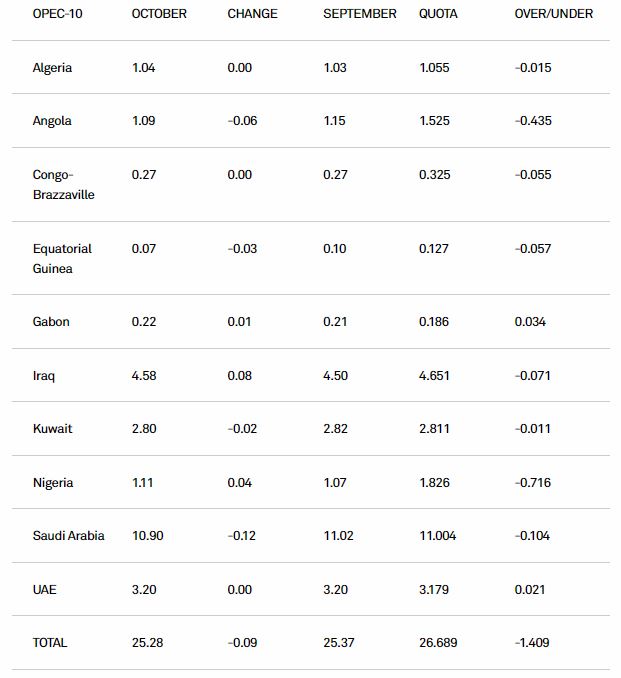

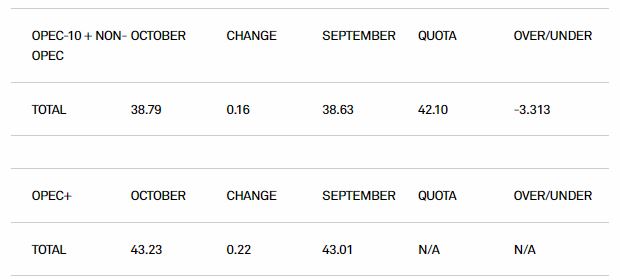

The OPEC+ oil producer alliance, which had pledged to cut output by 100,000 b/d in October, instead hiked production by 220,000 b/d as several members recovered some barrels lost by outages and maintenance, the latest Platts survey by S&P Global Commodity Insights showed.

Sharp output gains in Kazakhstan, Russia and Iraq were offset by losses in Saudi Arabia and Angola, as the 22-country coalition saw its output soar to 43.23 million b/d, its highest level in two-and-a-half-years. Only five of the 22 countries involved in the coalition actually reduced production last month, the survey found.

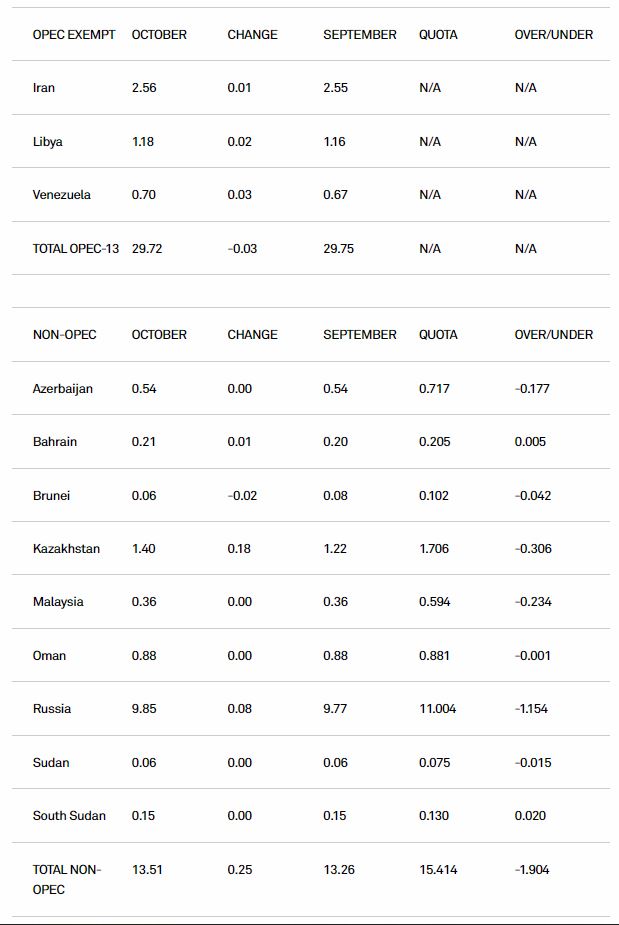

OPEC’s 13 countries produced 29.72 million b/d, a fall of 30,000 b/d from September, while Russia and eight other allies pumped 13.51 million b/d, up 250,000 b/d.

