Kinder Morgan Inc. (KMI) continued to improve its balance sheet in the final three months of 2020, but the company is toeing the line when it comes to spending this year, focusing on projects supporting the rampant growth in exports.

Speaking during a conference call Wednesday, CEO Steven Kean said 2020 “has shown us how important it is to have our priorities and principles straight.” Natural gas, KMI’s core business, saw lower transportation volumes because of lower commodity prices and Covid-19. However, the midstreamer brought online the long-awaited, and often contentious, Permian Highway Pipeline, only three months later than its original target.

With an eye on growing exports to Mexico and in the form of liquefied natural gas (LNG), the midstream giant expects to spend less than half of what it spent in 2020 on expansions and joint ventures this year, only $800 million, after setting a budget of $1.72 billion last year. The company reduced spending by $680 million amid the pandemic and the oil price downturn.

The expansion of the Kinder Morgan Louisiana Pipeline, which began construction in 4Q2020, is expected to be a focus for the year. The Acadiana expansion project would provide 945,000 Dth/d of natural gas capacity to serve the sixth LNG production unit at Cheniere Energy Inc.’s Sabine Pass LNG terminal. The pipeline could be in service as soon as early 2022.

In December, the company placed into service portions of Natural Gas Pipeline of America’s (NGPL) Gulf Coast Southbound project ahead of schedule. The entire project is expected to be placed into service by the end of March, increasing southbound capacity by around 300,000 Dth/d to serve Cheniere’s Corpus Christi Liquefaction export facility in South Texas.

Lower Gas Volumes

Although financial contributions from all of the business segments were down compared with 4Q2019, KMI President Kim Dang said lower interest expenses and lower sustaining capital expenditures (capex) year/year cushioned the blow.

Natural gas transport volumes were down 2% year/year, or 600,000 Dth/d, with large volume declines on pipeline systems out of the Rockies because of lower production. El Paso Natural Gas (EPNG) throughput also declined because of increases in transportation alternatives for Permian Basin production, namely PHP. The 2.1 Bcf/d system entered full commercial operations this month.

Tom Martin, president of the Natural Gas Pipelines Group, also attributed the lower EPNG volumes to weaker demand in California. The executive said much of the lower demand was seasonal and assuming demand returns in 2021, “we think that likely recovers a bit.”

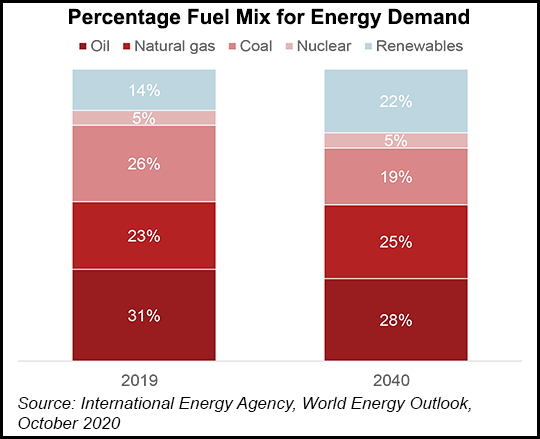

Martin added, “I think how we serve California is changing.” With the growth in renewable energy, some long-term volumes may not be as strong, especially to Northern California, he said. However, the amount of capacity needed into the market “probably grows over time as more renewable penetration increases in that area.”

Meanwhile, increased LNG exports and stronger industrial demand helped to offset the lower transport volumes across the pipeline systems. Dang said physical deliveries to LNG facilities off of the company’s pipes averaged almost 5 million Dth/d in the final three months of the year. “That’s a 50% increase versus the fourth quarter of 2019.” For 2020, the pipelines moved more than 40% of the volumes moving to U.S. LNG terminals.

Kinder Morgan

For the rest of the story: natural gas intel