The war in Ukraine and rising fossil fuel prices have escalated the pace of investments in clean energy, triggering seismic changes that will propel the renewable energy sector to become the largest source of global electricity by 2025.

As a result, companies have responded to the global energy crisis by investing in clean technologies at a far faster pace than anticipated thanks to strong backing by governments across the globe, said Janus Henderson Investors’ head of Global Sustainable Equities Hamish Chamberlayne.

“We expect to see (a) seismic shift from fossil fuel-based to renewable industries in the next decade.

“(But) it is important to note that renewable energy companies are only one aspect of achieving a low carbon economy.

“Electrification and digitalisation are two highly important vectors for decarbonisation and there are many different companies playing a part in these trends.”

Huge investments in renewables

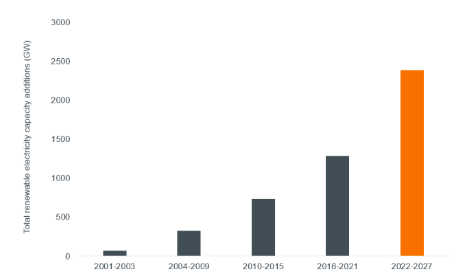

According to the International Energy Agency (IEA), global growth in demand for oil is expected to slow significantly by 2028 as countries move away from fossil fuels to renewables, which are forecast to account for over 90% of global electricity capacity expansion with output growing by almost 2,400 gigawatts between 2022 and 2027.

Of the renewables share, wind and solar are forecast to provide almost 20% of global power generation in 2027, with wind capacity doubling and solar capacity tripling.

These forecasts are the result of aggressive policy initiatives countries have put in place to strengthen energy security and meet net zero goals, Chamberlayne noted.

In particular, the European Union’s Green Deal and the US Inflation Reduction Act (IRA) seek to invest €1.8 trillion and US$370 billion, respectively, into the green transition, while China aims to increase renewable energy generation by 50% by 2025.

India’s green policy, on the other hand, is targeting 50% of electricity requirements from renewable sources by 2030.

“These initiatives will see the US, China and India double their renewable capacity expansion over the next five years, accounting for two-thirds of global renewables growth,” Chamberlayne said in a research note.

Renewables are becoming an increasingly larger portion of electricity capacity. Source: IEA.

Opportunities aplenty

The shift to alternative energy sources would, however, require large-scale changes and solutions to the current challenges around renewable energy, including successfully scaling capacity, managing renewable waste and ensuring effective energy storage, Chamberlayne said.

Thankfully, there are a host of innovative companies across the entire renewable infrastructure supply chain that offer solutions to these challenges, which are an investing opportunity.

“We believe that investing in these companies can keep us on the right side of disruption,” he added.