Despite the monthly increase, the gap between the group’s quotas and actual production remained a sizable 3.31 million b/d in October, according to the survey. However, this is a slight improvement compared with September, when the quota shortfall was as high as 3.57 million b/d. Iran, Libya and Venezuela are exempt from quotas.

OPEC+ has changed its production policies in recent months, leading to a rift between oil producers and some key consumers.

On Oct. 5, OPEC+ agreed to slash production quotas by 2 million b/d from November, saying it was a “technical decision” aimed at averting the impact of a potential global recession, even as the EU is set to begin an embargo on Russian crude imports on Dec. 5.

But this move sparked outrage from the US administration, accusing the alliance of endangering the world economy and helping finance Russia’s war in Ukraine.

Divergent output paths

The two biggest producers of the alliance, Saudi Arabia and Russia, have seen their output levels diverge substantially since the latter invaded Ukraine in late-February.

Saudi Arabia, which has been the largest producer in the bloc since February 2022, pumped 10.90 million b/d last month.

The kingdom reduced exports and also drew steadily from its crude inventories, survey panelists said.

This comes as the OPEC kingpin gears up to embark on steeper production cuts after months of increasing output, as the Saudi-US oil spat continues.

Saudi energy minister Prince Abdulaziz bin Salman recently accused the US of using its releases from strategic petroleum reserves “as a mechanism to manipulate markets.”

Russian crude output recovered to a seven-month high last month, as it prepares for an escalation in EU sanctions from December. It pumped 9.85 million b/d in October, up 80,000 b/d, boosted by higher crude exports and refining runs.

But it remains the biggest laggard in terms of its quota, producing about 1.15 million b/d below target, and this gap could widen in the coming months.

Russian oil supply disruptions are seen hitting 1.5 million b/d in February, according to S&P Global, due to the impact of the EU sanctions and price caps that are set to be enforced.

Recovery time

Non-OPEC Kazakhstan posted the biggest increase in the month, with output recovering by 180,000 b/d to 1.40 million b/d, according to the survey.

Maintenance at the country’s largest field, Tengiz, is fully complete, while output at Kashagan is now pumping at over half of its capacity, after a series of operational issues in the past few months.

Iraq managed an 80,000 b/d rise to hit 4.58 million b/d, as exports from the federal region surged to multi-year highs. Iraqi crude exports are perilously close to full capacity at its southern terminals, with space at storage facilities limited, restricting more production upside.

Nigeria posted its first monthly production increase in 2022, after months of sharp declines as it remains weighed down by pipeline sabotage, theft, and terminal outages.

Crude output rose 40,000 b/d to 1.11 million b/d as key grade Forcados returned after a hiatus of three months. Brass River and Bonny Light exports are likely to resume this month, which could push Nigeria to return as Africa’s largest oil producer.

Meanwhile, Libyan crude production rose to a 15-month high of 1.18 million b/d in October, up 20,000 b/d, as a deal which ended an oil blockade in July remains in place.

Among the OPEC+ members that saw production fall, Angola’s output dropped to 1.09 million b/d in October due to technical issues at some fields located in Block 17, according to the survey.

Deeper cuts

Looking ahead, oil traders will be keen to see how the OPEC+ alliance’s decision to cut November targets by 2 million b/d plays out as several of its members, including Russia, are producing vastly under their quotas.

Many analysts believe the actual amount of oil being removed from the market will be much smaller, somewhere between 800,000 b/d and 1 million b/d, most of it borne by Saudi Arabia and the UAE.

These production curbs would be the largest since the alliance instituted a historic 9.7 million b/d cut to rescue prices from the pandemic crash in May 2020 that was gradually unwound through September 2022.

Despite the alliance saying this move had nothing to do with prices and was more about oil demand concerns, oil prices have strengthened sharply in the past few weeks.

Platts assessed the Dated Brent physical crude price at $98.73/b Nov. 4, up 17% from $84.63/b Sept. 26, when rumors of an OPEC+ cut began swirling. But the benchmark is still down from a June 14 peak of $132.06/b, amid market concerns over a widespread recession.

The Platts survey figures measure wellhead production, and are compiled using information from oil industry officials, traders, and analysts, as well as reviewing proprietary shipping, satellite, and inventory data.

OPEC+ production (million b/d)