By Wolf Richter for WOLF STREET.

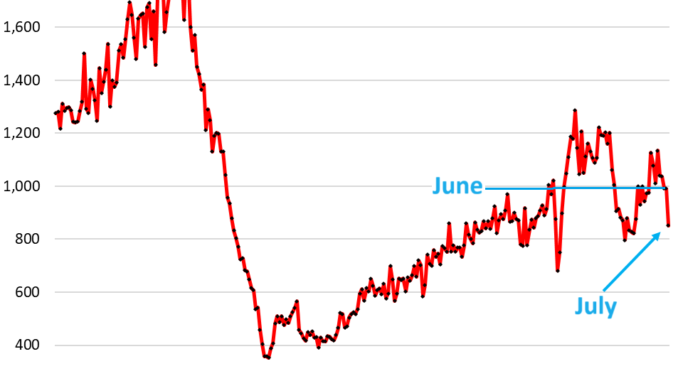

The headlines about residential construction starts this morning were of the-end-is-nigh type: “New-home construction plunges to lowest level since May 2020.” They were triggered by the data from the Census Bureau on construction starts of housing units in July: they dropped 6.8% from June, to a seasonally adjusted annual rate of 1.238 million single-family houses and units in multifamily buildings, the slowest pace since May 2020.

The drop was driven by single-family housing starts that suddenly plunged 14% in July, the biggest month-to-month plunge since lockdown-April 2020, though they’d done pretty well through June. That 14% plunge from June was a huge outlier move. June had been up 6% year-over-year and was well above the pre-pandemic pace, though it was slower than the frenetic pace of 2021 and 2022. Long-term construction planning doesn’t change on a dime like that.

The outlier-move in single-family starts coincided with Hurricane Beryl sweeping across the Gulf Coast in early July, which has shown up in other data, including a sudden spike in initial unemployment claims that had caused some wailing and gnashing of teeth in the rate-cut circus, but that then fell off again, and yesterday dropped to the lowest level in over a month, and were about 10% below a year ago.

So the construction industry in the South was dealing with the bad-weather effects of Hurricane Beryl. And that portion of the plunge in construction starts will bounce back.

But multifamily construction jumped 11.7% in July from June, the second monthly jump in a row, and were up 45% from the March low — though commercial real estate, including multifamily, is in a depression with loans defaulting left and right, and properties selling at huge discounts including at foreclosure sales, which we’ve been wringing our hands over for two years.

With lenders losing oodles of money on their loans, lending has gotten so tight that it became like a noose around the neck of developers. In addition, big projects that take years to plan and get approved were conceived in an era of 3% mortgages, and they may not make economic sense with mortgages at 7%, and lenders don’t want to fund a project that is economically doomed to fail and saddle them with losses. Many multifamily projects are stalled because they cannot get funding.

And yet construction starts jumped for the second month in a row, from the beaten-down pace of the prior months – a sign that they might have bottomed out in the spring.

In March, multifamily construction starts had plunged by 37% from the prior month, and by nearly 50% year-over-year to a seasonally adjusted annual rate of 251,000 units. And that may have been the bottom.

Since March, multifamily construction starts have jumped by 45%, to 363,000 units in July, which was still down 22% year-over-year, but off the bottom – back in the middle of the prepandemic range, and higher than in the years before 2013:

Multifamily had gone through a phenomenal construction boom. In the year 2021, over 473,800 housing units were started, the most since the fading construction boom in 1987. In 2022, multifamily starts jumped to 547,400, the most since 1986. In 2023, 468,600 units were started, with the first half still being strong, but then the CRE depression started invading in the second half. These were huge numbers. And those buildings – condos and rental apartments – are now coming on the market, amid fears of substantial oversupply in some markets (which would be a good thing for renters and condo buyers, but not for developers, landlords, and lenders).

Here is the long view, going back to 1965, of the dramatic multifamily construction booms back in the 1970s and 1980s, and how the boom in 2021-2023 stacked up:

So overall residential construction starts dropped by 6.8% in July from June, to a seasonally adjusted annual rate of 1.238 million, which was down 16% from a year ago, driven by the outlier drop in single-family starts:

What we’re worried about and what we’re not worried about.

We know that residential construction has cooled from the frenetic pace of 2021 and 2022.

Multifamily went through a construction surge that took it to multidecade highs, triggering fears of massive overbuilding as these units are now coming on the market. Nearly all new multifamily projects – condos or rental apartments – are at the higher end because that’s where the money is.

CRE has been in a depression for well over a year, and a year ago, multifamily construction starts showed the beginnings of a massive drop from the frenetic pace in the prior years. And that drop from the boom levels is substantial and has been felt for a year, and will be felt, and it worries us, but it may have bottomed out this spring, by the looks of it.

But the outlier-move in single-family construction in July, triggered by something other than long-term planning, is not on our worry list. Single-family construction has cooled from the frenetic pace in 2021 and 2022. But year-to-date through June, it was decent and well above the prepandemic years, and that’s likely the trend going forward.

Take the Survey at https://survey.energynewsbeat.com/