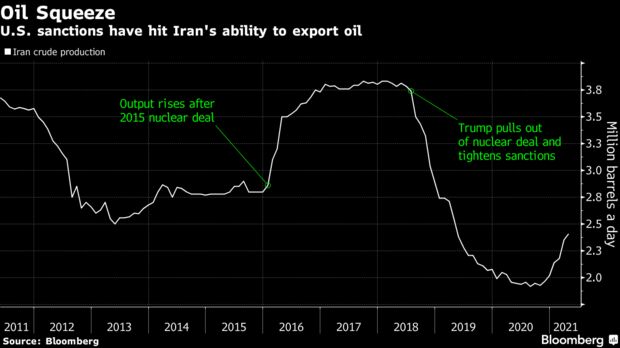

Energy News Beat Publishers Note (ENB): While this is an excellent article, it is not showing how Iran had continued production around the sanctions. The production and oil field activity have shown that it had been increasing prior to the current Biden Nuclear Talks. We are looking at when the numbers changed and the political activities.

Iran is preparing to ramp up global oil sales as talks to lift U.S. sanctions show signs of progress. But even if a deal is struck, the flow of additional crude into the market may be gradual.

State-controlled National Iranian Oil Co. has been priming oil fields — and customer relationships — so it can increase exports if an accord is clinched, officials said. In the most optimistic estimates, the country could return to pre-sanctions production levels of almost 4 million barrels a day in as little as three months. It could also tap a flotilla’s worth of oil that’s hoarded away in storage.

“Our return may be a gradual process rather than swift and sudden — it can’t happen overnight,” Khatibi said in an interview. It may be “a protracted process, in part due to the coronavirus pandemic that’s significantly hurt demand.”

The pace of Iran’s comeback may prove critical for the oil market. While fuel consumption is on the rebound, it remains depressed by lockdowns and new virus outbreaks. Extra Iranian supplies would impose a burden on other members of OPEC+, which has toiled for more than a year to clear a supply glut built up as the pandemic spread.

Within Reach

U.S. and Iranian diplomats, currently negotiating via intermediary governments in Vienna, have signaled that an agreement is within reach.

If successful, the negotiations could reactivate a 2015 international nuclear deal that Donald Trump withdrew the U.S. from in 2018. That would require Iran to once again accept limits on its atomic activities, in return for the lifting of an array of tough sanctions imposed by the former president.

Tehran has already taken advantage of a less hostile climate since President Joe Biden came to power in January. It is reviving petroleum sales, sending a flood of Iranian crude to emboldened Chinese buyers. The country’s production has climbed almost 20% this year to 2.4 million barrels a day, according to data compiled by Bloomberg. Most of that oil is still used domestically.

“Even if the sanctions are not removed, depending on their ability to sell oil in the gray market, they will increase their production further,” said Sara Vakhshouri, president of consultancy SVB Energy International LLC in Washington.

Maintaining Wells

Engineers at NIOC have been rotating crude production between different fields to maintain sufficient reservoir pressure, according to officials at the company, who asked not to be identified when discussing operations. The procedure is crucial for keeping up output levels. Gas injections at older oil fields in the south of the country are playing a similar role, SVB’s Vakhshouri said.

If there’s a deal with the U.S., the Islamic Republic could increase production to almost 4 million barrels a day in three to six months, according to Iman Nasseri, managing director for the Middle East at consultant FGE, who has decades of experience covering the region including a period working in Iran.

Others expect a slower pace. It would take 12 to 15 months after the lifting of sanctions to increase production to 3.8 million barrels a day, Reza Padidar, head of the energy commission of the Tehran Chamber of Commerce, said in an interview. Some work required to restore capacity at fields, such as removing and servicing blocked bore-hole pumps, can take as long as one month per well, he said.

China Stockpiles

Even before pumping more oil, Iran could boost its sales. FGE’s Nasseri estimates that the country has stockpiled about 60 million barrels of crude. About 11 million barrels of that crude, plus another 10 million barrels of a light oil called condensate, is in “bonded storage” in China, where it’s ready to be sold to refiners, according to FGE.

An Iranian restart poses complications for the Organization of Petroleum Exporting Countries and its allies. Led by Saudi Arabia and Russia, the 23-nation coalition is gradually restoring the oil output it cut last year when the coronavirus crisis battered demand.

Saudi Energy Minister Prince Abdulaziz bin Salman has signaled that the alliance would make room for Iran to boost output, as it has in the past. It’s unclear whether others, including countries eager to revive output such as Russia and the United Arab Emirates, will be so accommodating. But they may not need to be.

Difficult Talks

With Tehran and Washington still haggling to secure the best terms from the talks, a deal may take much more time. If recent confrontations in the Persian Gulf between U.S. and Iranian naval vessels escalate, it might slip away altogether.

Talks could also be affected by next month’s elections in Iran, after which President Hassan Rouhani is stepping down. While Supreme Leader Ayatollah Ali Khamenei has so far endorsed the negotiations, Rouhani’s successor may take a harder stance against the U.S.

Even if sanctions are removed, Iran faces other problems. Many refiners sign annual contracts at the start of the year, leaving little room for Tehran to strike its own long-term supply agreements for the time being, Khatibi said.

“Our biggest concern is limitations imposed on our customers and their fear of buying oil from Iran,” he said. “As we draw closer to the end of the year, we’ll see more term contracts happen.”

Trump’s sanctions “suffocated” Iran’s relationships with traditional customers including India, China, South Korea, Japan and Turkey to a greater extent than previous rounds of trade restrictions, said Padidar of the Tehran Chamber of Commerce.

“There is space for oil from Iran to return,” said Mike Muller, head of oil trading in Asia for Vitol Group, the world’s largest independent trader. “It won’t come back in one big bang.”

— With assistance by Golnar Motevalli, and Jonathan Tirone