By Wolf Richter for WOLF STREET.

The ransomware attack on CDK’s cloud-based dealership management system, which on June 19 had cut off nearly 15,000 dealers from the software that was running every aspect of their operation, wreaked havoc on processing and reporting sales by the end of June. The large publicly traded auto dealers, including AutoNation, warned about it last week. The work had to be done by hand. As of July 2, “substantially all” of the nearly 15,000 dealerships were back on the core system, according to CDK. But by then it was too late, in terms of catching up with processing and reporting to their manufacturers those deliveries that had been made since June 19.

Those deliveries that didn’t make it into Q2, will get picked up in July and Q3. Several automakers made reference in their press releases today to this “industry crisis.”

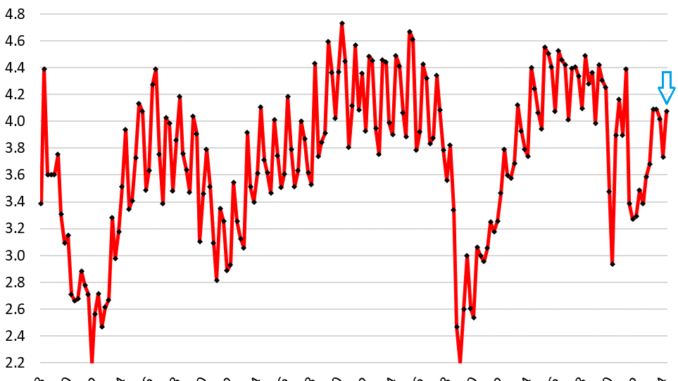

Despite this mayhem at the worst possible moment toward the end of the quarter, total new vehicle sales – deliveries by dealers or automakers to their end-users – rose by 9.1% from Q1, to 4.08 million vehicles, down just 0.4% year-over-year, according to the Bureau of Economic Analysis today.

As the chart shows, new vehicle sales have been a no-growth business since the 1980s, and only price increases and more expensive models kept revenues growing for automakers. But now the opposite is happening, after the huge price spikes in 2021 and 2022: New vehicle prices have started to edge down as automakers and dealers are piling on incentives and discounts.

Average incentives per vehicle sold rose 51% year-over-year to $2,625, or 5.3% of MSRP, according to J.D. Power estimates.

But automakers and dealers are still slow to react to this market, and to the large-scale build in inventories, and they’re letting go of their big-fat pandemic-era profit margins only very slowly. During periods in 2019, as inventories were also piling up, incentives ran over 10% of MSRP.

The average transaction price – including all incentives, discounts, and odious addendum stickers – fell 3% year-over-year to $44,857 in June, according to J.D. Power, on rising incentives by manufacturers, declining gross profit margins by dealers, and increased inventories of lower-priced vehicles that automakers had deprioritized during the era of shortages, in favor of high-dollar vehicles.

The ATP had spiked by 36% during the pandemic, from $34,900 in December 2019 to $47,300 in December 2022. Since that peak, the ATP has dropped by 5.2%. New vehicle prices are sticky on the way down, as everyone in the industry is trying to keep them from going down, while still maintaining sales momentum.

But the erstwhile shortage of vehicles has turned into what for some brands is a full-blown glut, and the vehicles must be sold and deals must be made, and to do that, the price spike is finally getting whittled down – but not nearly as fast as used vehicle prices that have dropped in a historic manner.

The biggest automakers in the US in Q2.

General Motors, #1: Sales of all its brands in the US rose 0.6% year-over-year, to 696,086 vehicles in Q2. All the growth was in EVs, whose sales surged by 40% year-over-year to 21,930 vehicles. Sales of vehicles with internal combustion engines (ICE) fell 0.3%:

GM killed its long-running EV, the Bolt and Bolt EUV, at the end of last year, and Bolt sales have become a trickle. But it has a slew of new EV models now on the market, including a full-size truck, though ramping up production of models with all-new powertrains and platforms is tough, and the numbers are still painfully small, but they’re coming up. GM is struggling with the problems every automaker has run into in setting up EV supply chains, from Tesla on down, and like all of them, has been dogged by quality issues of early production models.

