South Korean chipmaker SK Hynix Inc. provided a worsening outlook for the already slumping semiconductor market in its latest quarterly report, dashing all hopes for a quick rebound.

Hynix said it would slash capital expenditures by more than 50% from the current year due to an oversupply of memory chips. It reported that 2022 spending would be between $7 billion and $14 billion, meaning 2023 investments would be dramatically lower.

The move by Hynix is similar to the memory chip industry’s cuts made during the 2008-09 financial crisis. It may provide the understanding that the global economy is set for a vicious downturn next year.

“SK Hynix diagnosed that the semiconductor memory industry is facing an unprecedented deterioration in market conditions,” the company wrote in an earnings release, adding that “shipments of PCs and smartphone manufacturers, which are major buyers of memory chips, have decreased.”

Hynix warned about the steep decline in DRAM and NAND storage prices, falling by at least 20% last quarter. It will cut production gradually and expects elevated memory supply for the remainder of this year.

The South Korean chipmaker is one of the largest players in the memory space, trailing only Samsung Electronics Co.

Last month, Korea Economic Daily warned Samsung “lowered its semiconductor sales forecast for the second half of the year by more than 30%.” The newspaper attributed declining semiconductors demand “as the economy froze due to central bank rate hikes caused by global inflation.”

The paper warned: “As the semiconductor industry has entered a full-fledged ice age, there are many forecasts in the industry that the recession will continue until the first half of next year when semiconductor inventories are eliminated.”

Hebe Chen, an analyst at IG Markets Ltd., wrote Hynix’s massive capital expenditure cut is a “bold statement demonstrating their determination to confront the escalated uncertainties.”

“This CAPEX cut is a strong action that the market has been waiting for,” Greg Roh, head of technology research at HMC Investment & Securities, said after the earnings report. The move by the company could clear the memory glut by the second half of next year.

Global chip demand has rapidly slowed in recent quarters due to a plunge in shipments of PCs and smartphones as consumers and companies pull back on spending.

“I would say the current downturn is very severe for everyone involved in an unprecedented manner,” Noh Jong-won, the company’s chief marketing officer, said in an earnings call.

Besides Hynix, Texas Instruments Inc. also offered more gloom for the industry. It warned about a chip slowdown for personal devices and in the industrial-equipment market.

Other chip companies such as Taiwan Semiconductor Manufacturing Co., Intel Corp., and Nvidia Corp. have all warned about sliding demand this year.

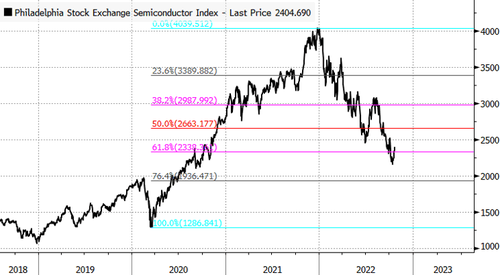

The Philadelphia Stock Exchange Semiconductor Index has slid more than 40% since peaking in late 2021.

Hynix also warned that the Biden administration’s chip restrictions on China could force closures of at least one major plant — though it said that would be in an “extreme situation.”

We recently pointed out that prices of graphics processing units have also plunged in recent months. Perhaps, this fall could be a great time to build out a gaming trading computer for a fraction of the price compared to where prices were earlier this year.