With earnings season in full swing, big players like Exxon, Halliburton and Baker Hughes have posted strong results despite lower crude prices in Q1.

Friday, April 28, 2023

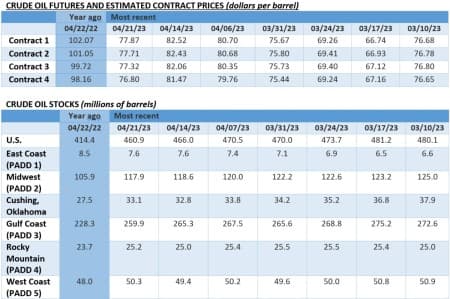

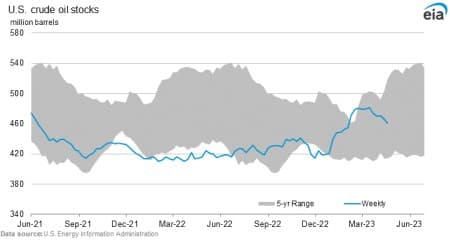

Oil prices have stabilized around $78 per barrel for ICE Brent and $74 per barrel for WTI after Wednesday’s double whammy of bad macroeconomic data. The decline in US capital goods spending confirmed fears that economic growth is slowing down in the United States, whilst refinery margins continued their descent this week as downstream players are finding it ever harder to stay profitable. As such, oil is set for its sixth straight monthly loss, despite the OPEC+ production cuts.

OPEC Goes Against IEA. OPEC Secretary General Haitham al-Ghais warned the International Energy Agency (IEA) to be very careful about discouraging investment into oil and gas, arguing that advocating for such measures and finger-pointing at oil producers will lead to increased volatility in the future. [if !supportLineBreakNewLine][endif]

Ship Insurers Warn of Russia’s Dark Fleet. Top executives from the shipping industry have warned that the oil price cap has made insurers even more wary of running afoul of US or EU sanctions and that depriving the increasing fleet of shadow tankers of insurance raises navigation safety risks.

Suncor Doubles Down on Oil Sands. French oil major TotalEnergies (NYSE:TTE) sold its carbon-heavy Canadian oil sands assets to Suncor Energy (TSO:SU) for $4.1 billion with potential additional payments up to $450 million, equivalent to 135,000 b/d of net bitumen production capacity and 2.1 Bbbls of 2P reserves.

Pioneer CEO Retirement Rekindles Exxon Takeover Talk. Scott Sheffield, the long-time CEO of US shale producer Pioneer Natural Resources (NYSE:PXD) announced he would retire at the end of this year, fuelling speculation that ExxonMobil’s (NYSE:XOM) reported $52 billion takeover might be much closer than thought.

Iran Seizes Oil Tanker Again. A Turkish-owned and operated tanker carrying Kuwaiti crude for Chevron in the US has been detained by the Iranian Navy after reportedly hitting another Iranian vessel in the Gulf of Oman, drawing the ire of the US which accused Tehran of interfering with navigational rights.

German Chemicals Major Keeps Options Open. German chemicals conglomerate BASF (ETR:BAS) is seeking to exit oil producer Wintershall Dea, preferably by means of a stock market listing though not ruling out an outright sale, after a massive $7.2 billion writedown in its shareholding there in 2022.

Glencore Is on a Buying Spree. Maintaining the suspense around its takeover of Teck Resources, mining and trading major Glencore (LON:GLEN) has in the meantime bought a 30% stake in Brazil’s alumina refinery Alunorte and a 5% stake in bauxite producer MRNS for $700 million, adding to its base metal portfolio.Russia Opens Up China Exports for Competition. Nearing in on the final investment decision for the 55 bcm Power of Siberia 2 gas pipeline, the Russian government is considering breaking Gazprom’s (MCX:GAZP) monopoly on pipeline exports and allow Rosneft and smaller producers to send gas to China, too.

Australia Extends Price Cap Into 2025. Australia’s government proposed to extend a price cap on natural gas until at least mid-2025, however softened its stance by allowing some pricing exceptions if major producers agree on domestic supply commitments into the country’s east coast hubs.

Stabroek Block Sees Yet Another Discovery. Whilst disclosing its Q1 results, US oil producer Hess Corp (NYSE:HES) announced that it made another offshore discovery in Guyana’s prolific Stabroek block alongside project partner ExxonMobil, taking the tally of hydrocarbon finds above 30.

Indonesian Supply Depresses Nickel. Global nickel markets are in for a sizable supply glut as booming Indonesian production, up 44% year-on-year so far, continues to outpace demand growth – the latter is still increasing despite recessionary headwinds, but only at an annualized 6% this year.

Quebec Might Run Out of Power. Canada’s Quebec province has for years lobbied US customers to buy its plentiful hydro power, leading to new projects such as the $6 billion Champlain Hudson Power Express, a transmission line to NY, however its massive commitments have created a 100 TWh shortfall towards local consumers.

Weak Graphite Demand a Harbinger of EV Trends. The world’s largest graphite miner Syrah Resources (ASX:SYR) said it would lower production from its main producing assets in Mozambique until demand improves, with growth hindered by a volatile anode market in China and high inventories.

China Wants More Chemicals Out of Coal. China’s oil major Sinopec (SHA:600028) has landed a $4.4 billion coal mining deal in the Inner Mongolia region of the country, seeking to use the coal for a 800,000-tonne per year coal-to-olefins refinery, expanding its petrochemical production portfolio.