There is a lot to unpack today, but if you want to make money, Silver, and Nat Gas are at the top of the list. The JP Morgan story with their silver problem is a wild ride for silver miners, and if you are looking to make some money, I show you the tools I am using. I do not give investment advice, just show you the tools and market information. Check with your CPA or certified investment professional.

1. The potential natural gas shortage in Europe and its impact on the silver markets. Stu discusses how natural gas shortages could lead to rationing and impact energy-intensive silver refining processes in Europe. Some forecasters say $420 for Silver in the next 90 days is realistic. It makes sense that JP Morgan moved its trading group to Singapore, and it was at a crossroads: either default or buckle down and buy everything they were short.

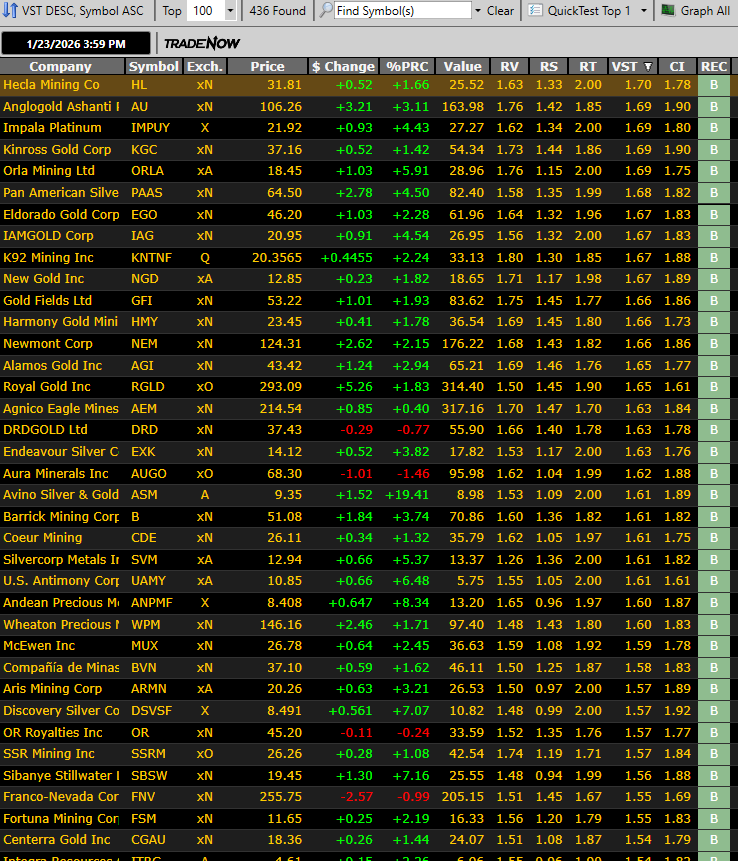

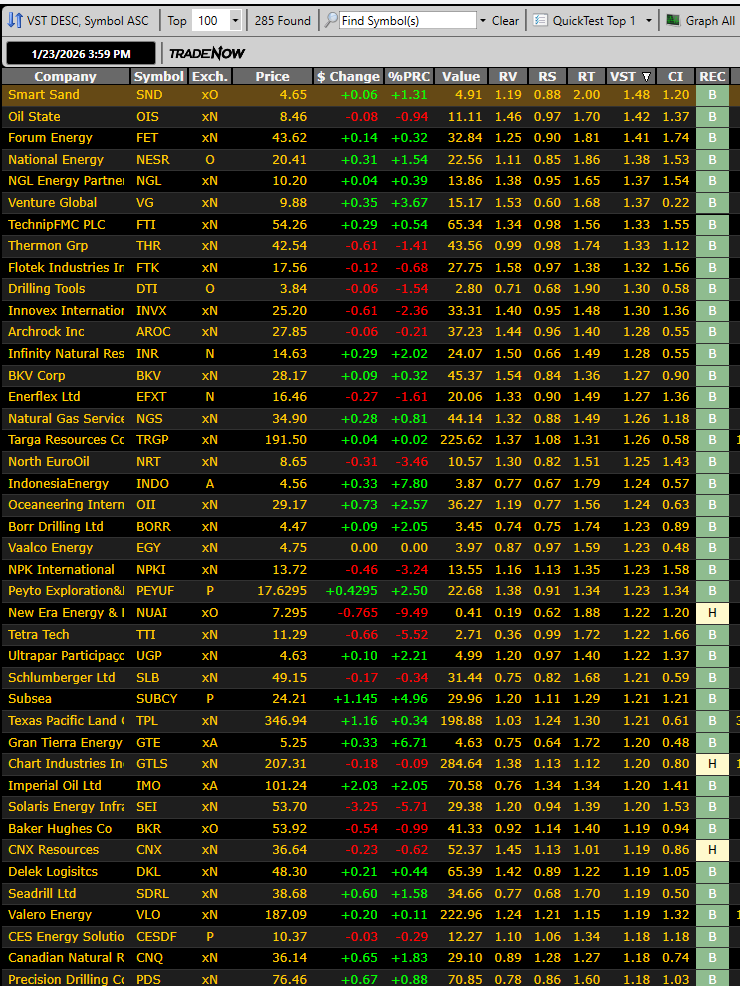

2. The performance and outlook of various mining and petroleum stocks, including Helca Mining, Coeur Mining, Pan American Silver, and Exxon. The host analyzes the current stock prices, valuations, and earnings of these companies.

3. The potential impact on Canada if it signs a trade deal with China, and the threat of a 100% tariff by President Trump on Canadian products. Stu discusses the economic consequences this could have for Canada. There could be a 4% drop in GDP and the loss of hundreds of thousands of jobs.

4. The decision by Shell to shutter or divest around 1,000 retail gas stations in the US, with a significant impact felt in California. The host is critical of California Governor Gavin Newsom’s energy policies.

5. The use of retired military engines for energy generation, which the host finds to be a promising idea.A great way to bridge the gap of demand for new natural gas turbines and get power to data centers behind the meter.

