Premier Oil Plc, the indebted North Sea driller being swallowed by Chrysaor Holdings Ltd., will re-emerge as the largest independent oil and gas producer among U.K. stocks just as the global crude market roars back.

“The new company will be much better placed than Premier, with a stronger balance sheet enabling it to pursue international growth and commit to a near-term dividend,” James Carmichael, an analyst at Berenberg, said in an email on Tuesday. There’s also a “very strong board that is being put in place.”

Harbour’s president will be Phil Kirk, who founded Chrysaor in 2007 with help from Barclays Plc and a U.S. private equity fund. Chrysaor made its first foray into U.K. waters 10 years later, buying assets from Royal Dutch Shell Plc, and after further acquisitions has become the No. 1 oil and gas producer in Britain.

Premier and Chrysaor said in December that Harbour would be a “highly cash-generative” business, producing more than 200,000 barrels of oil equivalent a day and with “significant” potential for international growth. While Premier’s business is weighted toward the North Sea, it also has assets in Asia and Latin America and has been working to get a project off the ground in the Falklands.

“Harbour Energy will start off with a significant production cash-flow base from its North Sea assets, alongside several upcoming projects to further build out its international portfolio and provide a growth driver,” said Daniel Slater, an analyst at Arden Partners Ltd. “The balance sheet will be in good shape.”

The forthcoming deal completion is timely, with crude recovering from 2020’s historic rout to trade above $65 a barrel in London, the highest in more than a year. As the global demand recovery outpaces the supply response, Brent could rise to $75 in the third quarter, Goldman Sachs Group Inc. said this week.

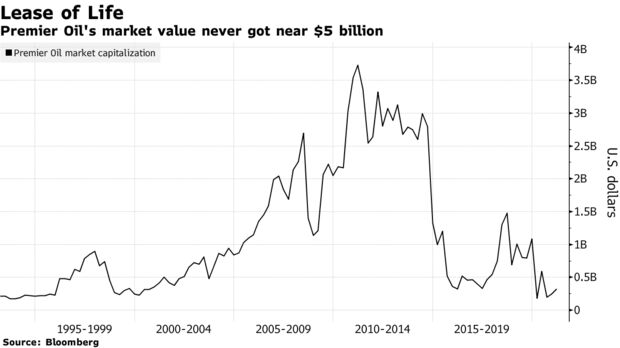

Harbour is expected to boast a market value of more than $5 billion, according to Jefferies, a level never achieved by Premier. Jefferies’ price target of 30 pence a share “rates the stock a true investment peer to Norway E&Ps but with differentiated upside from exposure to international M&A growth,” it said.

Chrysaor shareholders will own 77% of Harbour Energy, with 18% held by Premier’s creditors and only 5% by Premier’s current shareholders.

The new vehicle’s emergence on the U.K. stock market also comes as multiple large oil producers start to scale back spending on fossil fuels in a transition toward low-carbon energy. That means there could be “increasing asset and project choice for a well-funded company if some other operators divert spending into more diverse energy sources,” Arden’s Slater said.

Since last year, there has been little dealmaking in the oil and gas industry as the coronavirus crisis roiled the market. Many closely held explorers and producers paused plans to go public, including North Sea players Wintershall Dea GmbH, Neptune Energy Group Ltd. and Siccar Point Energy Ltd. With oil prices now reviving, and the outlook strengthening, that may change.

“Longer term, if Harbour Energy is able to re-rate, it could encourage other North Sea focused private equity players to take their investments public,” said Nathan Piper, an analyst at Investec. “Harbour Energy is important for rejuvenating investor interest in the U.K. E&P space.”