In a move that could reshape the geopolitical landscape of the Middle East and South Asia, Saudi Arabia and Pakistan have formalized a mutual defence agreement, binding the two nations in a pact that treats an attack on one as an attack on both. Signed on September 17, 2025, in Riyadh, this “comprehensive defensive agreement” encompasses all military means and institutionalizes decades of close cooperation between the Sunni-majority powers.

While the deal stops short of explicitly mentioning nuclear capabilities, it has sparked intense speculation about Pakistan extending its nuclear umbrella to the oil-rich kingdom, especially amid escalating regional tensions and doubts over U.S. security commitments.

For the energy sector, this pact carries profound implications. Saudi Arabia, the world’s largest oil exporter, has long sought to diversify its energy portfolio, including ambitions for a civilian nuclear program. Pakistan’s nuclear expertise—honed since its 1998 tests—could provide Riyadh with an alternative pathway to nuclear technology, bypassing stringent U.S. restrictions on enrichment and reprocessing.

This comes at a time when global oil markets are volatile due to disruptions in the Red Sea from Houthi attacks and broader instability, potentially stabilizing Saudi energy exports through enhanced military deterrence.

However, it also raises concerns about nuclear proliferation in a region already fraught with energy-related conflicts, from Iran’s uranium enrichment to Israel’s undeclared arsenal.

The Pact’s Details and Historical Context

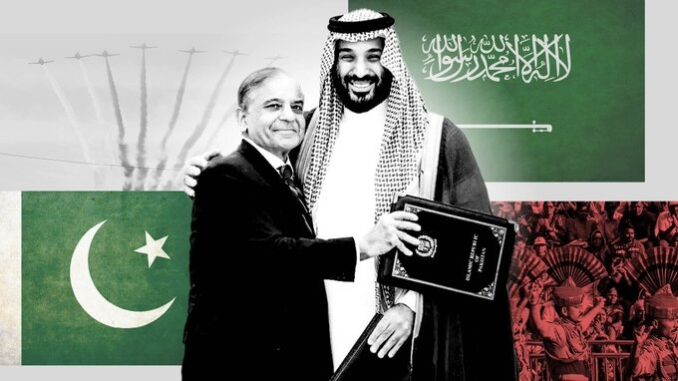

The agreement was announced following a meeting between Saudi Crown Prince Mohammed bin Salman and Pakistani Prime Minister Shehbaz Sharif. A statement from Pakistan’s government emphasized the mutual aggression clause, while a senior Saudi official described it as an evolution of longstanding ties rather than a reaction to specific threats.

Pakistan, the only Muslim-majority nuclear state, maintains the Islamic world’s largest army and has deployed 1,500–2,000 troops in Saudi Arabia for training and support roles. In return, Riyadh has provided economic lifelines, including a $3 billion loan to bolster Pakistan’s reserves.Ties between the two date back to the 1960s, with Saudi funding playing a key role in Pakistan’s nuclear development during the 1980s and 1990s.

Experts note that Saudi petrodollars helped finance Pakistan’s “Islamic bomb,” creating an implicit understanding that Riyadh could call on Islamabad’s arsenal in a crisis.

Recent events, including Israel’s September 9 strikes on Qatar targeting Hamas leaders and a brief Pakistan-India conflict in May, have accelerated this formalization.

Gulf states, increasingly wary of U.S. reliability post these incidents, are hedging their bets.

Energy ties underpin the alliance: Saudi Arabia supplies much of Pakistan’s oil imports, while Pakistan offers manpower and strategic depth. The pact could secure vital shipping lanes for Saudi exports, amid Houthi threats that have already halved trade through the region.

Reports indicate Pakistan has sent 25,000 troops to the Saudi-Yemen border, drawing Houthi warnings and highlighting the energy security stakes.

Middle East Alliances: A Shifting Landscape

The pact arrives amid a broader realignment in Middle East alliances, driven by the Gaza conflict’s spillover, Iran’s nuclear advances, and U.S. strategic retrenchment. Gulf monarchies are diversifying partnerships, moving beyond traditional U.S. umbrellas toward regional and Asian ties.