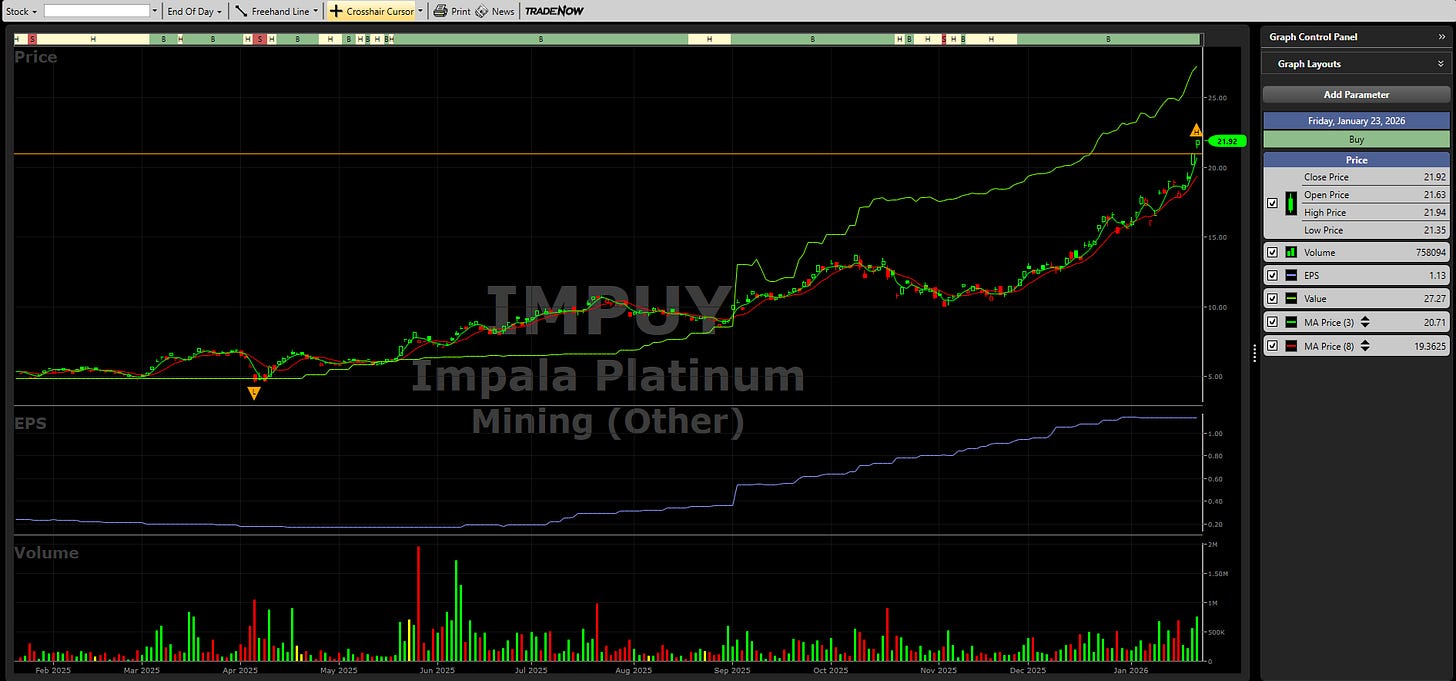

6. The performance of the overall stock market, with the Dow Jones down but the NASDAQ and S&P 500 up on the previous Friday. I do a quick run-through of some stock charts; let me know what you want to see in the future.

Time Stamps

01:07 JP Morgan and silver crisis to $420 – how to look at making money

03:50 Storm Fern rolls through, and how is the US Grid being powered

06:27 China signs a deal with Canada, and it may cost hundreds of thousands of jobs

09:13 Gavin Newsom steps in it again after Davos, Shell to shut down 1,100 gas stations

10:58 250 Actions the Trump adminstration has taken to ensure grid safety and lower prices

11:52 Sonsor Reese Energy Consulting

13:30 VectorVest Stock review of top stocks and what to look for in making money

We do not give investment advice; rather, we show you the tools and resources we use. Please check with your CPA or certified financial planner.

2.What Powers the U.S. Grid During a Major Storm

3.If China Signs a Deal With Canada, Trump Puts a 100% Tariff on All Products from Canada

4.Gov Newsom Under Fire yet Again as Shell Closes 1,100 Gas Stations, Causing Hardship on Citizens

6.Newsom’s Presidential Ambitions Died in Davos

7.AI and Data Centers Spark Innovation – Like Retired Military Aircraft Engines for Energy

Key Companies Stock Information

Here are the top mining stocks in VectorVest

I am putting a few that I am looking at for my portfolio on the potential Silver Run, as mentioned above. We cannot print the analyst reports that are available through VectorVest, and we highly recommend their subscription if you are investing in the market.

Helca Mining Co (HL) – Buy Rating on VectorVest

Anglogold Ashanti Plc (AU)

Impala Platinum Mining (IMPUY)

Kinross Gold Corp Mining (KGC)

Orla Mining Ltd (ORLA)

Pan American Silver Corp (PAAS)

Oil and Petroleum Companies We are Tracking

CNX Resources is a strong company in the Natural Gas Industry, and I am interviewing their CEO in two weeks.

I will be digging into all of these companies and more as we look at where and which tools are best for investors to consider.

We have some great podcasts rolling out, with Doomberg scheduled again, as I had some questions for him that warranted another podcast.

A shout-out to all of our great grid operators, grid balancing authorities, and oil, gas, and coal employees out there fighting to keep the grid rolling.

Get your CEO on the podcast: https://sandstoneassetmgmt.com/media/

Is oil and gas right for your portfolio? https://sandstoneassetmgmt.com/invest-in-oil-and-gas/

Reese Energy Consulting https://reeseenergyconsulting.com/