ENB Pub Note: This article was originally published on Bison Insights by Josh Young. We highly recommend subscribing to his Substack at Bison Inights.

Saudi Aramco recently brought the first phase of its Jafurah gas development online, a $100 billion project that is expected to reach 2 billion cubic feet per day of sustainable production by 2030. The gas will be used for domestic power generation, allowing Saudi Arabia to displace roughly 500,000 barrels per day of crude that it currently burns for electricity. That crude will then be “freed up” for export, increasing the number of barrels available to global markets.

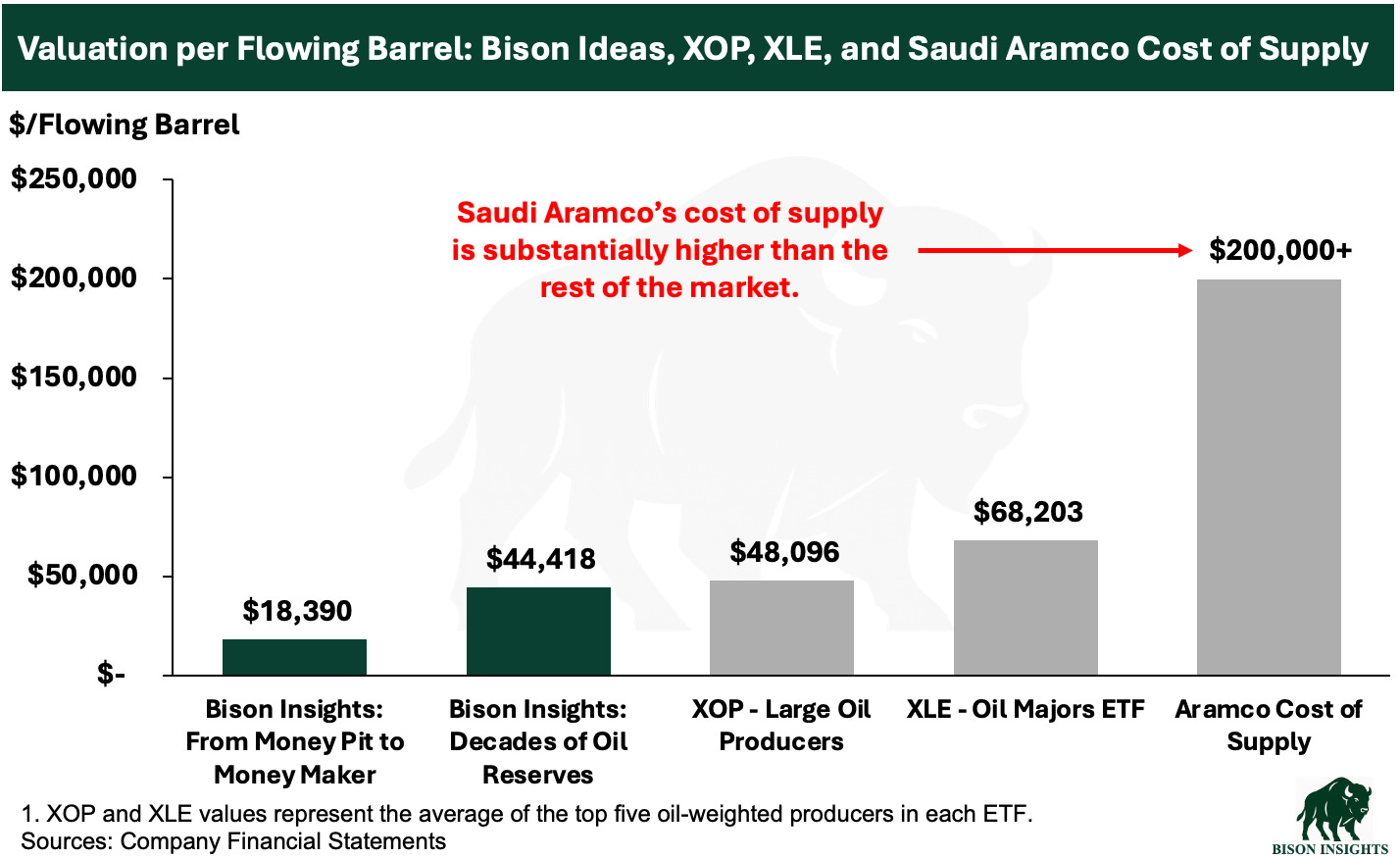

At first glance, this appears bearish for oil prices. More exportable supply should put downward pressure on prices. But looking past the physical barrels and considering the implications of the economics behind the project suggests the opposite conclusion: Saudi Aramco is effectively spending $100 billion to create an additional 500,000 barrels per day of oil production, implying a cost of ~$200,000 per flowing barrel.

Relative to North American oil producers, and especially the two oil-weighted companies I’ve written about in previous articles, the implied valuation embedded in Saudi Aramco’s decision is extraordinary:

Journey Energy, the idea featured in From Money Pit to Money Maker, is trading at ~$18,500 USD per flowing barrel of oil equivalent production, and with production set to grow materially, this valuation will fall further unless the stock price materially increases. Cenovus Energy, recently featured in Immediate Upside And Long Term Growth Potential, With Decades Of Oil Reserves, is valued at $44,500 USD per flowing barrel, but has over 30 years of reserve life in addition to a large downstream refining unit. The valuation that Saudi Aramco, the largest oil producer in the world, is placing on its own incremental supply is telling for how they think additional flowing barrels will be valued in the future.

Saudi Aramco’s Move Signals They Do Not Have Cheap Incremental Supply

Aramco’s decision indicates that they do not have meaningful low cost spare capacity left to bring online. If new oil supply could be added for less than the cost of Jafurah, it would be rational to pursue adding oil supply, not the gas project. Thus, the choice to invest in gas to displace crude burn is a signal that there are no large volumes of cheap oil production sitting idle.

