-

Fed chair to make final remarks before pre-decision blackout

-

IMF meetings will also take center stage in world economy

EMB Publishers Note: Investors are facing tough choices as they look to alternative investments to hedge against monetary policies and inflation. These include investing in energy of all types including renewables and oil. Oil still has a major advantage because of tax breaks.

Jerome Powell may reinforce bets that the Federal Reserve will raise interest rates by a half point next month when he makes final public remarks before the U.S. central bank’s pre-meeting quiet period.

The Fed chair will speak at an event on Thursday and later that day later take part in a panel hosted by the International Monetary Fund, along with European Central Bank President Christine Lagarde and other policy makers. Blackout starts midnight Friday.

Powell has already said that a 50 basis-point increase is possible at the Fed’s May 3-4 meeting. Comments by colleagues since then have hardened expectations they’ll make that move, as officials extend a hawkish pivot to curb the hottest inflation since 1981.

Minutes of their March meeting showed many favored raising rates by a half point and only opted for the more cautious 25 basis point move because of the uncertainty around Russia’s invasion of Ukraine.

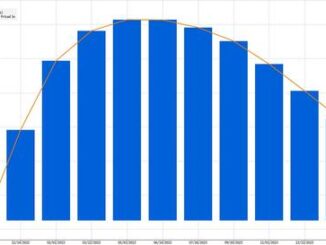

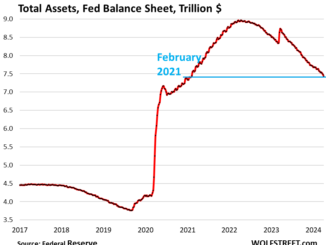

The account showed officials expect to start shrinking their balance sheet by $95 billion a month, or more than $1 trillion a year, and could announce a decision in May. Governor Lael Brainard said April 12 that could mean roll-off as soon as June.

Brainard also said that pricing in financial markets shows investors have gotten the message that officials will move “expeditiously” to lift rates to neutral, or the level that neither speeds up nor slows down the economy. Interest-rate futures imply at least another 200 basis points in tightening of the Fed’s main policy rate from its current 0.25% to 0.5% target range. Officials estimate neutral to lie at about 2.4%

The U.S. economic data calendar is relatively light in the coming week, with reports on March housing starts and sales of previously owned homes taking top billing. They come as mortgage interest rates are on the rise. Other reports include surveys on manufacturing and services.

What Bloomberg Economics Says:

“We expect the the Fed to hike at every meeting for the rest of 2022, but with only one 50-bps move — likely in May.”

–Anna Wong, Yelena Shulyatyeva, Andrew Husby and Eliza Winger, economists. For full analysis, click here

Elsewhere, economic highlights during a curtailed week in much of the world will include Chinese data pointing to the impact of lockdowns, and the IMF and World Bank meetings in Washington. The IMF will release its updated economic outlook on Tuesday, along with a global financial stability report.