13 years after ZeroHedge first explained (here and here) to the world how HFTs rig markets and pick the pocket of the average joe (all under the ‘legal’ umbrella of the exchanges), it appears the Securities and Exchange Commission (SEC) is about to take its first step to reduce some advantages enjoyed by high-speed trading firms, as it proposes the biggest changes to U.S. stock-market rules since the mid-2000s.

The SEC laid out four proposals on Wednesday that Chair Gary Gensler says would boost transparency and competition.

They delve into the guts of how the $43 trillion market works, and affect everything from order routing to pricing and disclosures that brokers must make to clients.

“Today’s markets are not as fair and competitive as possible for individual investors – everyday retail investors,” Gensler said in remarks ahead of the meeting.

As The Wall Street Journal reports, the proposals grew out of a review prompted by last year’s frenzied trading in GameStop Corp. They would fundamentally alter the relationships between brokerages that take investors’ orders to buy or sell securities, the high-speed traders that often handle those orders, and stock exchanges.

Payment for order flow would be significantly affected by the centerpiece of the SEC’s plans which proposes that brokers must send many small-investor stock orders into auctions. This would enable a mix of high-speed traders and institutional investors such as hedge funds or pension funds to compete to fill the orders, with the idea that investors would get better prices as a result – higher prices if they are selling shares, or lower prices if they are buying.

In another major change that likely kills high-frequency traders, the regulator also wants to reduce the rebates that exchanges can offer brokers in their own bid to pull more trades onto those platforms. Platform operators would have to start making their fees publicly known in advance, rather than after the fact based on volume within a given month.

Trading venues would also need to start allowing stocks to trade at smaller price increments on and off exchanges. The move, according to the SEC, would increase competition to fill orders and lower costs.

In a fourth proposal, the SEC is set to update and expand a more than 20-year-old rule that requires wholesalers and exchanges to publish monthly data about the quality of stock pricing they provide for investors. Among other proposed changes, the rule would be expanded to apply to brokerages with more than 100,000 customers. That means firms such as Robinhood Markets Inc. and Charles Schwab Corp. would be required to produce such detailed reports on execution quality for the first time.

The proposals will be open to public comment until at least March 31 before the agency can decide whether to finalize them.

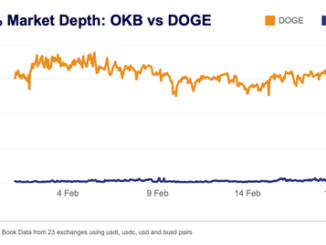

Finally, we note that currently about 40% of daily U.S. equities trading volume takes place off exchanges, much of it in the private retail-trading platforms run by Citadel and Virtu, and the latter is being sold…

If adopted, the rule would likely take effect in the first half of 2023.

Cue the massive lobbying effort.

Loading…