investments in hydrogen and sustainable tech; diversification from oil.

|

Low oil prices straining Saudi budgets (e.g., doubling deficits).

@georgikantchev

|

ExxonMobil, Chevron, or emerging hydrogen firms.

|

|

Healthcare & Defense

|

Stakes in biotech and arms; nuclear tech collaborations.

|

Ethical concerns (e.g., human rights); market overvaluation from hype.

|

Lockheed Martin, Pfizer; PIF’s recent U.S. equity shifts.

arabnews.com

|

Investors should monitor PIF’s filings, such as 13F reports, for portfolio changes—recent exits from tech stocks like Visa signal a strategic pivot.

Look for U.S. companies announcing Saudi-backed deals, as these could drive stock rallies. However, consider Saudi Arabia’s fiscal challenges: mega-project overruns and low oil prices have thinned PIF’s wallet, potentially affecting payout timelines.

Diversify across sectors to mitigate risks, and track White House updates for follow-on announcements.

This White House meeting not only cements U.S.-Saudi economic bonds but also positions both nations as leaders in the global tech and energy transition. As details unfold, the $1 trillion infusion could reshape markets, offering savvy investors a front-row seat to unprecedented growth.