New Delhi: It is safe to say that the oil markets are on the way to recovery, despite still-widespread Covid-19 infections, notably in India, Europe and the US, after suffering what has been its worst year ever.

Prices, after all, have largely recovered to pre-pandemic levels, comfortably sitting above $60/bbl, currently with the front-month Brent Futures contract at $66-67/bbl, a far cry from post-pandemic lows seen about a year ago when it fell to 20-year lows of under $20/bbl, while its US counterpart, WTI Futures, fell into negative territory for the first time ever.

The recovery is largely led by two factors – recovering demand, particularly among the main crude importers in Asia, such as China, India, South Korea and Japan; amid controlled supply, managed by the OPEC+ group, led by Saudi Arabia and Russia.

Supply – Cautiously Managed

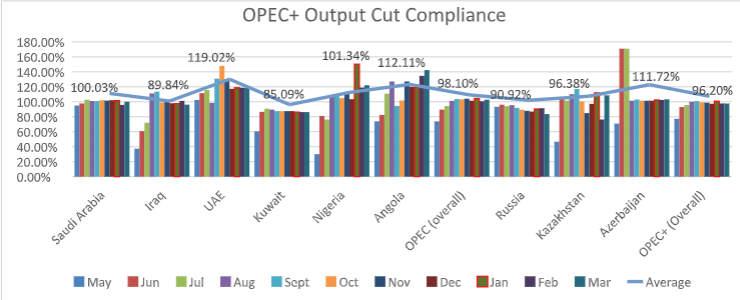

The OPEC+ group, which slashed their collective output from last May and has managed their production since, with oil kingpin Saudi Arabia leading the way, even making voluntary cuts on top of what the grouping has already committed.

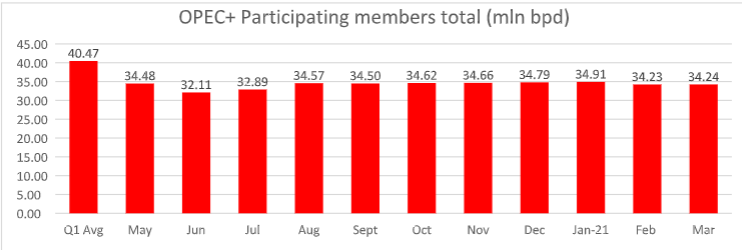

By March, the group’s collective output stood at 34.24 million barrels-per-day (bpd), comprising 21.04 million bpd from participating members of the OPEC alliance and 13.2 million bpd from other major non-OPEC producers such as Russia, Kazakhstan and Azerbaijan, well below the pre-pandemic Q1 2020 average of 40.5 million bpd.

Output across the 11 months since the cuts have been imposed averaged at 34.17 million bpd, hitting a low of 32.11 million bpd in June and rebounded above 34 million bpd from last August.

The Saudis, in particular, have been a prime mover of the output-cut regime, volunteering additional cuts of 1 million bpd for a 3-month period, February-April, bringing their average production for the first two months of the period to 8.19 million bpd, down from an average of around 9 million bpd since August and from the pre-pandemic Q1 average of 9.77 million bpd.

The least compliant are Iraq, Kuwait and Russia, at 85-90% adherence. The Russians, in particular, raised output dramatically in March, to a post-pandemic high of 9.5 million bpd, up from the May-February average of 9.06 million bpd, though still well under their Q1 average of 10.56 million bpd.

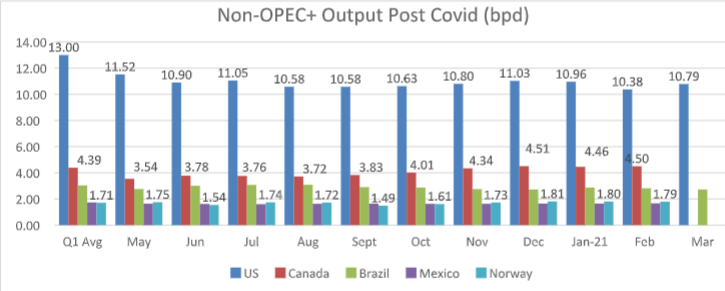

Other major oil producers that are not a party to the output-cut agreement, such as the US, Canada, Brazil, Mexico and Norway, also voluntarily reduced their production, though not quite as drastic as the OPEC+ members.