Toyota, #2: Sales of Toyota and Lexus brands combined in the US rose 9.2% year-over-year in Q2, to 621,549 vehicles.

EV sales, staring to: Sales of its pure EVs multiplied by four to 11,607 vehicles.

Ford, #3: Sales by Ford and Lincoln brands rose 0.8% year-over-year in Q2 to 536,050.

The sales growth was all in EVs (+61% yoy), while sales of vehicles with internal combustion engines (ICE) fell (-0.9% yoy), and sales of ICE vehicles without hybrid powertrains fell 5.0% (yoy).

Hybrids are ICE vehicles with an auxiliary electric drive as part of the powertrain. They’re more efficient, but usually somewhat more expensive, than the equivalent non-hybrid ICE model. Plug-in hybrids have larger batteries and more powerful electric motors than regular hybrids, but still have a gasoline engine. Most of the hybrids sold are regular hybrids.

Ford offers hybrid powertrain options on many of its models, including its F-150 pickup, and they’re popular. Hybrid sales are now eating into non-hybrid ICE sales which dropped 5% year-over-year:

Hyundai-Kia, #4: Hyundai is the parent company of Kia, with Hyundai holding a 33.9% stake in Kia, and Kia holding stakes in Hyundai subsidiaries. And they share vehicle platforms. They report US sales separately, but for our purposes, we look at them as one automaker with two brands.

Combined sales edged up 0.2% year-over-year in Q2 to 421,558 vehicles (Hyundai +2.2%, Kia -1.6%).

EV sales are hot: Hyundai EV sales jumped 15% year-over-year in Q2; Kia’s EV sales in Q2 exceeded 15,000 vehicles, it said without disclosing further details, and in the first half soared by 112% to 29,392 vehicles.

In its press release, Hyundai made reference to the CDK fiasco: “Once again in the face of yet another industry crisis the Hyundai dealers showed their resiliency by closing Q2 with a 2.2% increase in total sales.”

Honda, #5: sales rose 2.7% in Q2 year-over-year, to 356,457 units, “despite the software cyberattack impacting auto dealers nationwide,” it said in its press release.

Stellantis (FCA) #6: FCA sales plunged 21% year-over-year in Q2, to 344,993 vehicles. It dropped to the #6 spot for the first time ever, behind Honda, from the #5 spot it still had teetered on last year. And of course, they’re no EVs here.

Ram, Jeep, and Dodge dealers are sitting on 150 days’ supply, the worst of any brands, and Chrysler dealers on 140 days’ supply. Dropping sales and a glut of inventory call for all-out huge profit-margin-gobbling incentives and dealer discounts to move the vehicles. We’re still waiting if they’re going to get the message someday.

Nissan, #7: Sales of its brands Nissan and Infiniti combined fell 3.1% in Q2 year-over-year, to 236,721 vehicles.

Sales of its all-electric Ariya crossover jumped by 123% to 5,203 units. At least something is growing.

Tesla doesn’t disclose US sales. It only discloses global sales. For Q2, it reported 443,956 deliveries globally, up 14.8% from its extra-gloomy Q1 deliveries but still down 4.8% year-over-year. Tesla reports its Model S, Model X, and Cybertruck under the category, “Other.” It sold 21,551 of “other.” And it sold 422,405 Model Y and Model 3. In the US, Model Y was again the #2 bestseller in Q1 by registrations, behind only Toyota’s RAV4.

Because there was some confusing reporting in the media of Tesla’s deliveries, we’ll just post our chart here, though it doesn’t really fit because those are global sales, and we’re discussing US sales:

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

Take the Survey at https://survey.energynewsbeat.com/