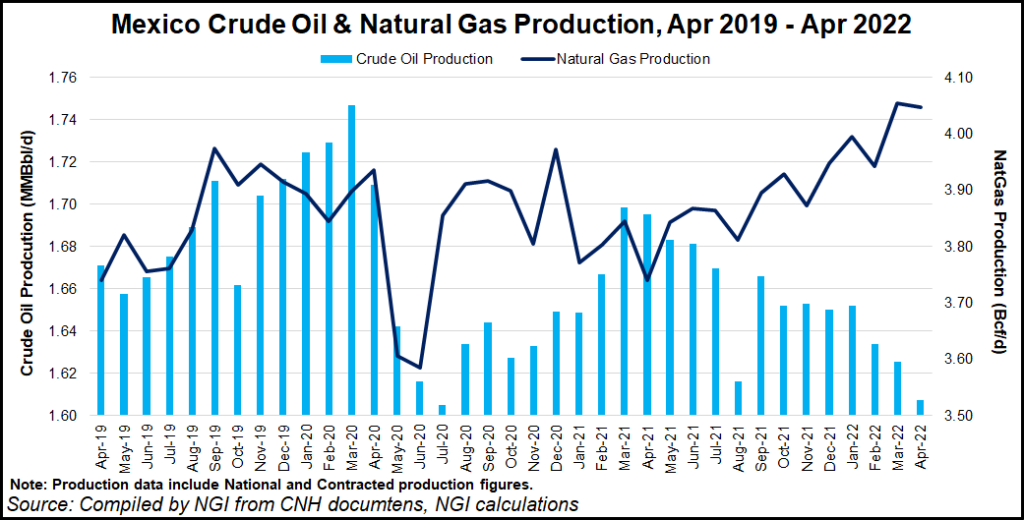

Mexico’s natural gas production averaged 4.05 Bcf/d in April, up from 3.74 Bcf/d in April 2021, according to new data from the country’s upstream regulator.

State oil company Petróleos Mexicanos (Pemex) supplied 4.05 Bcf/d or 95% of the total, up from 3.53 Bcf/d a year ago.

Private sector production, meanwhile, averaged 220 MMcf/d, up from 205.9 MMcf/d in April 2021, according to the latest figures from the Comisión Nacional de Hidrocarburos (CNH).

The top five producing natural gas fields, all operated by Pemex, were Quesqui (495 MMcf/d), Ixachi (282 MMcf/d), Maloob (280 MMcf/d), Akal (250 MMcf/d) and Onel (200 MMcf/d).

Production from Ixachi rose by about 46% year/year, CNH data show. Reuters reported this week that CNH is preparing to fine Pemex for excessive natural gas flaring at the onshore gas and condensate field in Veracruz state.

Mexico has grown increasingly reliant on pipeline natural gas imports from the United States in recent years, as Pemex has struggled to maintain output levels. Excluding natural gas consumed by Pemex, imports supplied 87% of Mexico’s gas demand as of January, CNH data show.

Mexico’s oil production, meanwhile, averaged 1.61 million b/d in April, down from 1.7 million b/d in the year-ago period.

The top oil producing fields were Maloob (260,000 b/d), Zaap (241,000 b/d), Xanab (88,000 b/d), Ayatsil (82,000 b/d) and Yaxche (53,000 b/d).

Although President Andrés Manuel López Obrador has frozen bid rounds and other processes to award upstream contracts to non-state firms, more than 100 contracts awarded under the previous government remain in effect.

Murphy Oil Corp. CEO Roger Jenkins said this month that the firm has been granted an additional exploration period by CNH for Block 5 offshore Mexico. Murphy plans to drill the Tulum exploration well there later this year.

Jenkins expressed optimism about the exploration campaign, citing successful drilling results by other operators nearby. Shell plc is planning another well just to the north, he said.

Management of Talos Energy Inc., leader of the consortium that made the Zama shallow water discovery in 2017, said this week it has invested about $111 million at the field since its inception.

“Zama’s expected value is multiples of invested capital to date and Talos has broad strategic optionality to ultimately realize that value,” the company said in its investor day presentation.

Energy ministry Sener earlier this year stripped Talos of its operatorship of the discovery and transferred it to Pemex. Talos retained a 17.35% working interest in the deposit, which contains more than 600 million boe of gross resources.

Talos said it anticipates submission of a unit development plan to CNH for approval, “a critical step” before the parties can make a final investment decision in 2023.

Oilfield services firms have cited a resurgence of upstream activity in Mexico and throughout Latin America, and not just offshore.

Nabors Industries Ltd. CEO William Restrepo said during the firm’s first-quarter earnings call that “in Mexico, we are seeing some rebirth on land activity” requiring top-end or high-spec drilling rigs.

The region’s national oil companies, including Pemex, also reported historically high profits during the first quarter amid surging global commodity prices.

Source: Naturalgasintel.com/