Output for the group averaged at 21.11 million bpd from May 2020 to February 2021, holding steady at these levels thru the 11-month period, down from their pre-pandemic Q1 average of 23.87 million bpd.

Output from Canada, the second-largest producer in the group, rose above pre-pandemic levels of 4.39 million bpd seen in Q1, averaging at 4.48 million bpd December-January, with Norwegian production also following suit, averaging at 1.8 million bpd December-February, above the Q1 average of 1.71 million bpd.

We believe the higher-price environment has already encouraged more output from the non-OPEC+ producers, notably Canada and Norway, though US production has remained fairly steady throughout the post-pandemic period at 10.5-11 million bpd, despite rising rig count, which has steadily increased since July to a post-pandemic high of 344 by Apr 16, up from a low of 172 last August, but still well-below pre-pandemic levels of above 600.

Demand – On the Rise in Asia, but Fragile

The higher-price environment is also driven by improving demand in key buyers in Asia, particularly China, India, South Korea and Japan, with their collective imports of crude hitting a post-pandemic high of 21 million bpd in February, higher than even pre-pandemic levels seen in 2019 at 20.4 million bpd and well-above the 2020 average of 19.95 million bpd.

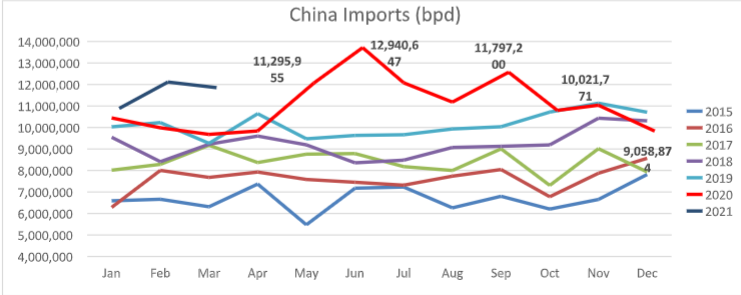

The rebound in demand is led by China, the world’s largest importer, which has recovered from Covid-19 since May 2020, and its crude imports have hit above 2019-average levels of 10.12 million bpd in 8 of the 10 months since, up till March this year, including hitting record-high levels twice last May and June, respectively at 11.3 million bpd and 12.94 million bpd.

Chinese exports for 2021 are expected to average higher than 2020’s record-high year-average of 10.78 million bpd mainly due to additional refining capacities coming online, led by private refiners Zhejiang Rongsheng’s 400,000-bpd of new capacity to its exisitng 400,000-bpd plant and Shenghong’s new 400,000-bpd refinery.

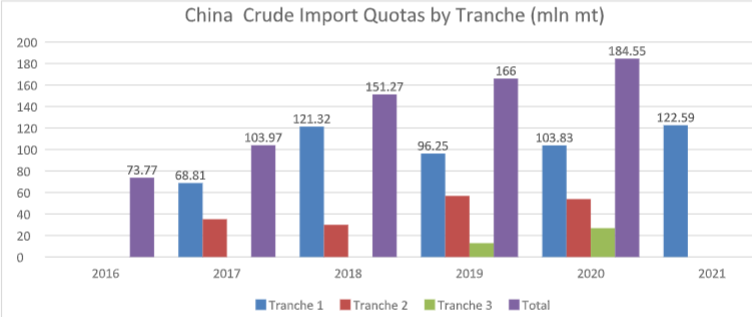

This also reflected by record-high Tranche 1 import quotas given to its private refiners, at 122.59 million mt, well above 2020’s level of 103.83 million mt.