Israel’s strikes on Qatar have prompted emergency summits and calls for joint Arab defense, though experts dismiss a unified Arab army as a myth due to internal rivalries.

Here’s a high-level overview of key Middle East alliances as of September 2025:

|

Alliance/Bloc

|

Key Members

|

Focus

|

Energy Implications

|

|---|---|---|---|

|

Abraham Accords (U.S.-backed)

|

Israel, UAE, Bahrain, Morocco, Sudan

|

Normalization with Israel; counter-Iran

|

Secures energy corridors like IMEC; diversifies UAE oil routes away from Hormuz.

|

|

Gulf Cooperation Council (GCC)

|

Saudi Arabia, UAE, Qatar, Kuwait, Oman, Bahrain

|

Regional security; economic integration

|

Coordinates oil production via OPEC+; wary of U.S., exploring China ties for energy tech.

|

|

Axis of Resistance (Iran-led)

|

Iran, Syria, Hezbollah, Houthis, Hamas

|

Anti-Israel/U.S.; Shia influence

|

Disrupts oil shipping (e.g., Red Sea attacks); Iran enriching uranium, threatening nuclear energy balance.

|

|

Eastern Mediterranean Gas Forum

|

Israel, Egypt, Cyprus, Greece, Jordan

|

Gas exports to Europe

|

Bypasses Turkey; enhances EU energy security amid Russia-Ukraine fallout.

|

|

Saudi-Pakistan Pact (New)

|

Saudi Arabia, Pakistan

|

Mutual defense; possible nuclear sharing

|

Could provide Saudi nuclear options for energy diversification; stabilizes oil exports via Pakistani military support.

|

|

India-Middle East-Europe Corridor (IMEC)

|

India, Saudi Arabia, UAE, Israel, EU

|

Trade and energy links

|

Threatened by pact’s India implications; aims for green energy transit but faces U.S.-China rivalry.

|

This table illustrates a fragmented region: Pro-U.S. blocs like the Abraham Accords focus on countering Iran, while Iran-aligned groups exploit instability for leverage.

The Saudi-Pakistan deal injects South Asian dynamics, unsettling India and potentially escalating nuclear risks.

Qatar’s bombing has forced a rethink of Gulf diplomacy, with states like Saudi seeking independent deterrence.

Implications for Trump’s Foreign PoliciesAssuming Donald Trump’s return to the White House in January 2025, this pact poses both challenges and opportunities for his “America First” doctrine. Trump’s first term emphasized massive arms sales to Saudi Arabia and the Abraham Accords, prioritizing U.S. energy independence and isolating Iran.

However, the deal signals eroding U.S. influence, as Gulf states hedge against perceived American unreliability—exemplified by Washington’s muted response to Israel’s Qatar strikes.

For energy policy, Trump has pushed for U.S. dominance in global markets, including pressuring OPEC+ on production. A Saudi-Pakistan nuclear tie could complicate U.S. non-proliferation efforts, potentially derailing negotiations for a U.S.-Saudi nuclear deal that includes enrichment rights.

This might force Trump to sweeten offers, like enhanced defense pacts or technology transfers, to reclaim leverage.

Critics argue it reflects the Gulf’s distrust of U.S. commitments, fueling a regional arms race that could spike oil prices amid instability.

On the flip side, Trump could view this as a chance to “reset” with allies like India and Saudi Arabia, countering China-Pakistan ties and bolstering IMEC as a U.S.-backed energy corridor.

India’s reaction—studying implications while noting “mutual sensitivities”—suggests room for U.S.-India coordination.

Ultimately, the pact tests Trump’s deal-making prowess: Will he pull Saudi back into the U.S. fold, or watch as Asian powers fill the vacuum?

In summary, this defence pact not only fortifies Saudi-Pakistan bonds but also underscores the Middle East’s volatile energy geopolitics. As alliances shift and nuclear shadows loom, global markets will watch closely for ripple effects on oil stability and clean energy transitions.

Avoid Paying Taxes in 2025

Crude Oil, LNG, Jet Fuel price quote

ENB Top News

ENB

Energy Dashboard

ENB Podcast

ENB Substack