The North American oil and gas exploration and production sector is gaining more investment dollars at the expense of pipeline operators as drillers substantially improve free cash flow and debt reduction, according to industry experts.

Midstream companies over the last few years have significantly streamlined their business structures to eliminate complicated features like incentive distribution rights, while guaranteed revenues from long-term, take-or-pay contracts shielded them from the tidal wave of default that producers faced as crude oil prices tanked in 2020. As drillers pivot to more conservative capital allocation strategies and their consolidation outpaces the pipeline universe, however, exploration and production companies are experiencing a rare advantage.

“Growing dividends/distributions has little place at the capital allocation table for 2022 as [midstream] yields remain elevated … and debt loads are still above investor targets,” analysts at energy investment bank Tudor Pickering Holt & Co. told clients Sept. 27. “Unlike prior cycles, midstream is not the only energy game in town for income investors, and a frequent refrain among clients is, ‘Why should I bother with midstream when I can get similar (or higher) yields and lower leverage with upstream?'”

Pure-play shale gas drillers in particular have recently signaled they will not spend money on growth, despite current higher commodity prices and free cash flow that are allowing them to pay down debt and setting up returns to shareholders in 2022. Permian Basin producers that supply oil and associated gas have also committed to similar measures, with ConocoPhillips set on “creating a massive free cash flow machine” after buying Concho Resources Inc.

Midstream corporate M&A, meanwhile, is happening much more slowly. Energy Transfer LP announced plans to buy Enable Midstream Partners earlier in 2021, and Inter Pipeline Ltd. shareholders are expected to approve a take-private offer from Brookfield Infrastructure Partners LP at the end of October. But CBRE Clarion Securities portfolio manager Hinds Howard said in an interview that the process of reaching a critical mass of companies remains a “slog.”

“The process of consolidation, rationalization and privatization that many of us have seen as necessary has just taken a very long time,” Howard explained in an email. “Unless the companies sell off quite a bit from where they trade today, I would not expect M&A to be done at huge premiums that would generate tons of enthusiasm for midstream.”

According to Sanford C. Bernstein & Co. LLC, the gap between companies with market capitalizations above $10 billion, and a lot of smaller C-corps and master limited partnerships that “generalists don’t really touch,” is growing even without further consolidation. For master limited partnerships of any size, the disadvantage is starker as fund flows continue to decrease.

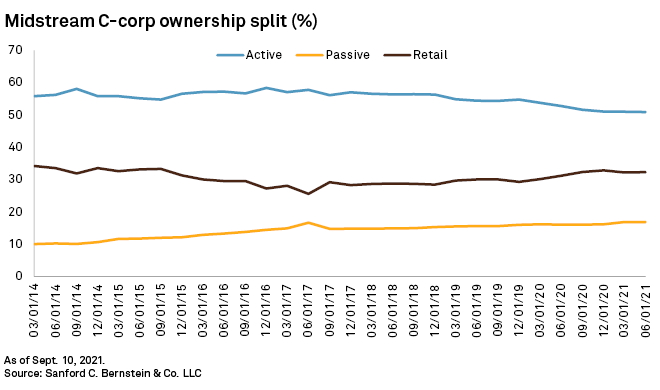

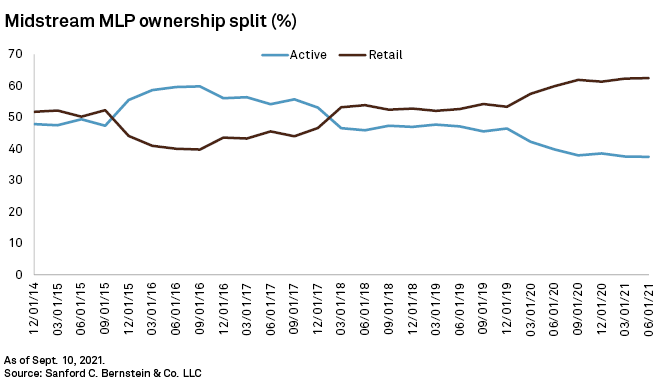

“We believe there is at least a one-turn penalty for being [a master limited partnership], more for the larger ones,” Bernstein analysts told clients Sept. 10. “Passive investment has been growing for C-corps and is now 17%. There is effectively no passive investment in [master limited partnerships], and active managers have been fleeing the midstream space.”

Because the pool of master limited partnership investors has plummeted, they continued, “flows are just moving between names (but nothing ever seems to move up).”

In addition, midstream firms that remain beholden to larger integrated parent companies, like BP PLC’s BP Midstream Partners LP, are problematic for potential and existing stockholders.

“Some of the ones that were spun out … the sponsors own 80% to 90% of them, and there’s no trading volume,” Miller/Howard Investments Inc. portfolio manager John Cusick explained in an interview. “How would we get in it without moving the market, or how would we get out of it if something happens?”

In this environment, Tudor Pickering Holt noted, the pipeline sector is also forced to play catch-up when it comes to dividends.

“While midstream base dividend yields remain highly competitive, upstream [the free cash flow to enterprise value ratio] in the mid-teens versus midstream in the mid-single digits means a significantly greater portion of FCF is required to generate similar payouts,” the bank said.

As the North American midstream sector’s great pipeline build-out cycle winds down, LNG is the fossil fuel poised to have the biggest earnings advantage given that revenues are “now driven by the ups and downs of U.S. production versus their choices around capex spend, building and contracting customers,” Bernstein wrote in a July report.

Cheniere Energy Inc., North America’s biggest LNG exporter, should be able to attract outside investor interest after checking “all four boxes” of cutting debt, introducing a dividend, resuming stock repurchases and contributing organic growth when it provided a capital allocation update Sept. 7, according to Raymond James & Associates Inc.

In the near term, however, a “terribly destabilizing” rise in global gas prices is adding to challenges that developers have faced in building sufficient commercial support and obtaining financing for new liquefaction projects as buyers hesitate to commit to long-term contracts.