This aligns with the broader pattern I have seen this year as OPEC+ rapidly unwound quotas to test how much supply members could realistically produce, which I recently wrote about in OPEC+ Production Increases and Spare Capacity Audit – Oil Market Implications. Actual output for core OPEC member countries has fallen short of the higher quota levels. The Jafurah investment indicates that Saudi Arabia too is running out of cheap incremental spare capacity.

Saudi Aramco’s Move Signals They Expect Higher Oil Prices

As noted above, Aramco is effectively investing $100 billion to create the equivalent of 500,000 barrels per day of new oil production capacity. This investment only makes sense if the freed-up crude will be sold at prices that justify the economics.

At 500,000 barrels per day, Aramco would free up 182.5 million barrels per year. At today’s oil price of roughly $60, that volume generates about $11 billion in annual revenue. After subtracting Aramco’s minimal operating, maintenance and transportation costs, the incremental free cash flow from these barrels is roughly $9— $10 billion per year.

The un-discounted implied payout period is roughly ten years at current prices, and materially shorter at higher prices. For Aramco to commit $100 billion of capital for this return profile, it must expect a tighter market, stronger pricing and limited availability of low-cost new supply. In my view, the company’s actions reflect a more bullish long-term outlook.

Implications For The Future State Of The Oil Market

Saudi Aramco is signaling the value they place on future oil production and the tightness of the oil market they see coming. They are making a massive, long duration investment that only pencils if oil prices are structurally higher and if incremental supply is difficult to bring on. It indicates that spare capacity is limited, new production is expensive and the future value of oil production is potentially much higher than what current equity valuations imply.

Disclaimer: This is for informational and educational purposes only. This is not an offer, solicitation, or investment recommendation. Please consult an advisor and do your own diligence. Past performance may not repeat itself. These are the personal views of Josh Young’s alone, and do not represent any other individual or organization.

Want to get your story in front of our massive audience? Get a media Kit Here. Please help us help you grow your business in Energy.