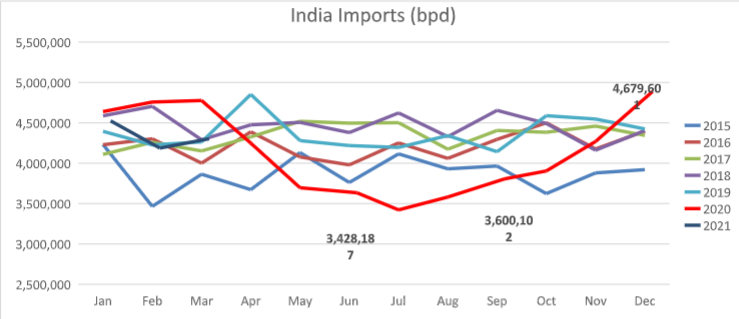

Demand from India, the world’s third-largest importer, has also rebounded from last November, with imports hitting pre-pandemic levels, averaging at 4.33 million bpd for November-March, steady versus the 2019 average of 4.37 million bpd and rebounding from the May-October average of 3.61 million bpd.

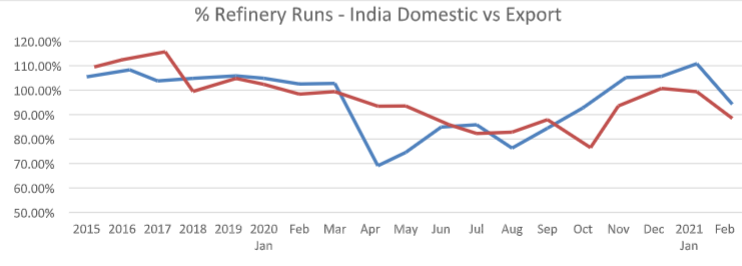

The uptick in runs is led mainly by state-owned refiners producing for the domestic market, which hit above 100% of their 16.27 million mt/year capacity since November, peaking at a post-pandemic high of 107.4% in January, surpassing the 5-year average of 104.3%, and rising strongly from the April-September low of 78.6%.

In contrast, runs from export-oriented refiners remained under their 5-year average levels of 106.3%, hitting a post-pandemic high of 97.3% in December before falling to 85.1% in February.

However, runs for both sets of refiners fell in February, to 90.85% for domestic refiners, with crude imports were at a 4-month low of 4.08 million bpd. We believe this is because of the high retail pump prices prevailing at the time, amid a weak rupee, which curbed demand for transportation fuels.

The government cut pump prices in March, leading to a rebound in crude imports at 4.2 million bpd, according to assessments by Refinitiv Oil Research, but the upside is limited by widespread second-wave Covid-19 infections in the country that is seemingly out of control and sparking record-high daily cases of 350,000 over the past several days, bringing the total number of cases to above 17 million, exceeding Brazil as the world’s no 2 most infected country.

Already, lockdowns have been imposed in the country’s major cities, which will curb fuel demand, but we believe the impact on oil demand will not be as severe as it was last May-September.

Oil demand from South Korea and Japan has remained below pre-pandemic levels up till March, under their respective 2019 average levels of 2.87 million bpd and 3.01 million bpd, though rebounding to post-pandemic highs of 2.55 million bpd for Japan and 2.5 million bpd for South Korea.

Demand is expected to stay at below-average levels for both countries in the near term, mainly due to peak seasonal maintenance up till June as well as still-widespread infections, particularly in Japan, with its government opting not to allow foreign visitors for the Olympics in August.

Conclusion – Not Quite There Yet

While the oil market is certainly on the way to recovery, it is still a long way to pre-pandemic levels, particularly with infections still widespread in Europe, the US and India, and aviation demand still far from normal levels.

Full recovery will depend on how quickly and effectively vaccines are rolled out, and if they are effective against the new strains of Covid-19.

A key factor will be how quickly major suppliers, both OPEC+ and other non-alliance producers, raise output, against the still-fragile demand scenario. We believe the producers will err on the side of caution, as they have shown throughout the post-pandemic period, and move in line with slowly-recovering demand.

Do not rule out further output cuts if the demand scenario worsens, though signs are that the producers want to gradually restore output.

[This piece was authored by Yaw Yan Chong, Director, Refinitiv Oil Research (Asia)]