In a landscape dominated by headlines about renewable energy and the push toward net zero emissions, a new report from Wood Mackenzie delivers a sobering reminder: global oil demand is far from fading. According to the consultancy’s Energy Transition Outlook 2025-2026, released in late October 2025, oil demand won’t peak until 2032—two years later than previously forecasted. This projection places the high point at 108 million barrels per day (mb/d), driven by resilient demand in transportation and petrochemicals, even as electric vehicle (EV) adoption lags in key markets like the United States and Europe.

The report underscores how fossil fuels remain cost-competitive and embedded in global energy systems, satisfying about 80% of primary energy needs despite trillions invested in alternatives.

This outlook aligns with broader trends showing the energy transition stalling. Challenges such as weather-dependent renewables, high backup costs, and geopolitical tensions have kept hydrocarbons central to energy security. Coal demand, for instance, hit record highs in 2024 and could break them again in 2025, highlighting the difficulty of displacing fossils entirely.

Wood Mackenzie warns that achieving net zero by 2050 is unattainable without massive annual investments of $4.3 trillion through 2060—up 30% from current levels—to overhaul power, grids, and new technologies. And the global markets can not support the trillions wasted on “green energy”.

U.S. Oil Demand: Steady Growth Amid SPR Refilling Efforts

In the United States, oil demand is expected to remain robust, with forecasts showing consumption rising to 20.4 mb/d in 2025 from 20.3 mb/d in 2024.

The U.S. Energy Information Administration (EIA) anticipates global oil demand growth slowing to 900,000 barrels per day (b/d) in 2025, but the U.S. will contribute through the industrial and transport sectors.

Sluggish EV sales, as noted in the Wood Mackenzie report, play a role in delaying the peak.

A key factor is the refilling of the Strategic Petroleum Reserve (SPR), depleted under the previous administration to combat price spikes. The Trump administration has begun modest purchases, authorizing 1 million barrels in October 2025 for delivery by early 2026, using $171 million in funds.

Energy Secretary Chris Wright estimates full replenishment could cost $20 billion and take years, aiming to restore the SPR to 727 million barrels from its current ~395 million.

However, maintenance delays have pushed some deliveries to late 2025, and no imminent large-scale plans are in place.

This effort could add upward pressure on prices, but record U.S. production (13.37 mb/d in 2025) provides a buffer.

Asia’s Powerhouse Demand: China, India, and Beyond

Asia remains the epicenter of oil demand growth, with India poised to lead. The EIA forecasts India’s consumption rising by 330,000 b/d in 2025, driven by transport and cooking fuels, accounting for ~25% of global growth.

OPEC sees even stronger expansion: 3.4% in 2025 to 5.74 mb/d, doubling China’s pace.

By 2030, India’s demand could hit 6.6-6.7 mb/d, fueled by urbanization and petrochemicals.

S&P Global projects India leading global demand amid renewable pushes, with refining capacity growing significantly.

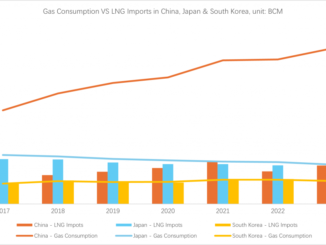

China’s story is more mixed. Demand growth slows due to EVs and LNG trucks, with peaks projected as early as 2025 at ~770 million tons (or 16.9 mb/d by 2027 per IEA).

Sinopec forecasts a 2027 peak at 800 million tons, with gasoline declining 2.4% in 2025.

Imports dropped in early 2025, signaling a plateau.

Excluding China and India, Asia’s demand (e.g., Southeast Asia) grows steadily but slower, adding ~3 mb/d by 2030 per IEA, led by petrochemicals.

Overall, non-OECD Asia (ex-China) added 2.5 mb/d from 2013-2023, with potential for more.

|

Region

|

2025 Demand Forecast (mb/d)

|

Projected Peak/Growth to 2032

|

|---|---|---|

|

US

|

20.4

|

Steady rise, no near-term peak

|

|

China

|

~16-17

|

Peak 2025-2027, then decline

|

|

India

|

5.74

|

+3.4% in 2025, leading global growth

|

|

Rest of Asia

|

Varies (e.g., Southeast growth)

|

+~3 mb/d by 2030

|

Europe’s Decline: UK and EU Grapple with Net Zero and Deindustrialization

In contrast, the UK and EU face accelerating oil demand declines tied to Net Zero policies and deindustrialization. The UK’s oil production is projected to drop 89% by 2050 from 2024 levels, with demand falling ~80% due to electrification and efficiency gains.

Dependency on imports rises to 52% by 2050.

Critics argue rushed transitions echo 1980s coal/steel closures, risking job losses without adequate support.

Gas boilers, heating 85% of homes, persist until at least 2032 despite 2025 bans in new builds.

The EU sees similar trends: oil consumption projected to decline across scenarios from 2025-2050, driven by EVs, efficiency, and policy shifts.

Net Zero requires phasing out fossils, but suppliers face revenue losses, risking instability without equitable transitions.

Wood Mackenzie notes Europe’s petrochemical capacity shrinking as Asia expands.

Can Growth Areas Outperform Europe’s Decline?

Absolutely. While UK/EU demand shrinks due to policy-driven deindustrialization, U.S. stability and Asia’s surge—led by India’s 1 mb/d growth by 2030—more than offset it.

Global demand rises to 103.9 mb/d in 2025, per IEA, with emerging Asia dominating.

This “energy addition” rather than pure transition—where renewables supplement rather than replace fossils—ensures oil’s longevity.

As the oilprice.com article notes, the transition’s stall keeps oil demand climbing through 2032.

The Substack piece echoes this, critiquing Net Zero as wasteful and emphasizing coal/natural gas growth in Asia, underscoring hydrocarbons’ role in energy security.

For investors and policymakers, this means oil isn’t “done yet”—it’s evolving, with Asia and the U.S. driving the narrative while Europe adapts to a lower-demand future.

Got Questions on investing in oil and gas? Or do you have a Tax Burden in 2025?

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack